Profit or passion? What it really costs to run a charter yacht

Discover the true costs and profits of running a charter yacht. Explore financial models, case studies, and expert tips to maximize earnings in yacht chartering.

Owning and operating a charter yacht is a dream for many, blending the allure of luxury travel with the potential for financial gain. But is it a viable business venture, or merely a passion project that comes with a hefty price tag? This article dives deep into the financial realities, operational challenges, and strategic decisions involved in running a charter yacht, offering insights from industry experts, real-world case studies, and practical advice for aspiring yacht owners. Whether you’re considering a second-hand vessel or a brand-new superyacht, understanding the costs, revenue potential, and management models is crucial to making an informed decision.

The Charter Yacht Market: An Overview

The global yacht charter market is thriving, driven by growing demand for unique, luxurious travel experiences. Popular destinations like the Mediterranean, Caribbean, and Croatia attract thousands of charterers annually, creating opportunities for yacht owners to generate income. However, profitability depends on multiple factors: the type and size of the yacht, its location, the business model, and the owner’s priorities—profit versus personal use.

Chartering can take several forms, including bareboat (no crew), crewed, fractional ownership, time-share, or full ownership. Each model has distinct financial implications, with profit margins ranging from 5% to 50% depending on the setup. While some owners aim to cover operating costs, others treat chartering as a business, leveraging tax advantages and strategic management to turn a profit.

Case Studies: The Financial Realities of Charter Yachts

To understand the profitability of charter yachts, let’s examine four real and hypothetical case studies that highlight different yacht types, sizes, and operational strategies.

Case Study 1: The Break-Even Superyacht

- Yacht: 48m Italian motor yacht, built in 2017

- Charter Rate: 7 weeks in the Western Mediterranean, €250,000–€310,000 per week

- Net Charter Income: €1,592,000

- Annual Running Costs: €1,575,000

- Net Revenue: €17,000

This 48-meter motor yacht demonstrates that breaking even is possible when chartering is prioritized over personal use. With weekly rates in the high season fetching up to €310,000, the yacht generates significant income. However, annual running costs—covering crew salaries, maintenance, insurance, and docking fees—nearly match the revenue. The slight profit of €17,000 highlights the rarity of profitability in superyacht chartering. As Kellie Shoemaker from Fraser Yachts notes, chartering often serves to offset costs and keep the vessel active, rather than generating substantial profits.

Case Study 2: The Classic Sailing Yacht

- Yacht: 47m Dutch sailing yacht, built in 1998

- Charter Rate: 9 weeks between the Mediterranean and Caribbean, €110,000–€125,000 per week

- Net Charter Income: €893,000

- Annual Running Costs: €1,337,000

- Net Loss: €444,000

Sailing yachts, like this 47-meter Dutch vessel, appeal to charterers seeking a slower, more traditional experience, particularly in the Caribbean’s winter trade winds. Despite lower running costs compared to motor yachts, the high maintenance required for rigging and sails results in a net loss. Liz Cox from Cecil Wright emphasizes that crew quality is critical for sailing yachts, as modern charterers expect high-caliber service, driving up crew costs. The yacht’s age impacts its charter rate, but a strong reputation can still attract bookings.

Case Study 3: The Mega-Yacht Challenge

- Yacht: 85m German motor yacht, built in 2010

- Charter Rate: 8 weeks between the Mediterranean and Caribbean, €850,000–€950,000 per week

- Net Charter Income: €4,680,000

- Annual Running Costs: €5,110,000

- Net Loss: €430,000

Larger yachts, such as this 85-meter German-built vessel, command premium charter rates but incur significant operating costs. With a smaller client base for mega-yachts, achieving 8–10 weeks of charter is considered successful, as Chris Callahan from Moran Yacht & Ship explains. Multi-week charters are common in this segment, but high maintenance, crew, and fuel costs often outweigh income. Strategic scheduling to minimize downtime and relocation costs is essential to improving financial performance.

