Is Boat Insurance Required in Michigan?

Boating in Michigan, the Great Lakes State, is a cherished lifestyle, with access to four Great Lakes and over 11,000 inland lakes. Whether you’re cruising Lake Michigan, fishing on an inland lake, or docking a yacht, protecting your vessel is critical. While Michigan law does not mandate boat insurance, various factors make it a wise investment. This comprehensive guide explores why boat insurance is essential, the types of coverage available, associated costs, and strategies to save, tailored for Michigan boaters.

Is Boat Insurance Legally Required in Michigan?

Michigan does not require boat insurance by law, unlike auto insurance. However, certain situations may necessitate coverage:

- Lender Requirements: If you finance your boat, lenders typically require comprehensive and collision coverage to protect their investment. This ensures the boat, their collateral, is covered for damage or loss.

- Marina Requirements: Many marinas and boatyards mandate liability insurance to dock or store your boat, safeguarding against potential damages to their property or other vessels.

- Voluntary Protection: Even if you own your boat outright, insurance mitigates financial risks from accidents, theft, or environmental damage, offering peace of mind.

Without legal requirements, the decision to insure rests on your risk tolerance and financial priorities. However, the potential costs of accidents—medical bills, property damage, or legal fees—make insurance a prudent choice.

Why Boat Insurance Matters

Boating carries inherent risks, from collisions to unpredictable weather. Insurance provides a financial safety net, ensuring you can enjoy Michigan’s waters without worry. Here’s why it’s essential:

- Financial Protection: Accidents can lead to significant expenses, including repairs, medical costs, or liability claims. Insurance covers these, preventing out-of-pocket losses.

- Asset Preservation: Boats are costly investments. Comprehensive coverage protects against theft, vandalism, or natural disasters, preserving your vessel’s value.

- Liability Coverage: If you cause an accident, liability insurance covers damages or injuries to others, shielding your personal finances.

- Peace of Mind: Knowing you’re covered allows you to focus on the joy of boating, whether fishing, cruising, or entertaining.

Real-World Scenario

Imagine cruising Lake Huron when a sudden collision with another boat damages both vessels and injures passengers. Without insurance, you could face thousands in repair costs, medical bills, and potential lawsuits. A comprehensive policy with liability coverage would handle these expenses, up to your policy limits, saving you from financial strain.

Types of Boat Insurance Coverage

Boat insurance policies are tailored to vessel size and use, with options for small watercraft (under 26 feet) and yachts (over 50 feet). Policies typically include two core components: physical damage and liability coverage, with optional add-ons for comprehensive protection.

Core Coverages

| Coverage Type | Description | Typical Limits |

|---|---|---|

| Physical Damage | Covers repairs or replacement for your boat, motor, and equipment due to collisions, storms, or other covered events. | Varies by policy; often agreed value or actual cash value. |

| Liability | Covers damages or injuries to others if you’re at fault, including legal fees. | $100,000–$1,000,000 per incident. |

| Medical Payments | Pays medical expenses for you and passengers injured in an accident, regardless of fault. | $1,000–$10,000 per person. |

| Personal Effects | Covers personal items like phones, fishing gear, or cameras lost or damaged on board. | Up to $10,000; $1,000 per item. |

Physical Damage Coverage Options

The payout for physical damage claims depends on the policy type:

- Agreed Value Policy: Pays the boat’s value at policy inception, ignoring depreciation. Ideal for newer or high-value boats but more expensive. Example: A $50,000 boat is fully covered for $50,000.

- Actual Cash Value (ACV) Policy: Accounts for depreciation, reducing payouts for older boats. More affordable but offers less coverage. Example: A $50,000 boat, depreciated to $40,000, pays out $40,000.

- Replacement Cost Policy: Covers repairs or replacement to restore the boat to pre-accident condition, often with higher premiums.

Optional Coverages

Enhance your policy with these add-ons:

- Uninsured/Underinsured Boater: Covers damages or injuries caused by an uninsured or underinsured boater. Essential in Michigan, where insurance isn’t mandatory.

- On-Water Towing (e.g., Sign & Glide®): Covers towing, fuel delivery, or jump-starts if your boat is stranded. Costs typically $50–$150 per incident without coverage.

- Propulsion Plus®: Repairs or replaces outboard or inboard/outboard motor units due to mechanical failure (excludes jet drives or inboard motors).

- Wreckage Removal: Covers costs to remove a sunken boat, often required by law.

- Fuel Spill: Pays for legally mandated cleanup of spilled fuel, protecting against environmental fines.

- Watersport Coverage: Covers injuries from water-skiing, tubing, or similar activities, typically up to $10,000.

- Fishing Equipment: Replaces lost or stolen gear, up to $10,000 total, $1,000 per item.

- Roadside Assistance: Covers trailer repairs or towing while transporting your boat.

- Boat Rental Reimbursement: Compensates for rental costs if your boat is unusable due to a covered loss.

