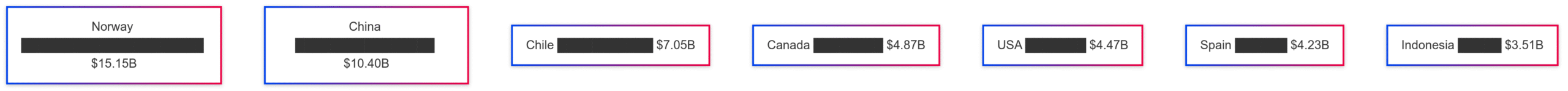

Top Fish And Seafood Exporting Countries

Discover the top 7 fish and seafood exporting countries, their market trends, key species, and economic impact in the global seafood industry.

The global seafood industry is a cornerstone of international trade, providing food security, economic growth, and livelihoods for millions. The global fish and seafood market was valued at over $236.61 billion, with the top 10 exporting countries contributing $54.21 billion in fish exports alone. This article explores the top seven fish and seafood exporting countries, their key products, market dynamics, and contributions to the global economy. From Norway’s premium salmon to Indonesia’s shrimp dominance, these nations shape the seafood trade landscape through innovation, sustainability, and strategic market positioning.

1. Norway: The Salmon Powerhouse

Norway has solidified its position as the world’s leading fish exporter, with exports valued at $15.15 billion. Renowned for its high-quality salmon and cod, Norway has capitalized on global demand for premium seafood, overtaking China in non-processed primary product categories.

Key Exports

- Salmon: Norway is the largest exporter of Atlantic salmon, with significant demand in the European Union (67% of exports) and the United States.

- Cod: Includes fresh, frozen, and clipfish varieties.

- Shellfish: Shrimp, snow crab, and king crab are growing export segments.

Market Dynamics

Norway’s success stems from its sustainable aquaculture practices and advanced fishing infrastructure. The country exported approximately 2.7 million metric tons of seafood in 2020, with salmon accounting for the lion’s share. Exports to Poland alone were worth $1.73 billion, highlighting Norway’s strong European market presence. Investments in technology and eco-friendly practices have bolstered Norway’s reputation for quality, making it a preferred supplier for premium markets.

Economic Impact

The seafood industry contributes significantly to Norway’s economy, generating NOK 50 billion from EU exports in 2015. Over 30,000 Norwegians are employed in the sector, with aquaculture driving job creation.

2. China: The Processed Seafood Giant

China remains the world’s largest exporter of processed seafood, with exports valued at $10.40 billion. Despite a 12.3% decline in overall seafood exports, China maintains dominance in processed products like squid and shrimp.

Key Exports

- Squid and Cuttlefish: $1.6 billion in 2013.

- Frozen Shrimp and Prawns: $1.2 billion.

- Frozen Fish: $1 billion.

- Edible Aquatic Plants: Kelp and similar products are significant contributors.

Market Dynamics

China’s seafood industry employs around 14 million people, with Japan, the United States, and Hong Kong as top export destinations. However, challenges like rising labor costs and reduced domestic production have led to a 14.5% drop in non-processed primary products (H.S. 0300), which comprise 53.9% of China’s seafood exports. The Sino-U.S. trade war has further impacted exports, reducing American demand since 2018.

Economic Impact

Despite setbacks, China’s seafood sector remains a vital economic driver, contributing significantly to its $3.6 trillion export economy. The focus on processed products ensures resilience, though increasing costs threaten its competitive edge.

3. Chile: The Salmon and Mussel Leader

Chile ranks third globally, with fish and seafood exports valued at $7.05 billion. Known for farmed Atlantic salmon and mussels, Chile is a key player in the global market.

Key Exports

- Salmon: Second-largest supplier of farmed Atlantic salmon globally.

- Mussels: Significant export to the EU and United States.

- Trout: Growing in demand.

Market Dynamics

Chile exported approximately 400,000 metric tons of seafood in 2020, with the United States ($2.86 billion) and Japan as primary markets. The EU accounts for 19% of Chile’s seafood exports. Improvements in aquaculture infrastructure and investments in sustainability have driven growth, positioning Chile as a reliable supplier of high-quality seafood.

Economic Impact

The seafood industry supports thousands of jobs in Chile, particularly in coastal regions. Its focus on sustainable practices enhances its global competitiveness, with exports expected to grow as demand for salmon rises.

4. Canada: Lobster and Crab Dominance

Canada’s fish and seafood exports reached $4.87 billion, driven by its dominance in lobster, crab, and salmon exports. The industry is a cornerstone of Canada’s food export sector.

Key Exports

- Lobster: Generated $1.52 billion in 2014, remains a top export.

- Snow Crab and Queen Crab: High demand in the United States.

- Salmon: Significant aquaculture production.

Market Dynamics

Canada exported around 300,000 metric tons of seafood in 2020, with 85% of processed seafood destined for international markets. The United States is the largest buyer, importing $3.14 billion worth of Canadian seafood. The aquaculture sector employs 14,000 Canadians, with over 80,000 livelihoods tied to fishing activities.