Case Study 4: The Perfect Charter Yacht

- Yacht: 60m Northern European motor yacht, built in 2025 (hypothetical)

- Charter Rate: 12 weeks between the Mediterranean and Caribbean, €500,000–€650,000 per week

- Net Charter Income: €5,359,832

- Annual Running Costs (First 5 Years): €3,200,000

- Net Revenue: €2,000,000

This hypothetical 60-meter yacht, designed by Hill Robinson, represents the ideal charter vessel. With a size that balances guest capacity (12) and crew (14), modern amenities like a spa and pool, and a strategic chartering schedule (8 weeks in summer, 4 in winter), it achieves a significant profit. Nicolas Fry from Hill Robinson notes that new yachts command premium rates and lower maintenance costs during the warranty period, making them attractive to charterers seeking cutting-edge features.

Financial Model: Breaking Down Costs and Revenue

To provide a clearer picture, let’s examine a financial model for a Bali 5.4 catamaran operating in the British Virgin Islands, a popular chartering destination.

| Item | Amount |

|---|---|

| Yacht Value | $1,750,000 |

| Charter Rate | 20 weeks at $33,200/week |

| Total Annual Income | $664,000 |

| Annual Direct Expenses (turnaround costs, booking fees, management, dockage, utilities, fuel, mooring) | $292,000 |

| Annual Operating Expenses (maintenance, crew salaries, insurance, admin, hurricane preparation) | $206,000 |

| Total Annual Expenses | $472,000 |

| Net Income | $165,000 |

| Annual Mortgage Principal & Interest | $155,000 |

| Total Annual Income | $10,000 |

| Tax Savings (31% tax rate) | $507,500 |

| Value of Owner Weeks (3 weeks) | $99,600 |

This model illustrates that while direct profit is modest, tax advantages and the value of owner usage significantly enhance the financial appeal. Owners who structure their yacht as a business can offset costs through deductions, making chartering a strategic financial move.

