Ship Surveys and Inspections

Ship surveys and inspections form the foundational framework for maintaining safety, regulatory compliance, environmental protection, and operational efficiency in the global maritime industry. These processes involve systematic evaluations of a vessel’s structural integrity, machinery, equipment, navigation systems, safety apparatus, and environmental management practices. Conducted by authorized entities such as flag state authorities, port state control (PSC) officers, classification societies, and independent surveyors, these assessments verify adherence to international conventions like SOLAS (Safety of Life at Sea), MARPOL (Prevention of Pollution from Ships), ISM (International Safety Management) Code, and MLC (Maritime Labour Convention).

The primary objectives include identifying deficiencies, mitigating risks, preventing detentions, and ensuring seaworthiness. Deficiencies can range from minor issues like inadequate personal protective equipment (PPE) to critical failures such as hull corrosion or malfunctioning fire suppression systems. Rectification timelines vary: non-serious items may allow 14-30 days, while safety-critical defects demand immediate action or detention until resolved.

This guide provides an in-depth exploration of ship surveys and inspections, covering definitions, purposes, processes, types, preparation strategies, regulatory frameworks, technological integrations, consequences of neglect, and best practices. It incorporates detailed explanations, comparative tables, specifications for key equipment, and Mermaid diagrams for visual clarity.

Understanding Ship Surveys and Inspections: Definitions and Distinctions

Key Definitions

- Inspection: A surface-level or targeted examination focusing on visible conditions, operational functionality, and immediate compliance. It notes issues like rust, leaks, or equipment malfunctions without invasive testing.

- Survey: A comprehensive, in-depth assessment by certified surveyors, often involving measurements, tests, and documentation reviews. Surveys are mandatory for certification renewal and include non-destructive testing (NDT) methods.

| Aspect | Inspection | Survey |

|---|---|---|

| Depth | Surface-level, observational | In-depth, analytical with tests |

| Frequency | As required (e.g., PSC on arrival) | Scheduled (annual, intermediate) |

| Conductor | PSC officers, flag state inspectors | Classification society surveyors |

| Outcome | Deficiency list, possible detention | Certification issuance/renewal |

| Tools | Visual aids, checklists | Ultrasonic gauges, drones, AI |

Purposes of Surveys and Inspections

- Safety Assurance: Verify life-saving appliances (LSAs), fire-fighting systems, and structural strength to protect crew, passengers, and cargo.

- Environmental Protection: Check ballast water management systems (BWMS), oil record books, and emission controls per MARPOL Annexes I-VI.

- Regulatory Compliance: Align with IMO conventions, ensuring valid certificates like International Load Line Certificate or IOPP (International Oil Pollution Prevention).

- Operational Efficiency: Identify maintenance needs to reduce downtime and fuel consumption.

- Risk Mitigation: Prevent accidents, pollution incidents, and financial losses from detentions (average cost: $50,000-$500,000 per day).

Inspections prevent incidents like the 2018 Maersk Honam fire (caused by cargo misdeclaration, highlighting safety equipment checks) or ballast water invasions leading to ecological damage.

Regulatory Bodies and Frameworks

Key Authorities

- Flag State Control: The registering country’s administration (e.g., Panama, Liberia) issues certificates and conducts periodic surveys.

- Port State Control (PSC): Regional MoUs (e.g., Paris MoU, Tokyo MoU) allow foreign ports to inspect vessels. High-risk ships (based on flag performance, age >12 years, prior detentions) face priority selection.

- Classification Societies: IACS members (e.g., DNV, Lloyd’s Register, ABS) class vessels and perform statutory surveys on behalf of flag states.

- Other Bodies: IMO, ILO for MLC; OCIMF for SIRE vetting.

International Conventions

| Convention | Key Requirements | Inspection Focus |

|---|---|---|

| SOLAS | Construction, equipment, operations | LSAs, fire systems, navigation |

| MARPOL | Pollution prevention | Oily water separators, incinerators |

| ISM Code | Safety management systems | SMS audits, crew training |

| MLC 2006 | Seafarer welfare | Accommodation, wages, rest hours |

| Load Line | Freeboard, watertightness | Hull openings, markings |

Non-compliance rates: Paris MoU reports ~3-5% detention rate annually, with common deficiencies in fire safety (18%) and LSAs (15%).

