The Importance of Ship Maintenance

Ship maintenance and repair form the backbone of maritime operations, ensuring vessels remain safe, efficient, and compliant with global standards. With over 100,000 vessels actively engaged in international trade, transporting everything from oil to food, the reliability of these ships is critical to global commerce.

Proper maintenance minimizes operational costs, extends vessel lifespan, prevents accidents, and supports environmental sustainability. This comprehensive guide explores marine maintenance systems for hulls and machinery, types of maintenance strategies, regulatory frameworks like the International Safety Management (ISM) Code, best practices, challenges, and the role of ship repair yards. By implementing structured maintenance plans, ship owners and operators can achieve optimal performance, reduce downtime, and ensure long-term profitability.

Understanding Ship Maintenance

Ship maintenance encompasses the proactive inspection, servicing, and repair of a vessel’s hull, machinery, propulsion systems, electrical components, and safety equipment. It is a planned process conducted either at sea, in port, or during dry-docking in specialized shipyards. Repair activities address damage or wear, ranging from minor fixes to major overhauls. The primary goal is to maintain seaworthiness, prevent failures, and comply with regulations.

Effective maintenance directly impacts safety by identifying potential hazards early, such as corrosion on the hull or malfunctioning engines. It boosts operational efficiency by reducing fuel consumption through clean hulls and tuned machinery. For instance, biofouling on a ship’s hull can increase drag by up to 20%, leading to higher fuel use and emissions. Regular cleaning and anti-fouling coatings mitigate this, potentially saving 5-10% on fuel costs annually for a mid-sized cargo vessel.

Maintenance also extends vessel lifespan. A well-maintained ship can operate for 25-30 years or more, compared to premature scrapping due to neglect. This longevity improves return on investment (ROI) for owners, as new vessels cost tens to hundreds of millions of dollars depending on type and size.

Key Benefits of Ship Maintenance

| Benefit | Description | Impact Example |

|---|---|---|

| Crew Safety | Early detection of faults in life-saving and firefighting equipment | Reduces accident risk by 40-50% |

| Cost Reduction | Prevents breakdowns; optimizes fuel and parts usage | Saves 10-15% on annual operating costs |

| Regulatory Compliance | Meets ISM, IMO, and classification society standards | Avoids fines up to $1 million per violation |

| Environmental Protection | Lowers emissions and spill risks through efficient systems | Cuts CO2 by 5-20% via hull/propeller maintenance |

| Operational Reliability | Minimizes downtime; ensures schedule adherence | Reduces unplanned stops by 30% |

Marine Maintenance Systems for Hull and Machinery

Marine maintenance systems are categorized by component: hull, machinery, propulsion, electrical/automation, and safety equipment. Each requires specific techniques, tools, and schedules.