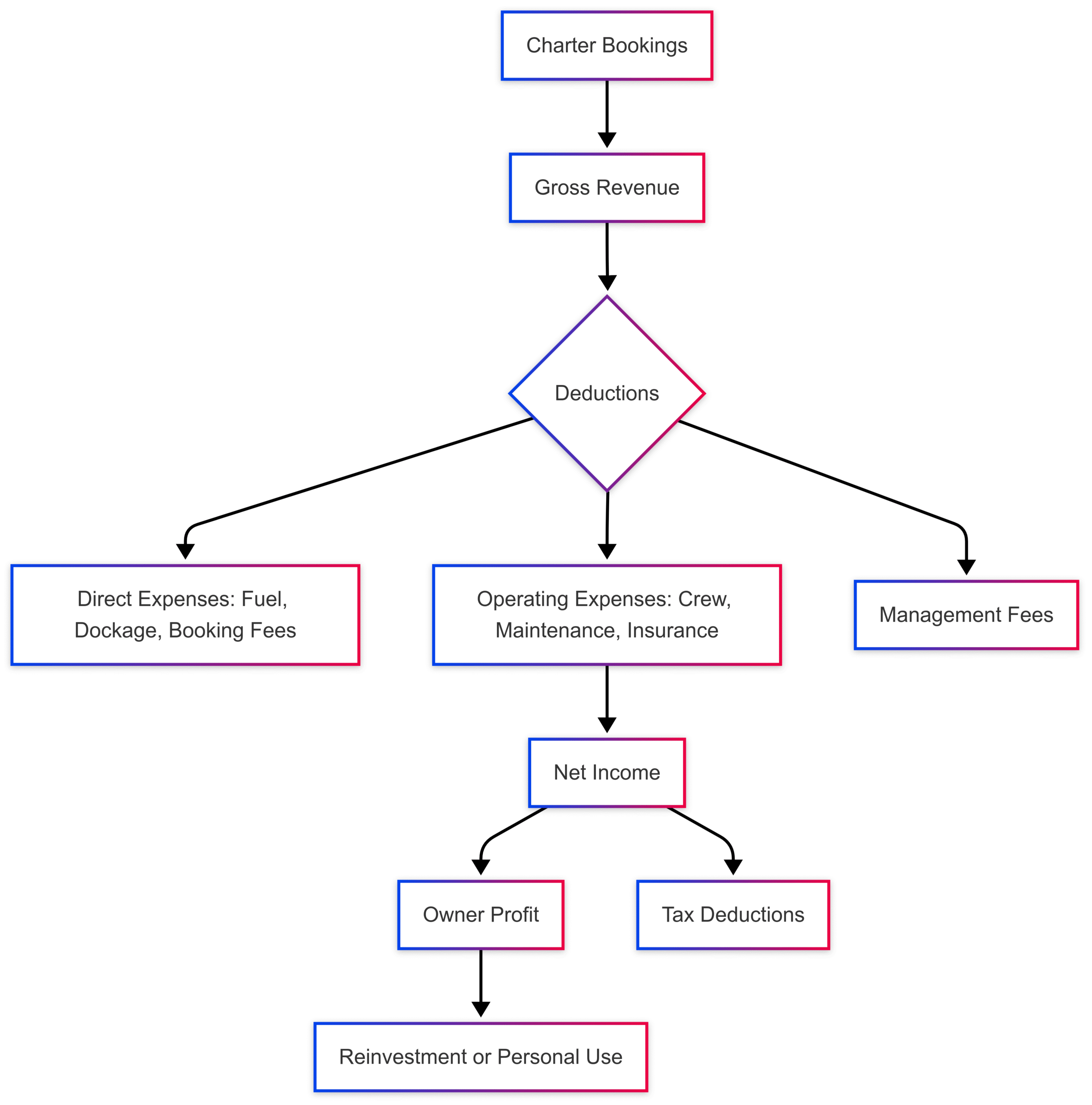

Chart: Charter Yacht Revenue Flow

This chart outlines the flow of revenue from bookings to final profit, highlighting key deductions that impact profitability.

Key Factors Affecting Profitability

1. Location and Seasonal Demand

Location is critical in the charter business. High-demand areas like the Caribbean (winter) and Mediterranean (summer) allow owners to charge premium rates. For example, Croatia’s Adriatic coast sees strong demand for sailboats and catamarans, with weekly rates ranging from €2,500 for a 40-foot sailboat to €30,000 for a 50-foot motor yacht. Strategic relocation to follow peak seasons can maximize bookings and reduce downtime.

2. Yacht Type, Size, and Age

- Sailboats (35–50 ft): Lower maintenance costs but lower charter rates (€2,500–€4,500/week). Ideal for families.

- Catamarans (40–50 ft): High demand, higher rates (€6,000–€10,000/week), but increased maintenance costs.

- Motor Yachts (50 ft+): Premium rates (€10,000–€30,000/week) but high operational costs.

- Age: Older yachts require more maintenance but can remain competitive with a strong reputation and regular refits.

3. Crew and Maintenance Costs

Crew quality is a major selling point. A skilled captain and chef can elevate a yacht’s reputation, but salaries and training add to expenses. Maintenance, including regular servicing and refits, is essential to avoid costly breakdowns and maintain charter appeal. Insurance costs are also rising, particularly for larger vessels.

4. Business Model

- Bareboat Chartering: 20–30% profit margin, no crew costs, but requires experienced renters.

- Crewed Chartering: 30–40% profit margin, higher rates, but crew salaries increase costs.

- Fractional Ownership: 10–20% profit margin, lower upfront costs, shared profits.

- Time-Share: 5–10% profit margin, minimal owner responsibility, low returns.

- Full Ownership: 40–50% profit margin, full control, high investment.

- Charter Management Companies: 20–30% profit margin, reduced operational burden, commission fees.

Strategies to Maximize Profit

1. Optimize Pricing

Set competitive rates based on market comparisons (size, age, amenities). For example, a 30-foot sailboat might charge $200/hour in a tourist hotspot, while a 60-meter superyacht could command €500,000/week. Offer package deals or off-season discounts to boost bookings.

2. Invest in Crew and Maintenance

A stellar crew, led by an experienced captain, drives repeat bookings. Regular maintenance prevents costly repairs and maintains the yacht’s appeal. As Chris Callahan notes, a planned maintenance program reduces the risk of breakdowns during charters.