Types of Ship Inspections and Surveys

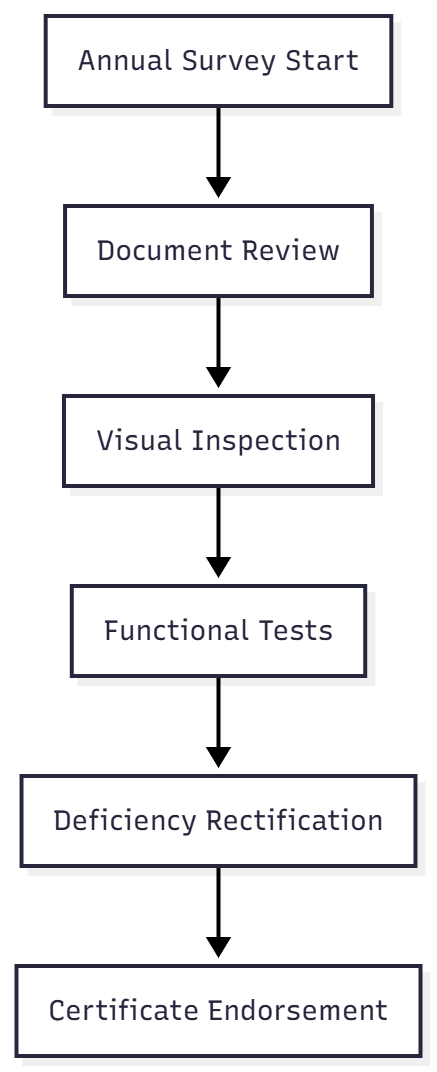

1. Annual Surveys

Mandatory every 12 months (±3 months window). Scope varies by vessel type (e.g., tankers require cargo system tests).

Key Checks:

- Hull plating thickness (minimum per class rules, e.g., 80% of original for steel).

- Machinery: Main engine, generators, pumps.

- Documentation: Oil Record Book, garbage management plan.

For oil tankers:

- Cargo piping pressure tests (1.5x working pressure).

- Inert gas system (IGS) oxygen <8%, pressure >100 mmWG.

2. Intermediate Surveys

Between 2nd and 3rd annual surveys (for vessels >5 years old). Includes enhanced hull examinations.

3. Renewal/Special Surveys

Every 5 years. Most comprehensive; requires dry-docking for vessels >15 years.

Dry-Dock Specifications:

- Interval: Every 2.5 years for passenger ships; 5 years for others (extendable to 7.5 with in-water surveys).

- Underwater checks: Propeller shaft clearance (<5mm wear), rudder pintle clearance (<3mm).

- Hull coating: Antifouling systems compliant with AFS Convention (no TBT).

| Dry-Dock Item | Specification | Acceptance Criteria |

|---|---|---|

| Hull Thickness | Ultrasonic gauging at 100+ points | >90% original thickness |

| Sea Valves | Dismantle/test | No leaks at 1.5x pressure |

| Anodes | Zinc/aluminum | >50% remaining mass |

4. Safety Construction Survey

Focus: Structural integrity.

- Corrosion: <20% wastage in frames.

- Watertight doors: Closing time <60 seconds.

- Bilge systems: Capacity per SOLAS (e.g., 2 pumps, each >50 m³/h).

5. Safety Equipment Survey

- Lifeboats: Davit load test (1.1x SWL), release gear inspection.

- Fire extinguishers: Pressure >12 bar, weight per CO2 type (e.g., 23kg cylinder).

- EPIRB: Battery expiry, hydrostatic release.

| Equipment | Specification | Test Frequency |

|---|---|---|

| Life Raft | 6-25 persons capacity, SOLAS Pack A/B | Annual servicing |

| Fire Pump | >25 m³/h at 3 bar | Monthly operational |

| GMDSS Radio | VHF DSC, MF/HF, SART | Annual performance |

6. Load Line Survey

- Freeboard marks: Plimsoll line visibility.

- Hatch covers: Weathertight (ultrasonic leak test <1% leakage).

7. Cargo Ship Safety Radio Survey

- GMDSS equipment: Battery capacity >1 hour (reserve), antenna integrity.

