Fuel Management and Compliance for Ships: Best Practices

Optimize ship fuel management with best practices for efficiency, compliance, and sustainability, ensuring cost savings and adherence to IMO 2020 regulations.

Fuel management and compliance are pivotal for modern shipping operations, balancing operational efficiency, environmental responsibility, and regulatory adherence. With fuel costs comprising 50-60% of a ship’s operating expenses and stringent regulations like the International Maritime Organization’s (IMO) 2020 sulfur cap, ship operators must adopt comprehensive strategies to optimize fuel use, reduce costs, and meet global standards. This article explores best practices for fuel management, compliance with environmental regulations, and emerging trends, providing actionable insights for maritime operators aiming to enhance efficiency and sustainability.

The Importance of Fuel Management in Shipping

Fuel is the lifeblood of maritime operations, but its high cost and environmental impact make efficient management critical. Inefficient fuel use increases operational expenses, while non-compliance with regulations like MARPOL Annex VI can lead to fines, port bans, and reputational damage. Effective fuel management involves optimizing consumption, ensuring fuel quality, and adhering to environmental standards. By implementing robust systems and practices, ship operators can achieve significant cost savings, reduce emissions, and maintain competitiveness in a rapidly evolving industry.

The IMO 2020 regulation, which mandates a global sulfur cap of 0.5% (down from 3.5%), has reshaped the maritime fuel landscape. Compliance requires adopting low-sulfur fuels, installing exhaust gas cleaning systems (scrubbers), or transitioning to alternative fuels. These measures, combined with advanced technologies and crew training, form the backbone of modern fuel management strategies.

Core Elements of Fuel Management

Effective fuel management encompasses several interconnected components, each contributing to operational efficiency and compliance. Below are the key elements:

1. Fuel Procurement and Quality Assurance

Procuring high-quality fuel that meets environmental standards is foundational. The IMO 2020 sulfur cap requires low-sulfur fuel oil (LSFO) or alternative compliance methods. Establishing long-term contracts with certified suppliers ensures consistent fuel quality and availability. For example, a container shipping company that secured agreements with reliable suppliers reduced fuel costs by 15% over two years through stable pricing and quality assurance.

Fuel quality is critical to prevent engine damage and ensure compliance. Regular fuel analysis, including bunker and system sample testing, identifies contaminants like catalytic fines, which can cause engine wear. Contracts should specify fuel quantity, technical specifications, and compliance with regulations like ISO 8217 for marine fuels.

2. Fuel Monitoring and Measurement

Accurate fuel monitoring is essential for tracking consumption and identifying inefficiencies. Technologies like flow meters, mass flow sensors, and telematics systems provide real-time data on fuel usage. These tools enable operators to detect anomalies, such as fuel theft or system inefficiencies, and optimize operations.

Case Study: A bulk carrier equipped with advanced fuel monitoring sensors reduced consumption by 10%, saving $200,000 annually on a single vessel. Such systems also support compliance by providing accurate data for emissions reporting.

3. Engine Performance Optimization

Optimizing engine performance reduces fuel consumption and emissions. Regular maintenance tasks, such as cleaning fuel injectors, calibrating flow meters, and using high-efficiency lubricants, enhance engine efficiency. Hull cleaning and propeller upgrades further reduce resistance, improving fuel economy.

Automated engine management systems control speed and shaft power, minimizing fuel waste. For instance, operating at constant shaft RPM can be more efficient than frequent speed adjustments. These systems, combined with condition monitoring, ensure engines operate at peak performance.

4. Voyage Planning and Route Optimization

Smart voyage planning minimizes fuel consumption by selecting optimal routes and speeds. Weather routing, which uses meteorological data to avoid adverse conditions, can reduce fuel use by up to 20%. Software tools, as outlined in IMO Resolution A.893(21), support precise planning by factoring in currents, wind, and traffic.

Just-in-time (JIT) arrival strategies coordinate with ports to optimize speed, reducing idling time and fuel waste. For example, early communication with port authorities allows ships to adjust speed for seamless berthing, enhancing efficiency.

5. Speed and Load Management

Speed optimization, or eco-steaming, balances fuel consumption with voyage requirements. Operating at the speed where fuel per tonne-mile is minimized—often referred to as the “optimum speed”—can yield significant savings. However, sailing too slowly may increase fuel use due to engine inefficiencies or soot buildup, as indicated by engine manufacturers’ power/consumption curves.