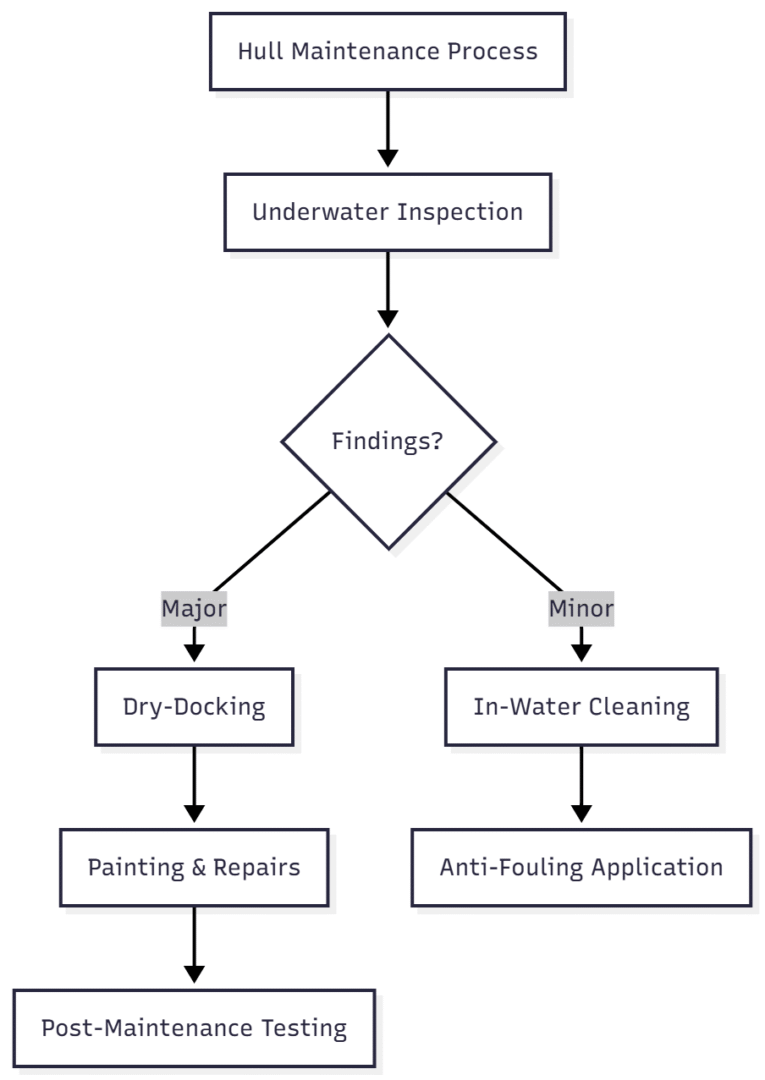

Hull Inspection and Maintenance

The hull is the vessel’s structural foundation, exposed to constant saltwater corrosion, biofouling, and mechanical stress. Regular maintenance prevents structural failure, which could lead to sinking or cargo loss.

- Underwater Hull Inspections: Conducted by divers or remotely operated vehicles (ROVs). Visual checks identify cracks, pitting, or coating damage. Non-destructive testing (NDT) like ultrasonic thickness measurement (UTM) gauges steel thickness. UTM devices, such as the Cygnus 1 (price: ~$2,500-$4,000), measure in millimeters with accuracy to 0.1mm. Inspections occur every 6-12 months or per class requirements.

- Dry-Docking: Vessels are lifted out of water in graving docks or floating dry docks for comprehensive access. Typical interval: 2.5-5 years. Activities include hull painting, propeller polishing, and rudder repairs. Costs range from $500,000 for a small tanker to $5 million+ for large container ships, including labor and materials.

- Hull Cleaning: Removes marine growth using brushes or high-pressure water jets. In-water cleaning systems like the HullWiper (eco-friendly, no divers needed) cost ~$50,000 per session but save fuel. Fouling can add 80% to hull resistance if untreated.

- Anti-Fouling Systems: Silicone-based paints (e.g., International Interspeed, ~$200/gallon) or ICCP systems prevent growth and corrosion. ICCP setups, like Cathelco systems (price: $100,000-$500,000 installed), use anodes to impress current, protecting steel for 5+ years.

Machinery Maintenance

Ship machinery includes engines, pumps, compressors, and auxiliaries. A Planned Maintenance System (PMS) schedules tasks digitally via software like AMOS or ShipManager (~$10,000-$50,000 annual license).

- Condition-Based Maintenance (CBM): Uses sensors for vibration (e.g., SKF Microlog, ~$5,000), oil analysis (kits ~$100/sample), or thermography (FLIR cameras, ~$1,000-$10,000). Detects issues like bearing wear before failure.

- Preventive Maintenance: Lubrication, filter changes, alignments every 500-1,000 running hours. Extends life by 20-30%.

Propulsion System Maintenance

- Engine Overhauls: Main engines (e.g., MAN B&W 2-stroke) overhauled every 10,000-20,000 hours. Involves piston replacement, cylinder liner honing. Costs: $1-5 million.

- Fuel System: Injector testing (equipment ~$2,000), filter replacement. Ensures 95%+ combustion efficiency.

- Turbocharger Maintenance: Cleaning impellers, bearing checks. ABB turbochargers (~$500,000 new) serviced annually.

Electrical and Automation System Maintenance

- Inspections: Switchboards, generators tested for insulation resistance (>1 MΩ). Multimeters like Fluke 87V (~$500).

- Sensor Calibration: Using standards like Hart communicators (~$3,000).

- Automation: PLC updates, hardware checks in integrated systems like Kongsberg (~$1 million+ installed).

Safety and Firefighting Equipment Maintenance

- Life-Saving Appliances: Lifeboats davit tests, raft servicing per SOLAS. Costs ~$5,000 per unit.

- Firefighting: CO2 system hydrostatic tests every 10 years, extinguishers annually.