Coverage for Different Boat Types

Michigan’s diverse boating scene includes sailboats, powerboats, fishing boats, cabin cruisers, bass boats, center consoles, and yachts. Each requires tailored coverage:

- Sailboats: Need coverage for masts, sails, and rigging, plus liability for crew injuries.

- Powerboats: Higher horsepower increases liability risks; ensure adequate coverage.

- Fishing Boats: Prioritize fishing equipment and personal effects coverage.

- Cabin Cruisers/Yachts: Require higher liability limits and comprehensive coverage due to size and value.

- Bass Boats/Center Consoles: Benefit from propulsion and watersport coverage for versatile use.

Boat Insurance Costs in Michigan

The average annual cost for a Progressive boat insurance policy in Michigan is approximately $331, with liability-only policies starting at $100 per year. Costs vary based on:

- Boat Type: Pontoons, PWCs, sailboats, or yachts have different risk profiles. A 50-foot yacht costs more to insure than a 20-foot pontoon.

- Horsepower: Higher-powered engines (e.g., 500HP vs. 50HP) increase premiums due to speed-related risks.

- Boating Experience: Experienced boaters may qualify for lower rates.

- Claims History: Past claims, even non-fault, can raise premiums.

- Coverage Limits: Higher limits or add-ons like towing increase costs.

- Location: Boating on the Great Lakes may cost more than inland lakes due to navigation risks.

Sample Cost Breakdown

| Boat Type | Coverage | Annual Premium (USD) |

|---|---|---|

| 20-ft Pontoon | Liability Only | $100–$150 |

| 25-ft Fishing Boat | Comprehensive + Collision | $250–$350 |

| 40-ft Cabin Cruiser | Full Coverage + Towing | $400–$600 |

| 60-ft Yacht | Full Coverage + Yacht Add-Ons | $800–$1,500 |

Strategies to Lower Boat Insurance Costs

Michigan boaters can reduce premiums with these discounts and strategies:

- Multi-Policy Discount: Bundle boat insurance with auto, home, renters, RV, or motorcycle policies for up to 10–20% savings.

- Paid-in-Full Discount: Pay the annual premium upfront to save 5–10%.

- Responsible Driver Discount: Maintain a clean boating record for lower rates.

- Safety Course Discount: Complete a USCG-approved boating safety course to reduce premiums by 5–15%.

- Original Owner Discount: Owning the boat from new may qualify for discounts.

- Storage Practices: Store boats indoors during off-season to avoid freeze or vermin damage, potentially lowering rates.

- Self-Inspection: Use apps like Ahoy!’s to document boat condition, earning up to $100 deductible discounts.

Example Savings

A boater with a 25-foot fishing boat paying $350 annually could save:

- $35 (10%) with a multi-policy discount.

- $17.50 (5%) for paying in full.

- $35 (10%) for a safety course.

Total: $87.50 savings, reducing the premium to $262.50.

Michigan Boating Regulations and Insurance Implications

While insurance isn’t mandatory, Michigan’s boating laws impact coverage needs:

- Registration: All watercraft, except those under 16 feet with no motor, must be registered with the Michigan Department of State and display a decal. Insurance doesn’t affect registration but ensures financial protection.

- Age Restrictions: Operators under 14 cannot legally operate personal watercraft, reducing liability risks for younger boaters but requiring coverage for adults.

- Safety Equipment: USCG mandates one Type I, II, or III personal flotation device per person. Insurance can cover replacement if damaged in an accident.

- Navigation Limits: Policies may restrict coverage to specific waterways (e.g., inland lakes vs. Great Lakes). Confirm coverage for your boating areas.

