Top 10 Engine Types Used in Commercial Vessels

Discover the top 10 engine types powering commercial vessels, from diesel to hydrogen fuel cells, with specs, applications, and sustainability insights.

The maritime industry, responsible for over 80% of global trade by volume, relies on sophisticated propulsion systems to navigate oceans, rivers, and coastal waters. From colossal container ships to nimble ferries, the engine type determines a vessel’s performance, fuel efficiency, emissions, and compliance with stringent environmental regulations like those set by the International Maritime Organization (IMO). As fuel costs rise and decarbonization goals intensify, understanding the top engine types in commercial vessels is critical for shipowners, engineers, policymakers, and maritime professionals.

This comprehensive guide explores the 10 most prevalent engine types in commercial shipping, detailing their mechanics, applications, advantages, and role in the industry’s push toward sustainability. We include real-world examples, technical specifications, and emerging trends to provide a clear picture of marine propulsion today and tomorrow.

1. Two-Stroke Low-Speed Diesel Engines

Primary Use: Container ships, oil tankers, bulk carriers

Key Manufacturers: MAN Energy Solutions, Wärtsilä

Power Output: 10,000–80,000 kW

RPM Range: 60–120

Fuel Types: Heavy Fuel Oil (HFO), Marine Diesel Oil (MDO), Very Low Sulphur Fuel Oil (VLSFO)

Two-stroke low-speed diesel engines are the backbone of large commercial vessels. Their high thermal efficiency (up to 50%) and ability to burn cost-effective heavy fuels make them ideal for ships requiring immense power at low speeds. These engines are directly coupled to the propeller, eliminating the need for a gearbox, which enhances reliability and reduces maintenance.

Advantages:

- Exceptional fuel efficiency

- High torque for large propellers

- Long operational life (20–30 years)

Challenges:

- High NOx and SOx emissions (mitigated with scrubbers or VLSFO)

- Large size and weight

Real-World Example: The MAN B&W 11G95ME-C9.5 powers ultra-large container ships like those in Maersk’s Triple-E class, delivering 75,000 kW to haul 18,000 TEU (Twenty-foot Equivalent Units).

2. Four-Stroke Medium-Speed Diesel Engines

Primary Use: Cruise ships, Ro-Ro vessels, ferries, offshore supply vessels

Key Manufacturers: Wärtsilä, Caterpillar, MAN

Power Output: 1,000–20,000 kW

RPM Range: 400–1,200

Fuel Types: MDO, VLSFO, biofuels

Four-stroke diesel engines are versatile, compact, and widely used in vessels requiring dynamic performance. Operating at medium speeds, they require a reduction gearbox but offer flexibility for diesel-electric configurations, auxiliary power, and compliance with IMO Tier III emissions standards when paired with exhaust gas treatment systems.

Advantages:

- Compact design

- Lower emissions with after-treatment

- Suitable for hybrid systems

Challenges:

- Higher fuel consumption than two-stroke engines

- More complex maintenance

Real-World Example: Wärtsilä’s 46DF engines power modern cruise ships, integrating with ABB’s Azipod propulsion for efficiency and maneuverability in polar regions.

3. Dual-Fuel Engines (LNG and Diesel)

Primary Use: LNG carriers, container ships, ferries

Key Manufacturers: MAN Energy Solutions, Wärtsilä

Power Output: 5,000–50,000 kW

Fuel Types: LNG, MDO, VLSFO

Emissions Reduction: ~25% CO₂, ~90% SOx, ~80% NOx

Dual-fuel engines switch seamlessly between LNG and diesel, offering environmental and operational flexibility. LNG’s lower carbon footprint and near-elimination of sulfur oxides align with IMO 2020 sulphur cap and future greenhouse gas (GHG) targets, making these engines a cornerstone of green shipping.

Advantages:

- Significant emissions reduction

- Fuel flexibility

- Proven reliability in LNG carriers

Challenges:

- Methane slip concerns

- Limited bunkering infrastructure

Real-World Example: CMA CGM’s LNG-powered container ships use MAN B&W ME-GI engines, reducing emissions on trans-Pacific routes.

4. Gas Turbines

Primary Use: Naval ships, fast ferries, high-speed Ro-Ro vessels

Key Manufacturers: General Electric, Rolls-Royce

Power Output: 20,000–50,000 kW

RPM Range: 3,000–7,000

Fuel Types: Marine gas oil, jet fuel

Gas turbines excel in applications demanding high power-to-weight ratios and rapid acceleration. Their compact size and quick start-up make them ideal for high-speed vessels, though high fuel consumption limits their use in cost-sensitive commercial operations.