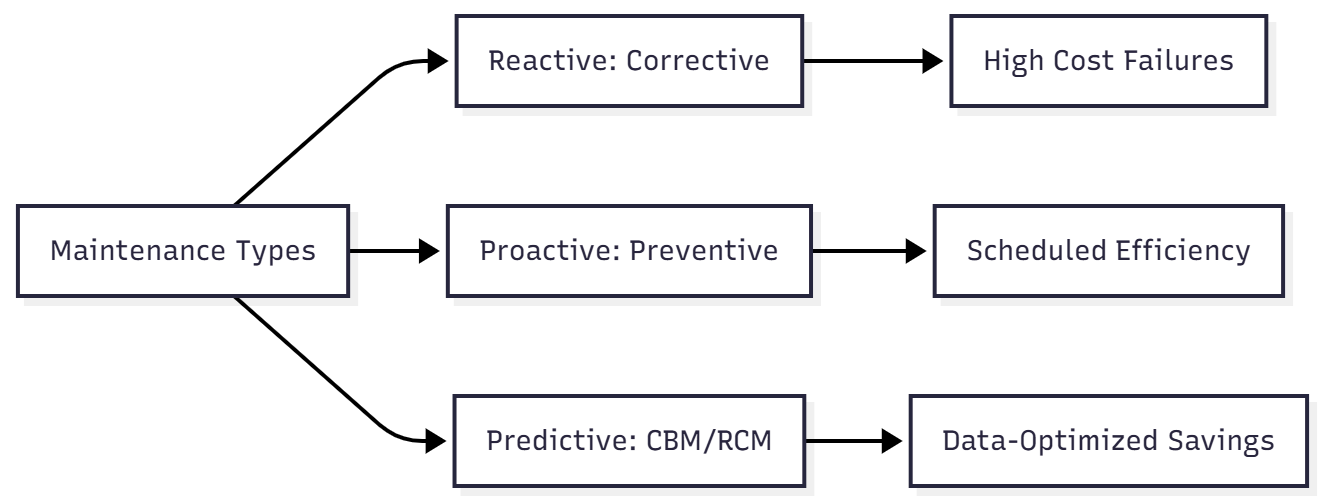

Types of Maintenance Strategies

Shipping companies select strategies based on vessel type, age, and operations.

| Type | Description | Pros | Cons | Typical Application |

|---|---|---|---|---|

| Unplanned/Corrective | Fix after failure | Low initial cost | High downtime, risk | Non-critical items |

| Planned/Preventive | Scheduled intervals | Predictable, extends life | Over-maintenance possible | Engines, pumps |

| Predictive/CBM | Data-driven, real-time monitoring | Minimizes unnecessary work | Requires sensors/tech | Turbochargers, bearings |

| Reliability-Centered (RCM) | Analyzes failure modes for optimal tasks | Cost-effective, focused | Complex analysis | Complex systems like automation |

Regulatory Framework: ISM Code and Compliance

The ISM Code mandates safe operation and pollution prevention. Key elements:

- Maintenance database for all equipment.

- Non-conformity reporting and corrective actions.

- PMS integration for scheduling.

Compliance avoids detentions; non-compliance fines exceed $100,000. Classification societies (e.g., DNV, ABS) certify via surveys.

Energy Efficiency and Environmental Impact

Maintenance drives energy savings:

- Hull fouling: 1mm slime increases fuel by 5%.

- Engine tuning: Optimizes specific fuel oil consumption (SFOC) to 170-180 g/kWh.

- Propeller polishing: Reduces roughness, saves 3-5% fuel.

Global fleet emissions: ~3% of world CO2. Maintenance supports IMO’s Energy Efficiency Existing Ship Index (EEXI) and Carbon Intensity Indicator (CII).

Implementing Effective Maintenance Plans

Steps for PMS development:

- Inventory Equipment: Register all items in database.

- Set Intervals: Based on manufacturer (e.g., Wärtsilä engines: 8,000 hours minor overhaul), history, and risk.

- Assign Responsibilities: Qualified personnel (e.g., Chief Engineer).

- Document and Audit: Digital logs for audits.

Software tools: DN V’s ShipManager (~$20,000/year), ABS Nautical Systems.