Economic Impact

The seafood industry is a vital economic pillar in Canada, particularly in Atlantic provinces. Its focus on high-value species like lobster ensures strong export revenues.

5. United States: A Diverse Exporter

The United States ranks fifth, with fish exports valued at $4.47 billion. Its diverse range of products and robust domestic market make it a significant player.

Key Exports

- Alaskan Pollock: A major export, used in processed products like surimi.

- Salmon: Both wild-caught and farmed.

- Fish Roe and Surimi: Account for 40% of exports.

- Lobster and Crab: High demand in Canada ($1.06 billion).

Market Dynamics

U.S. seafood exports have grown by 43% over the past five years, driven by increased production volumes rather than price hikes. In 2020, the U.S. exported 500,000 metric tons of seafood, with key markets including Canada and the EU. The industry’s focus on sustainability and quality supports its global competitiveness.

Economic Impact

The U.S. seafood sector supports coastal economies, with Alaska and the Pacific Northwest as key production hubs. Its export value nearly matches poultry exports, underscoring its economic significance.

6. Spain: Tuna and Shrimp Specialist

Spain’s fish exports reached $4.23 billion, with a focus on tuna, shrimp, and octopus. The country is a key player in the European seafood market.

Key Exports

- Tuna: A major export to Italy ($1.34 billion).

- Shrimp: Both fresh and frozen.

- Octopus: Growing in demand.

Market Dynamics

Spain’s strategic location and advanced processing facilities support its export industry. The EU is the primary market, with Italy as the top destination. Spain’s emphasis on quality and diverse product offerings strengthens its position.

Economic Impact

The seafood industry is a significant employer in Spain, particularly in coastal regions like Galicia. Its export growth reflects strong demand for Mediterranean seafood products.

7. Indonesia: Shrimp and Tuna Hub

Indonesia’s fish exports were valued at $3.51 billion, driven by its abundant marine resources and strategic location. The country is a major exporter of shrimp and tuna.

Key Exports

- Shrimp: Largest export segment, with $804.79 million to China.

- Tuna: High demand in Asian markets.

- Frozen Fish: Significant contributor to export value.

Market Dynamics

Indonesia produced 15.26 million tons of fish in 2012, with 9.45 million tons from aquaculture. East Java accounts for a third of exports. China and Japan are key markets, with growing demand for sustainable products driving investments in aquaculture.

Economic Impact

The seafood industry employs millions in Indonesia, supporting coastal communities and contributing to economic growth. Its focus on shrimp ensures strong export revenues.

Market Trends and Challenges

Growth Drivers

- Rising Demand: Global demand for seafood, particularly premium species like salmon and lobster, drives export growth.

- Sustainability: Countries like Norway and Chile prioritize eco-friendly practices, enhancing market appeal.

- Trade Agreements: Facilitate access to key markets like the EU and United States.

Challenges

- Rising Costs: China’s increasing labor costs threaten its dominance in processed seafood.

- Trade Tensions: The Sino-U.S. trade war has reduced Chinese exports to the U.S.

- Resource Depletion: Declining wild fish stocks in some regions, like China, impact primary product exports.

Comparative Analysis

| Country | Export Value (USD Billion) | Key Exports | Top Markets |

|---|---|---|---|

| Norway | 15.15 | Salmon, Cod, Shellfish | Poland, EU, USA |

| China | 10.40 | Squid, Shrimp, Frozen Fish | Japan, USA, Hong Kong |

| Chile | 7.05 | Salmon, Mussels, Trout | USA, Japan, EU |

| Canada | 4.87 | Lobster, Crab, Salmon | USA, EU |

| USA | 4.47 | Alaskan Pollock, Salmon, Roe | Canada, EU |

| Spain | 4.23 | Tuna, Shrimp, Octopus | Italy, EU |

| Indonesia | 3.51 | Shrimp, Tuna, Frozen Fish | China, Japan |

Mermaid Chart: Export Value Comparison

Future Outlook

The global seafood market is poised for continued growth, driven by rising consumer demand for healthy, sustainable protein sources. Norway’s focus on premium products and Chile’s aquaculture advancements will likely maintain their top rankings. China must address labor costs and trade barriers to retain its processed seafood dominance. Emerging markets like Indonesia and Canada will benefit from investments in technology and sustainability. Stakeholders must prioritize innovation and responsible practices to ensure long-term growth in this dynamic industry.

Conclusion

The top seven fish and seafood exporting countries—Norway, China, Chile, Canada, the United States, Spain, and Indonesia—play a pivotal role in the $236.61 billion global seafood market. Their diverse products, from Norway’s salmon to Indonesia’s shrimp, meet rising global demand while supporting millions of livelihoods. As the industry evolves, sustainability, technological advancements, and strategic trade partnerships will shape its future, ensuring these nations remain leaders in the global seafood trade.

Happy Boating!

Share Top Fish And Seafood Exporting Countries with your friends and leave a comment below with your thoughts.

Read What to Do When Someone Falls Overboard until we meet in the next article.