Advantages:

- Lightweight and compact

- Fast response time

- Suitable for hybrid COGES systems

Challenges:

- High fuel costs

- Expensive maintenance

Real-World Example: GE’s LM2500 gas turbines power Royal Caribbean’s Millennium-class cruise ships, enabling high-speed transatlantic crossings.

5. Steam Turbine Engines

Primary Use: Legacy LNG carriers, nuclear-powered vessels

Key Manufacturers: Mitsubishi Heavy Industries, General Electric

Power Output: 10,000–40,000 kW

Fuel Types: Boil-off gas (LNG carriers), nuclear reactors

Once dominant in maritime propulsion, steam turbines are now niche, primarily in older LNG carriers using boil-off gas or nuclear-powered vessels like icebreakers. Their thermal efficiency (~30%) lags behind diesel engines, driving their decline in newbuilds.

Advantages:

- Reliable for specific applications

- No direct fuel emissions (nuclear)

Challenges:

- Low efficiency

- High operational complexity

Real-World Example: Russia’s Arktika-class nuclear icebreakers use steam turbines driven by nuclear reactors for Arctic navigation.

6. Diesel-Electric Propulsion

Primary Use: Cruise ships, research vessels, offshore service vessels

Key Manufacturers: ABB, Siemens

Power Output: 5,000–30,000 kW

Fuel Types: MDO, VLSFO, biofuels

Diesel-electric systems use diesel engines to generate electricity, which powers propulsion motors. This configuration offers flexible engine placement, reduced vibration, and enhanced redundancy, making it popular in vessels requiring precise control and passenger comfort.

Advantages:

- Flexible machinery layout

- Improved fuel efficiency

- Lower noise and vibration

Challenges:

- Higher initial cost

- Complex electrical systems

Real-World Example: Norway’s Ampere, a fully electric ferry, uses battery-powered propulsion, cutting CO₂ emissions by 95% on short routes.

7. Hybrid Propulsion Systems

Primary Use: Tugboats, ferries, offshore vessels

Key Manufacturers: Wärtsilä, Rolls-Royce

Power Output: Varies by configuration

Fuel Types: Diesel, batteries, shore power

Hybrid propulsion combines diesel engines with batteries or shore power, optimizing fuel use in emission control areas (ECAs). These systems excel in vessels with variable operating profiles, such as tugs and ferries, reducing noise and emissions during low-speed or idle modes.

Advantages:

- Fuel savings (up to 30%)

- Reduced emissions

- Enhanced maneuverability

Challenges:

- High upfront costs

- Battery lifespan concerns

Real-World Example: Color Line’s Color Hybrid ferry operates on battery power in Norwegian fjords, minimizing environmental impact.

8. Nuclear Marine Propulsion

Primary Use: Icebreakers, naval vessels

Key Manufacturers: Rosatom, General Electric

Power Output: 50,000–100,000 kW

Fuel Types: Nuclear reactors

Nuclear propulsion offers unmatched endurance, powering vessels for years without refueling. However, safety, regulatory, and political barriers restrict its use to specialized naval and icebreaking applications.

Advantages:

- Zero fossil fuel reliance

- Long operational range

- High power output

Challenges:

- Regulatory restrictions

- High construction costs

Real-World Example: Russia’s nuclear-powered Arktika icebreakers ensure year-round Arctic route access.

9. Methanol-Fueled Engines

Primary Use: Feeder ships, chemical tankers, pilot projects

Key Manufacturers: MAN Energy Solutions

Power Output: 5,000–20,000 kW

Fuel Types: Methanol, diesel

Methanol is a biodegradable, sulfur-free fuel compatible with modified diesel engines. Its potential to use bio- or e-methanol makes it a promising low-carbon alternative, gaining traction in newbuilds and retrofits.

Advantages:

- Low emissions

- Easier storage than LNG

- Scalable with green methanol

Challenges:

- Limited bunkering infrastructure

- Higher fuel cost (currently)

Real-World Example: Maersk’s methanol-powered feeder ship, launched in 2023, showcases methanol’s role in decarbonizing short-sea shipping.