Maintenance Interval Factors Table

| Factor | Influence on Interval |

|---|---|

| Manufacturer Specs | Base intervals (e.g., 500 hours lubrication) |

| Historical Data | Adjust for past failures |

| Operational Use | Continuous vs. standby |

| Regulatory Requirements | SOLAS, class surveys |

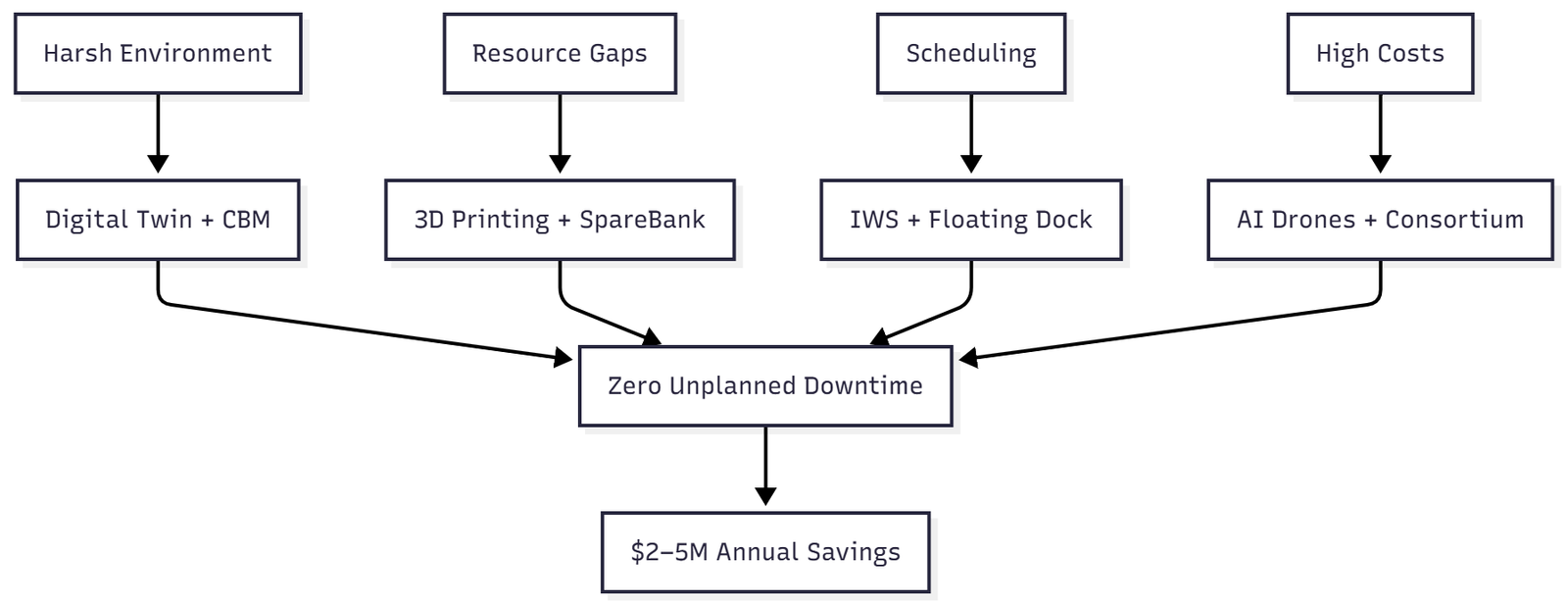

Challenges in Ship Maintenance

1. Harsh Marine Environment – Accelerated Degradation

Saltwater is 800× more corrosive than freshwater. In tropical waters (28–32°C, high salinity, high bio-activity):

- Corrosion rate doubles every 10°C rise.

- Biofouling growth: 1 mm slime in 30 days → 5% fuel penalty; heavy barnacles in 3 months → 20–40% drag.

- Result: Maintenance intervals shrink 20–30% (e.g., from 12 to 9 months for hull UTM).

Real-World Impact:

A 180,000 DWT bulk carrier trading Asia–Australia lost $1.2M/year in extra fuel due to unmanaged fouling.

Solutions & Implementation:

| Solution | How It Works | Tools & Costs | ROI |

|---|---|---|---|

| Advanced Anti-Fouling Coatings | Silicone foul-release (e.g., International Intersleek 1100SR) — slime slides off at 8+ knots. | $180–$250/gallon; 5-year life | 8–12% fuel savings → $800k/year |

| ICCP + MGPS Combo | Impressed Current Cathodic Protection + Marine Growth Prevention System. | Cathelco ICCP: $250k install | Corrosion rate ↓90% |

| In-Water ROV Cleaning | Brush/ cavitation systems clean hull without dry-dock. | HullWiper ROV: $45k–$60k per clean | 1 clean = 5–7% fuel save |

| Environmental Monitoring | Real-time salinity, pH, temp sensors → adjust intervals. | YSI ProDSS: $3,500 | Optimize PMS intervals |

Action Plan:

- Apply foul-release during next dry-dock.