Load management, including optimal trim and ballast, reduces hull resistance. Adjusting ballast according to the vessel’s Ballast Water Management Plan ensures stability while minimizing fuel use. For instance, optimizing trim for a fully loaded ship can reduce fuel consumption by 5-10%.

Environmental Compliance: Navigating IMO 2020 and Beyond

Compliance with MARPOL Annex VI, particularly the IMO 2020 sulfur cap, is non-negotiable for ship operators. This regulation limits sulfur content in marine fuels to 0.5% globally, with stricter 0.1% limits in Emission Control Areas (ECAs). Non-compliance risks penalties and operational restrictions. Below are the primary compliance strategies:

1. Low-Sulfur Fuel Oil (LSFO)

Switching to LSFO is the simplest compliance method, requiring no major modifications. However, challenges include fuel price volatility, supply chain constraints, and compatibility with existing systems. Regular fuel testing ensures LSFO meets specifications and prevents engine issues.

Cost Estimate: LSFO prices range from $500-$700 per metric ton, depending on market conditions and port availability. Operators must factor in potential price fluctuations when budgeting.

2. Exhaust Gas Cleaning Systems (Scrubbers)

Scrubbers allow ships to use high-sulfur heavy fuel oil (HFO) while removing sulfur emissions. Open-loop scrubbers use seawater, closed-loop systems use freshwater with chemicals, and hybrid systems offer flexibility. Scrubbers reduce long-term fuel costs but require significant upfront investment.

Cost Estimate: Installation costs range from $2-6 million per vessel, with annual maintenance costs of $100,000-$200,000. Waste disposal for closed-loop systems adds operational complexity.

3. Alternative Fuels

Alternative fuels like liquefied natural gas (LNG), biofuels, and synthetic fuels offer long-term sustainability. LNG reduces SOx, CO2, and particulate matter emissions but requires specialized storage and engine modifications. Biofuels are renewable but limited in supply, while synthetic fuels are still in development.

Cost Estimate: LNG infrastructure retrofitting costs $5-10 million per vessel. Biofuel prices vary widely ($600-$1,000 per metric ton), and synthetic fuels remain cost-prohibitive for widespread adoption.

Compliance Monitoring and Reporting

Compliance requires robust monitoring and reporting systems:

- Automatic Identification System (AIS): Tracks ship location and speed, aiding fuel efficiency analysis.

- Emission Control Area (ECA) Monitoring: Ships in ECAs must report emissions data regularly, ensuring compliance with 0.1% sulfur limits.

- IMO Data Collection System (DCS): Mandates annual fuel consumption reporting for ships over 5,000 gross tonnage.

Accurate documentation, including bunker delivery notes and fuel sample analyses, is critical for audits and inspections. A shipboard fuel management plan outlines procedures for different operational modes, particularly in ECAs.

Best Practices for Fuel Management

Implementing best practices ensures optimal fuel use, compliance, and cost savings. Below are actionable strategies:

1. Implement Smart Fuel Management Systems

Integrated software solutions provide real-time insights into fuel consumption, enabling data-driven decisions. These systems detect inefficiencies, monitor fuel purchases via fuel cards, and prevent theft. For example, telematics systems can reduce fuel waste by 5-15% by identifying suboptimal engine performance.

2. Conduct Regular Crew Training

Well-trained crews are critical for fuel efficiency. Training programs should cover eco-steaming, engine maintenance, and emergency fuel management protocols. A European ferry operator reduced emissions by 30% by setting fuel efficiency targets and incentivizing crew performance.

3. Prioritize Preventive Maintenance

Routine maintenance, such as cleaning fuel injectors and inspecting tanks, prevents inefficiencies and breakdowns. Establishing Key Performance Indicators (KPIs) for fuel consumption and emissions helps track progress and identify improvement areas.

4. Minimize Idling Time

Reducing unnecessary engine idling, particularly during port stays, saves fuel. Shore power, where available, reduces generator use, improving air quality and efficiency. For example, using shore power in ports can cut fuel consumption by 10-20% during berthing.

5. Optimize Propeller and Rudder Systems

Upgrading propellers with fins or nozzles improves propulsive efficiency, reducing fuel use by 5-10%. Advanced rudder designs, such as twist-flow rudders, minimize resistance. Regular propeller polishing and hull cleaning further enhance efficiency.