8. Port State Control (PSC) Inspections

Unannounced; initial (visual), expanded if issues found.

- Priority: Black-listed flags (e.g., detention rate >7%).

- Common codes: 01 (hull), 07 (fire safety), 15 (ISM).

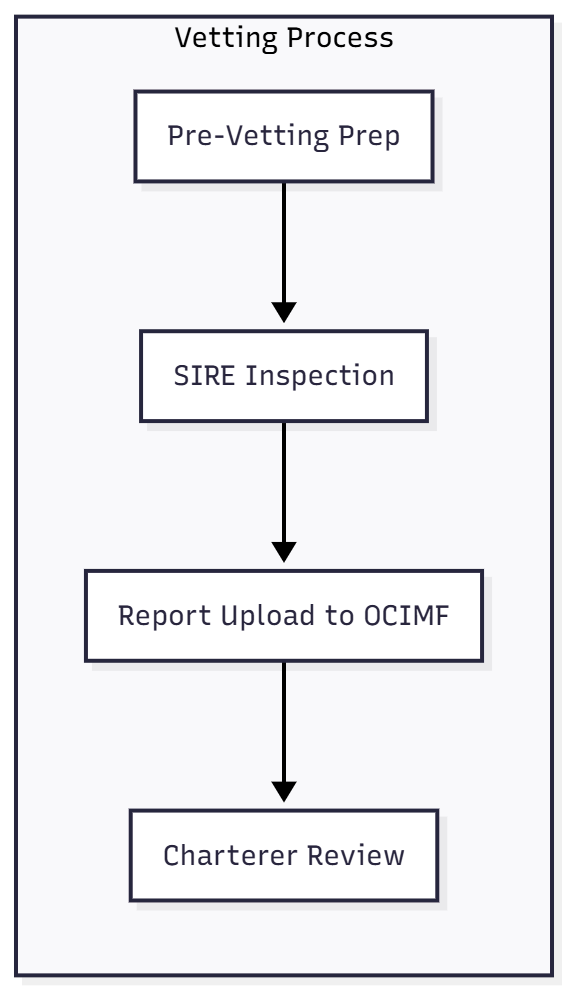

9. Vetting Inspections (SIRE, OVID, CMID)

Oil major-specific.

- SIRE: 1,000+ observations; VIQ (Vessel Inspection Questionnaire).

- Pass criteria: <10 observations >3 severity.

10. Terminal Safety Surveys

- Cargo transfer: Manifold drip trays, ESD links.

- Failure: Blacklisting (e.g., ExxonMobil criteria).

11. Other Specialized Surveys

- P&I Condition Survey: For insurance; focuses on management.

- Pre-Purchase Survey: Full valuation; cost ~$1-2 per GT.

- Bunker/ Draft Survey: Accuracy ±0.5% for quantity disputes.

- Ultrasonic Hatch Cover Test: Tightness per IACS UR Z26.

The Inspection Process: Step-by-Step

Phase 1: Preparation

- Crew drills: Fire, abandon ship.

- Documents: 20+ certificates organized (e.g., DOC, SMC).

- Self-assessment checklists.

Phase 2: Execution

- Opening Meeting: Scope discussion.

- Document Review: Logs, certificates (validity checks).

- Physical Inspection:

- Deck: Mooring winches (SWL markings), liferafts.

- Engine Room: Oily water separator (15 ppm alarm), fuel quick-closing valves.

- Accommodation: MLC compliance (room size >3.6 m²/person).

- Crew Interviews: Competency verification.

- Functional Tests: Lifeboat lowering (full load), emergency generator auto-start (<45 seconds).

Phase 3: Reporting and Close-Out

- Deficiency codes (e.g., 17: detention, 30: rectify before departure).

- Report: Photos, measurements, recommendations.