- Install ICCP + MGPS.

- Schedule bi-annual ROV cleaning in high-fouling routes.

2. Resource Constraints – Spare Parts & Skilled Labor Shortages

- Global supply chain delays: Critical spares (e.g., piston crowns) stuck 60–90 days in transit.

- Labor gap: 12–15% vacancy in marine engineers (per BIMCO 2023); senior chiefs retiring faster than training.

- Onboard stock mismatch: 40% of spares are wrong spec or obsolete.

Real-World Impact:

A VLCC waited 28 days in Singapore for a turbocharger cartridge → $1.8M demurrage + off-hire.

Solutions & Implementation:

| Solution | How It Works | Tools & Costs | ROI |

|---|---|---|---|

| 3D-Printed Spares Onboard | Print gaskets, impellers, brackets using metal/polymer printers. | Markforged Metal X: $150k | ↓90% wait time for non-critical parts |

| Digital Spare Parts Catalog | OEM-linked database with 3D models, criticality ranking. | DNV ShipManager Parts: $10k/year | Stock accuracy ↑95% |

| Global Spare Pooling | Shared warehouse network (e.g., Wilh. Wilhelmsen SpareBank). | $50k/year membership | 48-hour delivery in 50+ ports |

| Crew Upskilling Program | Partner with METIs for hybrid training (mechanical + digital). | $2,500/crew/year | ↓30% external contractor reliance |

Action Plan:

- Audit spares → tag A-B-C criticality.

- Join SpareBank + install 3D printer on large vessels.

- Launch 24-month cadet-to-engineer pipeline.

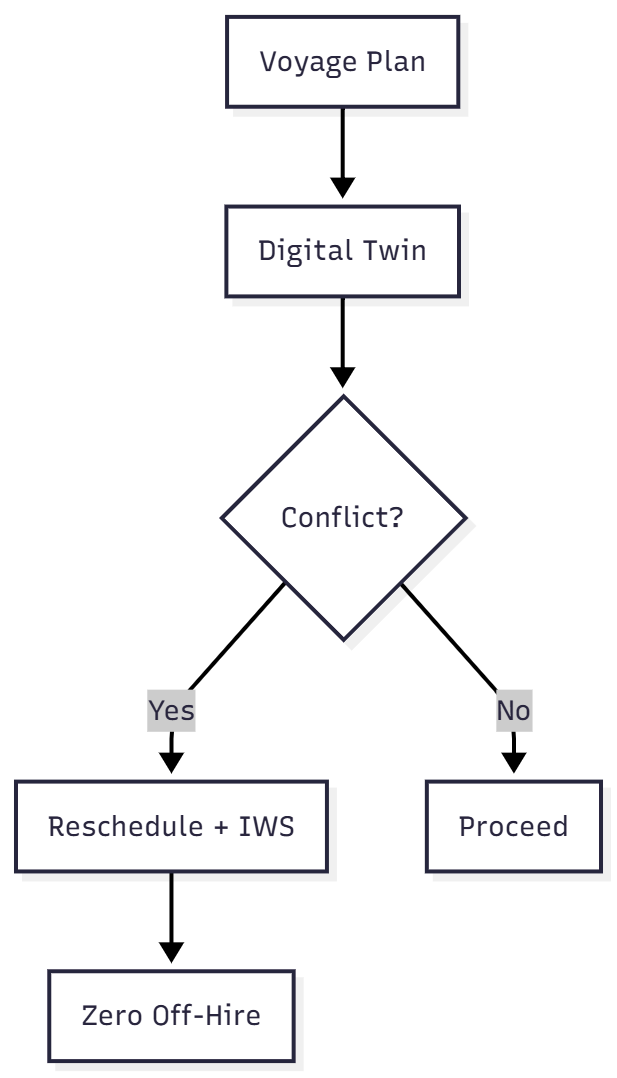

3. Scheduling Conflicts – Voyage vs. Maintenance Windows

- Port stays <48 hours → insufficient for major jobs.

- Dry-dock slots booked 6–18 months ahead (post-COVID backlog).

- Charterer penalties: $25k–$50k/day off-hire.

Real-World Impact:

A container ship delayed dry-dock by 14 months → $3.2M in coating failure repairs.