10. Hydrogen Fuel Cell Systems

Primary Use: Inland waterway vessels, R&D projects

Key Manufacturers: Ballard Power Systems, Siemens

Power Output: 100–1,000 kW

Fuel Types: Hydrogen

Hydrogen fuel cells generate electricity via electrochemical reactions, producing zero emissions at the point of use. While promising for short-sea and inland shipping, challenges in storage, safety, and infrastructure limit their current adoption.

Advantages:

- Zero-emission propulsion

- Quiet operation

- High efficiency

Challenges:

- Scalability issues

- Immature infrastructure

Real-World Example: Japan’s HydroBingo ferry tests hydrogen fuel cells for coastal routes, paving the way for wider adoption.

Comparative Analysis of Engine Types

| Engine Type | Primary Use | Power Output (kW) | Fuel Efficiency | Emissions Profile | Cost (USD/kW) |

|---|---|---|---|---|---|

| Two-Stroke Diesel | Container ships, tankers | 10,000–80,000 | High (~50%) | High NOx/SOx | ~300–500 |

| Four-Stroke Diesel | Cruise ships, ferries | 1,000–20,000 | Moderate (~45%) | Moderate (Tier III) | ~400–600 |

| Dual-Fuel (LNG/Diesel) | LNG carriers, container ships | 5,000–50,000 | High (~48%) | Low SOx, moderate CO₂ | ~500–700 |

| Gas Turbines | Naval ships, fast ferries | 20,000–50,000 | Low (~30%) | High CO₂ | ~800–1,200 |

| Steam Turbines | Legacy LNG carriers, nuclear | 10,000–40,000 | Low (~30%) | Varies (fuel type) | ~1,000–1,500 |

| Diesel-Electric | Cruise ships, research vessels | 5,000–30,000 | High (~45–50%) | Moderate (Tier III) | ~600–800 |

| Hybrid Propulsion | Tugs, ferries | Varies | High (with batteries) | Low in ECA | ~700–1,000 |

| Nuclear Propulsion | Icebreakers, naval | 50,000–100,000 | N/A (no fuel cost) | Zero (operational) | ~2,000–3,000 |

| Methanol-Fueled | Feeder ships, chemical tankers | 5,000–20,000 | Moderate (~45%) | Low CO₂/SOx | ~600–800 |

| Hydrogen Fuel Cells | Inland vessels, R&D | 100–1,000 | High (~60%) | Zero | ~1,500–2,000 |

Engine Selection Factors

Choosing the right engine depends on several factors:

- Vessel Size and Type: Large ships favor two-stroke diesels; smaller vessels opt for four-stroke or electric systems.

- Operating Profile: Long-haul routes prioritize fuel efficiency; short-sea routes benefit from hybrid or electric propulsion.

- Regulatory Compliance: IMO Tier III and ECA rules drive adoption of LNG, methanol, and hybrid systems.

- Fuel Availability: LNG and methanol require bunkering infrastructure, limiting their use in some regions.

- Lifecycle Costs: Initial costs, fuel expenses, and maintenance influence long-term decisions.