- Appeal process: Within 14 days to flag state.

| Deficiency Example | Code | Action Time | Cost Impact |

|---|---|---|---|

| Faulty Fire Door | 07 | Immediate | $5,000 repair |

| Expired Certificate | 01 | Before sailing | Detention fees |

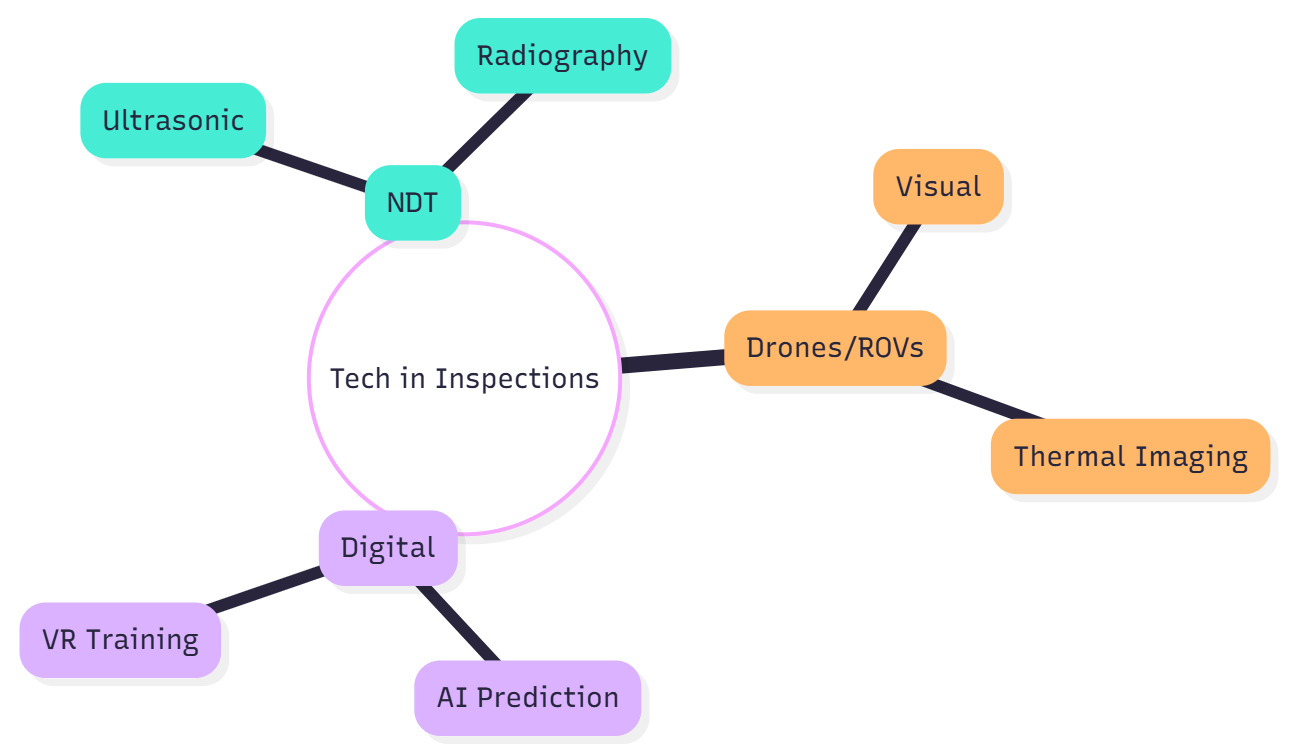

Technological Advancements in Inspections

Non-Destructive Testing (NDT)

- Ultrasonic Thickness Measurement (UTM): Probe frequency 5 MHz; accuracy ±0.1 mm.

- Magnetic Particle Inspection (MPI): For crack detection in welds.

- Drone Inspections: DJI Matrice 300; 4K camera, 55-min flight; accesses confined spaces.

Digital Tools

- Remote Inspection Techniques (RIT): IACS Rec. 42; live streaming via ROVs.

- AI Analytics: Predicts corrosion rates using historical data (e.g., ABS NS software).

- Blockchain for Certificates: Immutable records reduce fraud.

Preparation Strategies for Inspection-Ready Vessels

- Maintenance Management: Planned Maintenance System (PMS); critical equipment >95% availability.

- Crew Training: STCW-compliant; MLC rest hours logged (max 14h work/24h).

- Mock Inspections: Quarterly internal audits.

- Environmental Solutions: BWMS (e.g., Alfa Laval PureBallast; capacity 150-3000 m³/h; UV treatment).