Solutions & Implementation:

| Solution | How It Works | Tools & Costs | ROI |

|---|---|---|---|

| In-Water Surveys (IWS) | ROV + UTM replaces intermediate dry-dock. | ABS-approved IWS: $80k | Save 1 dry-dock every 5 years |

| Digital Twin Scheduling | Simulate maintenance windows vs. voyage plans. | Kongsberg Digital Twin: $120k setup | ↑15% schedule adherence |

| Floating Dock Leasing | Mobile dry-docks (e.g., Damen Floating Dock). | $1.2M/month lease | Zero port wait |

| Opportunity Maintenance | Bundle tasks during cargo ops (e.g., generator overhaul in 12-hour port). | PMS trigger logic | ↓25% unplanned stops |

Action Plan:

- Apply for IWS approval with class.

- Integrate digital twin with chartering software.

- Pre-book floating dock for peak season.

4. High Costs – 2–5% of Vessel Value Annually

Challenge Explained:

- Large ships (e.g., 15,000 TEU): $5–10M/year in maintenance.

- Breakdown: 40% dry-dock, 30% spares, 20% labor, 10% surveys.

- Hidden cost: Unplanned downtime = $50k–$150k/day.

Solutions & Implementation:

| Solution | How It Works | Tools & Costs | ROI |

|---|---|---|---|

| Condition-Based Maintenance (CBM) | Sensors trigger tasks → eliminate 30% of preventive jobs. | Wärtsilä Expert Insight: $100k/year | $1.2M/year savings |

| Bulk Purchasing Consortium | Fleet-wide OEM contracts. | Via INSA or IMPA | ↓18% on spares |

| Drone + AI Inspections | Replace diver surveys; AI detects 95% of defects. | Flyability Elios 3: $55k | ↓60% survey cost |

| Life-Cycle Costing (LCC) Model | Predict TCO at purchase → choose durable components. | DNV LCC Tool: $8k | ↑12% ROI over 25 years |

Cost Breakdown Optimization:

| Category | Current % | Target % | Annual Saving (10,000 TEU ship) |

|---|---|---|---|

| Dry-Dock | 40% | 30% | $800k |

| Spares | 30% | 22% | $600k |

| Labor | 20% | 15% | $400k |

| Surveys | 10% | 5% | $200k |

Action Plan:

- Launch CBM pilot on main engine + generators.

- Deploy drone team (2 drones + 1 pilot).

- Renegotiate OEM spares via consortium.

Integrated Solution Framework

Ship Repair Yards and Dry-Docking

Repair occurs in yards like:

- Damen Shipyards: 1,500+ jobs/year, facilities in Netherlands, prices ~$100,000-$10 million per project.

- BAE Systems San Diego: 950-ft dry dock, handles warships up to 50,000 tons.

- China Shipbuilding Industry Corporation (CSIC): Massive scale, newbuilds + repairs.

Types:

- Routine: Painting, cleaning.

- Standard: Machinery swaps.

- Major Refits: Conversions (e.g., tanker to FPSO, $50-200 million).

- Emergency: Collision repairs, 24/7 response.

Best Practices for Optimal Maintenance

1. Conduct Routine Inspections with Digital Checklists

Why it matters:

Human error in manual inspections causes 60–70% of missed defects. Routine, structured checks catch corrosion, leaks, or wear before they escalate.

Implementation Steps:

- Develop component-specific checklists (e.g., main engine, ballast system, fire dampers).

- Use mobile-first digital platforms:

- SafetyCulture (iAuditor): ~$10/user/month; offline-capable, photo tagging, auto-reports.

- TeroTiva PMS, MarineCFO, or ABS NS5: $15–$50/user/month.

- Schedule via PMS calendar (e.g., daily visual rounds, weekly functional tests).

- Incorporate NDT:

- Ultrasonic thickness gauging (UTM) on hull plates every 6 months.

- Thermographic scans of electrical panels quarterly.

Tools & Costs:

| Tool | Cost | Use Case |

|---|---|---|

| SafetyCulture | $120/user/year | Daily rounds, photos, issue logging |

| Cygnus 4+ UTM Gauge | $3,800 | Hull steel thickness |

| FLIR E96 Thermal Camera | $9,500 | Hotspot detection |

KPIs:

- 100% checklist completion rate

- <5% repeat findings in 30 days

- 95% on-time inspection compliance

2. Maintain Accurate, Cloud-Based Maintenance Records

Why it matters:

Accurate history enables trend analysis, supports audits, and prevents over-maintenance. Paper logs fail during PSC inspections.