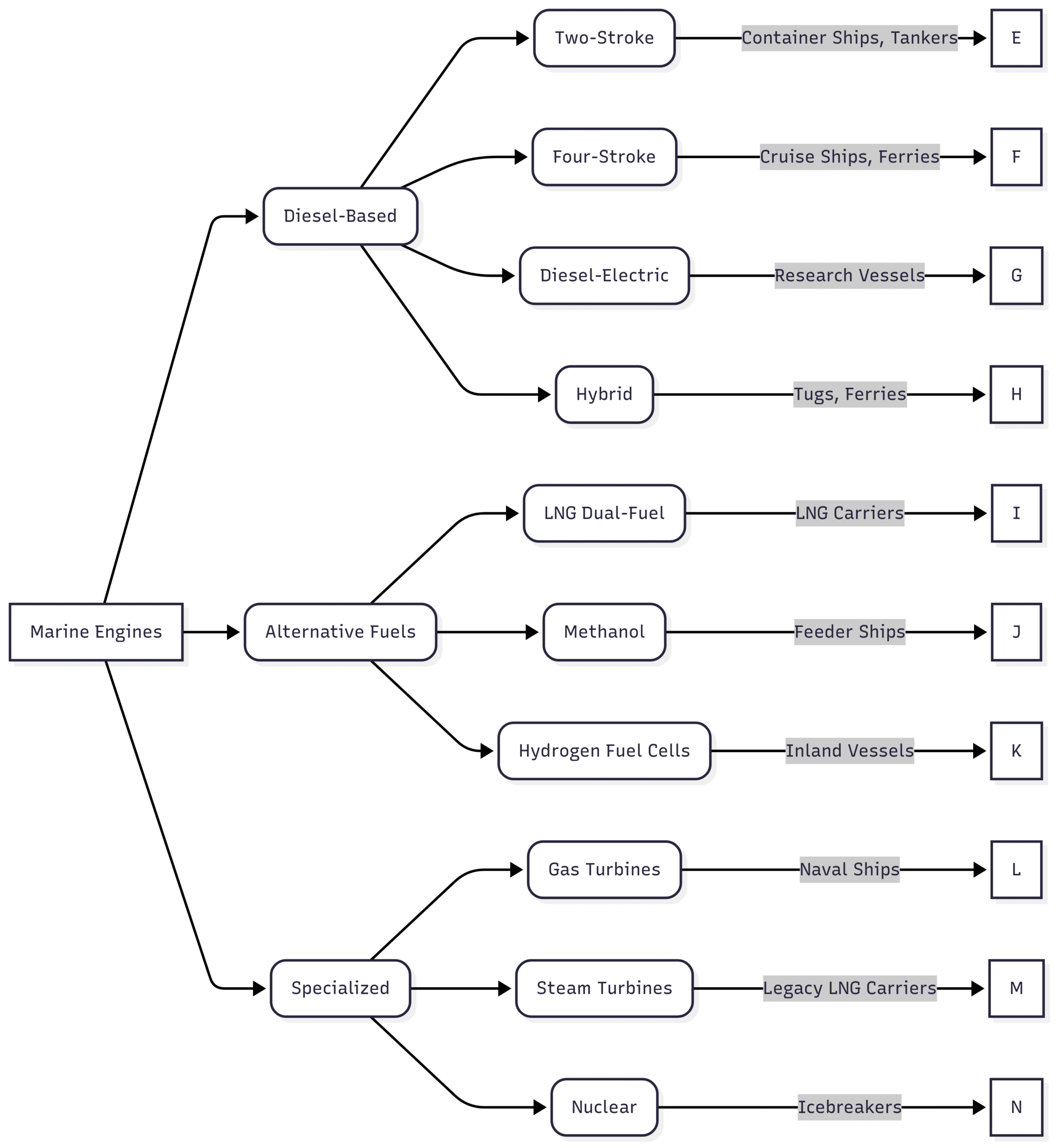

Chart: Engine Type Applications

Industry Trends and Future Outlook

The maritime sector is undergoing a transformation driven by environmental regulations and technological innovation:

- Decarbonization Push: IMO’s 2050 net-zero target accelerates adoption of LNG, methanol, and hydrogen.

- Hybridization Growth: Batteries and shore power reduce emissions in ports and ECAs.

- Digitalization: Smart engines with real-time monitoring optimize fuel use and maintenance.

- Alternative Fuels: Bio- and e-methanol, green hydrogen, and ammonia are gaining research focus.

Case Studies

- Maersk Triple-E Class: Two-stroke diesel engines with waste heat recovery systems achieve 20% fuel savings.

- Color Line’s Color Hybrid: Battery-powered operation in ports cuts emissions in Norway’s fjords.

- Norled’s MF Hydra: The world’s first hydrogen-powered ferry demonstrates zero-emission potential.

FAQs

Why are two-stroke diesel engines dominant in large vessels?

How do dual-fuel engines support sustainability?

What limits hydrogen fuel cell adoption?

How do hybrid systems save fuel?

What role do regulations play?

Conclusion

Marine propulsion is evolving rapidly to balance efficiency, cost, and environmental impact. Two-stroke and four-stroke diesel engines remain dominant, but LNG, methanol, and hydrogen technologies signal a shift toward sustainability. Hybrid and electric systems are transforming short-sea shipping, while nuclear and gas turbines serve niche roles. By understanding these top 10 engine types, stakeholders can navigate the complexities of vessel design, retrofitting, and compliance in a decarbonizing world.

For shipowners seeking tailored solutions, partnering with experts like Mack Boring Parts & Co., backed by manufacturers such as Yanmar, Scania, and OXE, ensures access to high-quality engines suited to diverse commercial needs. As the industry sails toward a greener future, staying informed on propulsion technologies is essential for success.

Happy Boating!

Share Top 10 Engine Types Used in Commercial Vessels with your friends and leave a comment below with your thoughts.

Read Critical Speed of Marine Diesel Engines: Resonance Risks and Mitigation until we meet in the next article.