- Cost-Effective Upkeep: Annual budget 1-2% of vessel value for surveys.

| Preparation Item | Frequency | Responsible Party |

|---|---|---|

| Drills | Monthly | Master/Chief Officer |

| Thickness Gauging | Annual | Superintendent |

| Certificate Renewal | As expiry | DPA |

Consequences of Neglect

- Detentions: Tokyo MoU: 1,200+ in 2024; average 3-5 days.

- Financial: Fines $10,000-$1M; insurance hike 20-50%.

- Reputational: White/Grey/Black list (Paris MoU); reduced charters.

- Legal: MLC violations: Back wages + repatriation.

- Environmental: MARPOL fines up to $25M (e.g., oil discharge).

Case Study: Prestige (2002) – Inadequate surveys led to spill; $4B cleanup.

Impact on Operations and Industry

- Efficiency: Well-maintained vessels: 5-10% fuel savings.

- Insurance: H&M premiums lower by 15% for class-maintained ships.

- Market Value: Survey history adds 10-20% to resale (e.g., 10-year-old bulk carrier: $15M with clean record vs. $12M with deficiencies).

Best Practices and Service Providers

Maintain continuous readiness:

- Integrate PMS with class software.

- Use third-party superintendents for dry-docks.

- Partner with firms like DNV for surveys or environmental consultants for MARPOL compliance.

(Note: Prices vary; e.g., annual survey ~$5,000-$20,000 depending on GT. Dry-dock: $100,000-$1M+.)

Frequently Asked Questions

An inspection is a targeted, often unannounced check (e.g., Port State Control) focusing on visible compliance and immediate safety risks. A survey is a scheduled, in-depth assessment by a classification society surveyor, involving measurements, tests (like ultrasonic gauging), and certification renewal. Surveys are mandatory for class and statutory certificates; inspections can lead to detention.

Cargo ships require dry-docking every 5 years (maximum interval), with an intermediate in-water survey possible between year 2.5 and 3.5. Passenger ships need it every 2.5 years. It allows full inspection of the underwater hull, propeller, rudder, and sea chests—areas prone to corrosion, biofouling, and damage that cannot be assessed afloat.

Deficiencies are coded (e.g., Code 17 = detainable). Minor issues get a 14–30-day rectification window; serious safety or pollution risks trigger detention until fixed. The ship cannot sail, incurs daily costs ($50,000+), and the flag/operator faces fines, higher PSC priority, and potential blacklisting under regional MoUs (Paris, Tokyo, etc.).

SIRE (Ship Inspection Report Programme) is a mandatory vetting standard by oil majors (OCIMF members) to assess tanker safety and operational quality before chartering. An OCIMF-accredited inspector boards for 8–12 hours, completes the VIQ (1,000+ questions), and uploads the report. A poor SIRE record can block high-value contracts.

Implement a robust PMS (Planned Maintenance System), conduct monthly crew drills, keep all certificates current and organized, perform quarterly internal audits, and use digital logbooks. Pre-inspection self-checks with ultrasonic thickness readings and functional tests of critical systems (fire pumps, lifeboats, OWS) ensure zero-deficiency readiness.

Conclusion

Ship surveys and inspections are the bedrock of maritime safety, compliance, and efficiency. These rigorous processes—spanning structural assessments, equipment tests, and environmental audits—safeguard crew, cargo, and ecosystems while upholding SOLAS, MARPOL, ISM, and MLC standards. A single deficiency can trigger detention, costing $50,000–$500,000 daily, escalate insurance premiums, or bar vessels from charters.

Yet, proactive preparation yields rewards: early defect detection cuts downtime, clean records boost resale value 10–20%, and optimized maintenance reduces fuel use 5–10%. Modern tools—drones, ultrasonic NDT, AI analytics—shift surveys from reactive to predictive, enabling remote, data-driven oversight.

For owners and officers, readiness is non-negotiable: embed PMS, drill crews monthly, audit internally, and digitize logs. Zero-deficiency vessels don’t just comply—they excel, securing trust, contracts, and sustainability. In a regulated, high-stakes industry, disciplined survey adherence defines operational success and long-term viability.

Happy Boating!

Share A Guide to Ship Surveys and Inspections with your friends and leave a comment below with your thoughts.

Read The Importance of Ship Maintenance until we meet in the next article.