3. Leverage Charter Management Companies

Partnering with a management company like Hill Robinson or Moravia Yachting can streamline operations, from marketing to maintenance. Owners typically receive 15–25 weeks of bookings annually, with the company handling logistics for a commission. This model is ideal for owners seeking passive income.

4. Focus on High-Demand Locations

Base the yacht in charter hotspots like Split, Dubrovnik, or the Bahamas to minimize relocation costs and maximize bookings. Scheduling back-to-back charters in the same region reduces downtime.

5. Upsell and Cross-Sell

Offer add-ons like catering, water sports equipment, or branded merchandise to increase revenue per charter. Referral programs can also attract new clients.

Real-Life Insights: Owen and Amanda’s Story

Owen and Amanda, a couple working as first mate and chief stewardess on a 30-meter yacht in the Caribbean, provide a firsthand perspective on the charter lifestyle. Earning a base salary of $2,500–$3,000/month each, plus $2,250 in tips per charter and a $500 charter incentive, they can make over $5,000/month extra during busy periods. Their work involves long hours (16–18 hours/day during charters), from cleaning to guest services, but the financial rewards and travel opportunities are significant.

Their advice? Start early, save diligently, and invest in qualifications like the STCW95 course. While the lifestyle is glamorous—exploring the Bahamas, Virgin Islands, and beyond—it comes with challenges, like missing family events and working in close quarters with demanding guests.

The Role of Tax Advantages

For many owners, tax deductions are a key financial benefit. By structuring the yacht as a business, owners can deduct expenses like maintenance, crew salaries, and depreciation. In the Bali 5.4 case study, tax savings at a 31% rate amounted to $507,500 annually, significantly offsetting costs. Consulting with tax advisors and charter management companies can help owners maximize these benefits.

Choosing the Right Yacht

Selecting a yacht for chartering requires balancing market demand with investment costs. In Croatia, sailboats (35–50 ft) and catamarans (40–50 ft) are most popular due to their affordability and appeal to families. Motor yachts target the luxury segment but require higher investment. Key considerations include:

- Guest Capacity: 12 guests is ideal for mid-size yachts.

- Amenities: Modern features like spas, pools, and water toys attract premium charterers.

- Brand: Northern European brands like Feadship or Lürssen maintain timeless appeal.

- Maintenance: Newer yachts have lower initial costs but higher purchase prices.

Legal and Administrative Considerations

In markets like Croatia, commercial chartering requires:

- Registration: Vessels must be registered for commercial use, including safety inspections.

- Taxation: 13% VAT on rental services, plus income or corporate tax.

- Insurance: Commercial policies covering guest safety and damages.

- Contracts: Clear rental agreements to protect owners and guests.

Sole proprietorships with fewer than three vessels may benefit from lump-sum taxation, while larger operations require a company structure.

Sample Yachts for Sale with Charter Potential

| Yacht | Price | Location | Charter Potential |

|---|---|---|---|

| 2023 FP Isla 40 | $449,000 | USVI | High demand for family charters |

| 2023 Lagoon 50 | $1,250,000 | Nassau, Bahamas | Strong bookings in luxury segment |

| 2024 Bali 4.8 | $1,250,000 | Saint Barthélemy | Proven income stream |

| 65m Codecasa Eternity | €35,000,000 | Bahamas | Premium rates, established reputation |

Conclusion: Profit or Passion?

Running a charter yacht can be profitable, but it’s not a guaranteed path to wealth. Success requires a commercial mindset, strategic planning, and a focus on high-demand locations and quality crew. While some yachts, like the hypothetical 60-meter vessel, achieve significant profits, most owners use chartering to offset costs and enjoy tax benefits. For those prioritizing personal use, the financial return may be modest, but the lifestyle benefits—exploring stunning destinations and sharing unforgettable experiences—are unparalleled.

If you’re considering entering the charter business, consult with experts like Catamaran Guru or Moravia Yachting to explore ownership models, review booking histories, and develop a tailored financial strategy. With careful planning, a charter yacht can be both a passion project and a smart investment.

Happy Boating!

Share Profit or passion? What it really costs to run a charter yacht with your friends and leave a comment below with your thoughts.

Read How Much It Costs to Winterize a Boat (From 20+ Quotes) until we meet in the next article.