Implementation:

- Use centralized digital PMS with:

- Equipment register (serial numbers, install date, OEM manuals)

- Running hours counter integration

- Work order history with parts used, labor hours, photos

- Cloud sync ensures shore office and ship access same data in real time.

- Auto-backup and version control (e.g., DNV ShipManager Cloud).

Tools & Costs:

| System | Cost | Features |

|---|---|---|

| DNV ShipManager | $25,000–$60,000/year (fleet) | Full PMS, class integration |

| AMOS by SpecTec | $15,000–$40,000/year | Inventory + maintenance |

| Planned Maintenance Module (free-tier options) | $0–$5,000 | Smaller vessels |

KPIs:

- 100% digital record compliance

- <24-hour delay in work order closure

- Full audit trail for last 5 years

3. Invest in STCW-Certified Crew Training & Competency Mapping

Why it matters:

A trained crew reduces maintenance errors by 40% and responds faster to emergencies.

Implementation:

- Mandatory STCW refresher courses every 5 years.

- OEM-specific training:

- MAN, Wärtsilä, Caterpillar engine courses ($1,500–$3,000/crew)

- ABB turbocharger maintenance ($2,000)

- Onboard competency matrix: Role Required Skill Certification Renewal Chief Engineer Engine Overhaul STCW III/2 5 yrs Electrician HV Safety STCW A-III/6 5 yrs Bosun Hull Inspection RYA Yachtmaster 3 yrs

- VR simulation training (e.g., Kongsberg K-Sim): $50,000 setup, reduces real-machine risk.

KPIs:

- 100% crew certification compliance

- <2 maintenance-related incidents per 10,000 running hours

- Annual training hours: ≥40 per technical crew

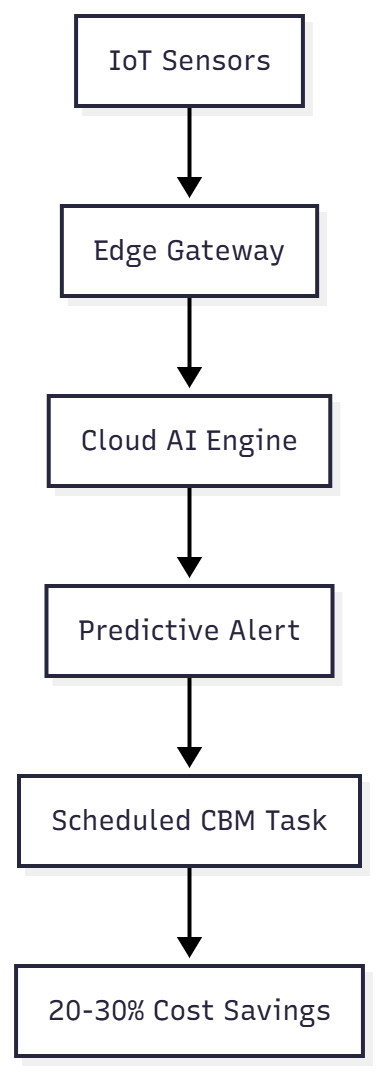

4. Integrate IoT Sensors & AI-Driven Predictive Analytics

Why it matters:

Shifting from time-based to condition-based maintenance (CBM) saves 20–30% in parts and labor.

Implementation:

- Install IoT sensors:

- Vibration: SKF Enlight Pro ($1,200/sensor + $5,000 gateway)

- Lube oil: Parker Kittiwake ANALEX ($8,000 online analyzer)

- Temperature/pressure: WAGO or Siemens IO-Link ($300–$600/point)

- Feed data into AI platform:

- Prisma Sense (Wärtsilä): ~$100,000 initial + $20,000/year

- GE Predix, Siemens MindSphere, or Kongsberg Vessel Insight

- AI predicts failures:

- Bearing wear: 30–60 days warning

- Fuel injector clog: 100 hours before drop in performance

KPIs:

- Predictive maintenance ratio: ≥60% of critical tasks

- False alarm rate: <5%

- MTBF increase: +25%

5. Adopt Proactive, Risk-Based Strategies (RCM + CBM)

Why it matters:

Not all equipment fails equally. Reliability-Centered Maintenance (RCM) prioritizes critical systems.