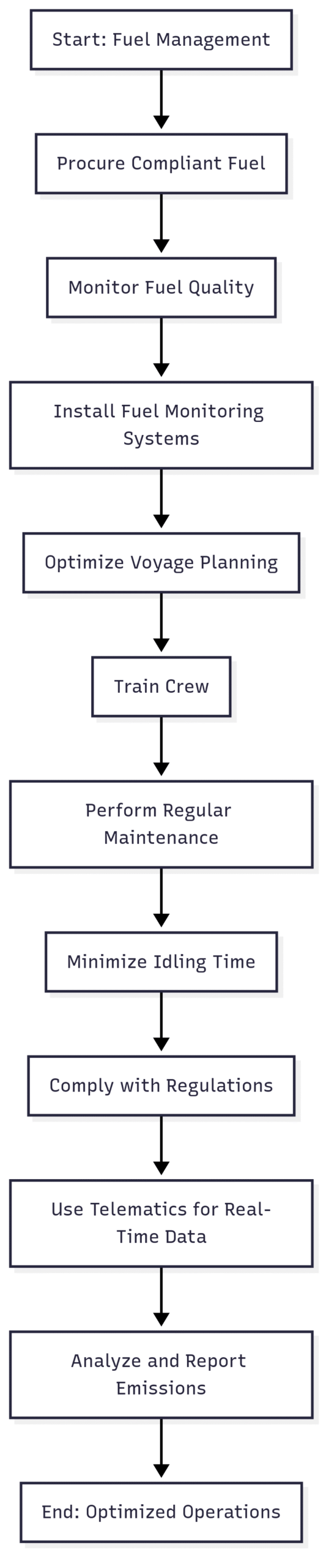

Chart: Fuel Management Workflow

Future Trends in Fuel Management

The maritime industry is evolving rapidly, driven by technological advancements and sustainability goals. Key trends include:

1. Digital Twin Technology

Digital twins create virtual ship models, allowing operators to simulate fuel usage and optimize operations. For example, a digital twin can predict fuel savings for different routes, reducing costs by 5-10% without physical testing.

2. Autonomous Shipping

AI-driven autonomous ships minimize human error, optimizing fuel use through real-time adjustments. These systems could reduce fuel consumption by 10-20% in the coming decade.

3. Green Fuel Innovations

Zero-emission fuels like hydrogen and ammonia are gaining traction. Hydrogen-powered ships could eliminate SOx and CO2 emissions, but infrastructure costs remain high ($10-20 million per vessel). Ammonia, while promising, requires safety and storage advancements.

Table: Comparison of Fuel Types for Compliance

| Fuel Type | Sulfur Compliance | Cost per Metric Ton | Infrastructure Cost | Environmental Impact |

|---|---|---|---|---|

| LSFO | Yes | $500-$700 | Low | Moderate (CO2 emissions) |

| HFO with Scrubbers | Yes | $300-$500 | $2-6M per vessel | High (waste disposal) |

| LNG | Yes | $400-$600 | $5-10M per vessel | Low (reduced CO2, SOx) |

| Biofuels | Yes | $600-$1,000 | Moderate | Low (renewable) |

| Synthetic Fuels | Yes | $1,000-$2,000 | High | Very Low (zero-emission) |

Challenges and Considerations

Implementing fuel management and compliance strategies involves challenges:

- Fuel Price Volatility: Fluctuating LSFO and alternative fuel prices complicate budgeting.

- Infrastructure Limitations: LNG and biofuel bunkering facilities are limited in many ports.

- Regulatory Complexity: Evolving IMO regulations require continuous adaptation.

- Retrofitting Costs: Upgrading engines or installing scrubbers demands significant capital.

Ship operators must also consider trade routes and vessel types. For example, wind-assisted propulsion may be impractical for short-sea shipping due to high traffic density, while long-haul vessels benefit more from speed optimization.

Conclusion

Effective fuel management and compliance are critical for the maritime industry’s sustainability and profitability. By adopting best practices—such as smart fuel monitoring, voyage optimization, crew training, and preventive maintenance—operators can reduce costs by 10-20%, enhance environmental performance, and meet IMO 2020 standards. Investing in technologies like digital twins and exploring green fuels like hydrogen will future-proof operations. As regulations tighten and fuel costs rise, proactive fuel management ensures shipping companies remain competitive and resilient in a dynamic global market.

Happy Boating!

Share Fuel Management and Compliance for Ships: Best Practices with your friends and leave a comment below with your thoughts.

Read IMO approves net-zero regulations for global shipping until we meet in the next article.