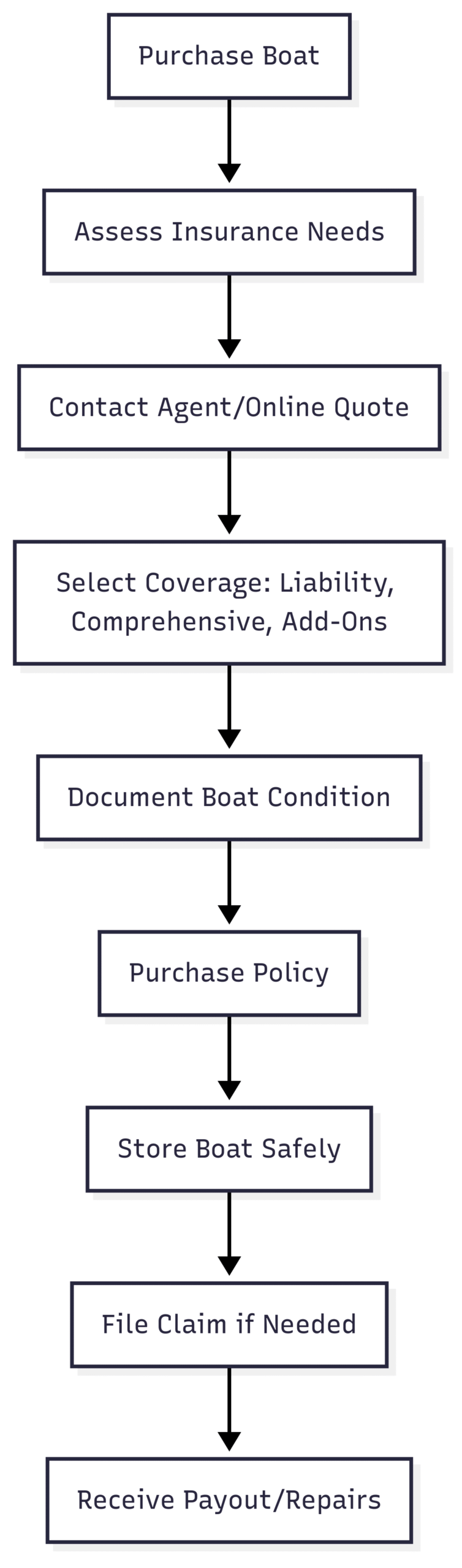

Insurance Workflow

Choosing the Best Boat Insurance in Michigan

The best policy balances coverage and affordability. Progressive and Ahoy! are notable providers in Michigan:

- Progressive: Offers policies starting at $100/year for liability, with no marine survey required. Includes add-ons like Sign & Glide® and Propulsion Plus®.

- Ahoy!: Specializes in recreational boats up to 95 feet, with a digital-first approach. Covers boats up to 40 years old, 500HP per engine, or $2.5M in value. Unique features include Phone Overboard Protection and self-inspection discounts.

Provider Comparison

| Provider | Key Features | Starting Price (USD) |

|---|---|---|

| Progressive | No survey, towing, mechanical coverage, multi-policy discounts | $100/year (liability) |

| Ahoy! | Digital quoting, Phone Overboard, weather alerts, self-inspection | $150/year (varies) |

How to Get a Quote

- Online: Use Progressive’s website or Ahoy!’s app for instant quotes.

- Phone: Call Progressive (1-866-749-7436) or Ahoy! (1-855-289-2469).

- Agent: Contact local agents like Dalessandro Agency Inc. in Grand Rapids for personalized guidance.

Homeowners Insurance vs. Boat Insurance

Homeowners policies offer limited boat coverage, typically for small watercraft used in specific waterways. Filing a boat claim may increase homeowners premiums. A dedicated boat policy provides:

- Tailored coverage for hull, motor, and equipment.

- Protection without impacting homeowners rates.

- Higher liability limits for water-based incidents.

Off-Season Considerations

Michigan’s boating season is seasonal due to cold winters. Policies may include:

- Storage Requirements: Indoor storage may be required to cover freeze or vermin damage.

- Short Rate Refunds: Canceling during off-season may result in lower refunds due to higher seasonal premiums.

- Lay-Up Discounts: Some insurers offer reduced rates during non-use periods if the boat is stored properly.

Preparing for Claims

To streamline claims:

- Document Condition: Take photos or conduct a professional inspection to establish the boat’s pre-loss condition.

- Keep Records: Store receipts for equipment and maintenance.

- Understand Policy: Review exclusions (e.g., vermin damage, navigation limits) to avoid surprises.

Tailored Coverage for Michigan Boaters

Michigan’s unique waterways demand specific considerations:

- Great Lakes: Higher risks due to open water; ensure policies cover these areas.

- Inland Lakes: Lower risk but require coverage for theft or vandalism during storage.

- Seasonal Use: Opt for policies with flexible terms for off-season storage.

Boat Type-Specific Needs

- Sailboats: Coverage for rigging damage and crew liability.

- Powerboats: Higher liability for speed-related incidents.

- Fishing Boats: Emphasis on gear and equipment coverage.

- Yachts: Comprehensive policies for high-value vessels, including wreckage removal.

FAQs

Is boat insurance mandatory in Michigan?

No, but lenders or marinas may require it. It’s recommended for financial protection.

How much does boat insurance cost in Michigan?

Averages $331/year with Progressive; liability-only starts at $100/year. Costs depend on boat type, horsepower, and coverage.

Can homeowners insurance cover my boat?

Limited coverage for small boats; a separate policy is better to avoid premium increases.

What discounts are available?

Multi-policy, paid-in-full, safety course, responsible driver, and original owner discounts.

Does insurance cover Great Lakes boating?

Check policy navigation limits; some exclude open waters unless specified.

Final Thoughts

While boat insurance isn’t required in Michigan, it’s a critical safeguard for your vessel and finances. From liability to comprehensive coverage, policies protect against accidents, theft, and environmental risks. With averages around $331/year and discounts like multi-policy or safety courses, affordable options are accessible. Providers like Progressive and Ahoy! offer tailored solutions, with digital tools enhancing the experience. Document your boat’s condition, understand policy terms, and choose coverage that matches your boating lifestyle—whether on Lake Michigan or a quiet inland lake.

Share Is Boat Insurance Required in Michigan? with your friends and Leave a comment below with your thoughts.

Read What Are the Boat Requirements in Arkansas: Guide until we meet in the next article.