Implementation:

- Conduct RCM workshop (per ISO 55001):

- List all systems

- Identify failure modes (FMEA)

- Assign risk priority (Likelihood × Consequence)

- Define maintenance type:

- Run-to-failure (low risk)

- Preventive (medium)

- CBM/PdM (high risk)

Example Risk Matrix:

| System | Failure Mode | Risk Score | Strategy |

|---|---|---|---|

| Main Engine | Piston seizure | 24 (High) | CBM + 8,000 hr overhaul |

| Bilge Pump | Motor burnout | 12 (Med) | Preventive (1,000 hr) |

| Navigation Lights | Bulb failure | 6 (Low) | Run-to-failure |

- Integrate into PMS: Auto-generate tasks based on risk.

Tools:

- ReliaSoft RCM software: $15,000/license

- Excel-based FMEA templates (free for small fleets)

KPIs:

- Critical equipment availability: ≥99.5%

- Maintenance cost per running hour: ↓15–25%

- Zero high-risk failures in 12 months

By embedding these five interconnected practices, ship operators achieve zero unplanned downtime, full regulatory compliance, and maximum vessel lifespan — turning maintenance into a profit driver, not a cost center.

Case Studies and Real-World Applications

- Container Ship Example: A 10,000 TEU vessel with PMS reduced downtime from 5% to 1%, saving $2 million/year.

- Tanker Retrofit: ICCP installation cut corrosion repairs by 50%, payback in 3 years.

Future Trends in Ship Maintenance

- Autonomous Inspections: Drones/ROVs with AI (e.g., Anybotics robots, ~$150,000).

- Green Technologies: Bio-based anti-fouling, hydrogen-ready engines.

- Sustainability: Refits for IMO 2050 goals, extending life vs. newbuilds.

Frequently Asked Questions

Preventive maintenance follows fixed schedules (e.g., engine oil change every 1,000 running hours) to stop failures before they occur, regardless of actual condition. Predictive maintenance uses real-time data—vibration sensors, oil analysis, thermography—to trigger tasks only when wear is detected. Predictive cuts unnecessary work by 20-30% and reduces downtime, but requires sensors costing $5,000–$50,000 per system.

Commercial vessels typically dry-dock every 2.5–5 years per classification society rules (ABS, DNV, Lloyd’s). Interval depends on age, trading area, and coating condition. Special surveys at 5-year marks are mandatory; intermediate surveys allow in-water alternatives if hull condition permits. Costs range $500,000–$5 million based on size.

The ISM Code (Section 10) requires every ship to have a digital or documented PMS that schedules, tracks, and records all maintenance. It must identify critical equipment, assign responsibilities, and log non-conformities with corrective actions. Audits verify PMS data; non-compliance risks PSC detention or fines up to $100,000.

Marine growth increases hydrodynamic drag: 1 mm of slime adds ~5% fuel burn; heavy calcareous fouling can raise it 20–40%. Prevention includes silicone foul-release coatings ($150–$250/gallon) or ICCP systems ($100,000–$500,000 installed). In-water cleaning with ROV brushes every 6–12 months restores efficiency; propeller polishing alone saves 3–5% fuel.

Top causes: main engine failures (35%), electrical faults (20%), and hull/corrosion issues (15%). Reduction strategy: shift to Condition-Based Maintenance with continuous monitoring (vibration, lube oil, thermography), maintain 100% spare parts criticality stock, and train crew via STCW refresher modules. Fleets using digital PMS and IoT sensors cut unplanned stops by 30–40%.

Conclusion

Ship maintenance and repair are the cornerstone of safe, efficient, and sustainable maritime operations. By implementing robust Planned Maintenance Systems (PMS), leveraging Condition-Based and Predictive strategies, and adhering to the ISM Code, vessel operators minimize downtime, reduce fuel consumption by up to 20%, and extend service life beyond 25 years.

Regular hull inspections, anti-fouling applications, engine overhauls, and digital monitoring prevent costly failures while ensuring crew safety and regulatory compliance. As global trade relies on over 100,000 vessels, proactive maintenance preserves profitability, protects marine ecosystems, and meets stringent environmental standards like IMO’s CII and EEXI. Investing in skilled crews, advanced technologies, and strategic dry-docking transforms maintenance from a cost center into a competitive advantage. Ultimately, disciplined ship maintenance secures operational reliability, safeguards lives, and sustains the maritime industry’s vital role in global commerce.

Happy Boating!

Share The Importance of Ship Maintenance and Repair with your friends and leave a comment below with your thoughts.

Read Ship Materials and Welding Techniques until we meet in the next article.