How Much Does a Boat Cost to Own: 5 Key Factors to Consider

Boat ownership is a dream for many, offering the freedom to explore the open waters and create unforgettable memories. However, it’s essential to understand the full scope of costs associated with boat ownership before setting sail. In this comprehensive guide, we will explore the factors that contribute to boat ownership expenses and highlight the importance of thorough financial planning and budgeting.

While the allure of owning a boat is undeniable, it’s crucial to go beyond the initial purchase price and consider the various ongoing expenses. Understanding the full cost of boat ownership allows prospective owners to make informed decisions, avoid financial strain, and ensure a sustainable and enjoyable boating experience.

Financial planning and budgeting play a vital role in successfully managing the costs of boat ownership. By setting realistic expectations and allocating funds appropriately, boat owners can navigate the financial waters with confidence. So, let’s dive into the intricacies of boat ownership costs and chart a course for responsible financial planning.

Initial Purchase Cost:

The initial purchase cost of a boat can be a significant expense and is influenced by various factors. Here are some key points to consider:

- Boat Type, Size, Age, and Condition: The type of boat, its size, age, and overall condition significantly impact its purchase cost. Different boat types, such as motorboats, sailboats, or yachts, come with varying price ranges. Larger boats generally have higher price tags. Older boats may be more affordable upfront but could require more maintenance and repairs. Opting for a boat in good condition can save money in the long run.

- Thorough Research: Conducting thorough research is crucial before making a purchase. Explore different boat models, compare prices, and consider the features that align with your needs and boating activities. Research online listings, visit boat dealerships, and consult with experts to gather information and make informed decisions.

- New vs. Used Options: Consider both new and used boat options. New boats come with the advantage of warranty coverage and the latest features, but they generally come with higher price tags. Used boats can offer cost savings, but it’s important to inspect their condition, maintenance history, and potential repair needs. A marine survey is recommended for used boats to identify any hidden issues.

- Additional Expenses: In addition to the purchase price, factor in other expenses associated with the purchase. These may include sales tax, registration fees, and insurance costs. Sales tax rates vary by jurisdiction, so research the applicable tax rate for your region. Registration fees depend on the boat’s size and your location. Insurance is essential to protect your investment and should be factored into the overall purchase cost.

Understanding the significant cost involved in purchasing a boat and conducting thorough research are crucial steps in making an informed decision. Consider your budget, boating preferences, and long-term financial goals to find a boat that aligns with your needs and financial capabilities. By considering both new and used options and factoring in additional expenses, you can make a well-informed choice when purchasing a boat.

Financing Options:

When purchasing a boat, there are various financing options available to help manage the cost. Understanding these options and their implications is crucial for making informed financial decisions. Here are some key points to consider:

- Loans: Boat loans are a common financing option. They allow you to borrow the funds needed to purchase the boat and repay the loan over a specified period. When obtaining a boat loan, factors such as your creditworthiness, income, and down payment will influence the interest rate and loan terms offered by lenders.

- Leases: Boat leasing, also known as boat financing or boat leasing, is an alternative to traditional loans. With a lease, you essentially rent the boat for a predetermined period. At the end of the lease term, you can choose to purchase the boat, return it, or enter into a new lease agreement. Lease terms and conditions can vary, so carefully review the terms before committing to a lease.

- Implications of Interest Rates, Loan Terms, and Down Payments: The interest rate on your boat loan significantly impacts the overall cost of ownership. Higher interest rates can result in higher monthly payments and more interest paid over the loan term. Additionally, the loan term affects the total interest paid. Longer loan terms may result in lower monthly payments but higher overall interest costs. A larger down payment can reduce the loan amount and potentially lower interest charges.

- Financial Commitment and Long-Term Obligations: It’s essential to understand the financial commitment and long-term obligations associated with boat financing. Monthly loan or lease payments, insurance premiums, and ongoing expenses must be factored into your budget. Assess your financial situation and consider your ability to comfortably meet these obligations over the long term.

Carefully evaluate your financing options, comparing interest rates, loan terms, and down payment requirements. Take into account your financial stability, income, and personal financial goals. Remember that boat financing is a long-term commitment, and it’s crucial to ensure it aligns with your overall financial plan.

Seek advice from financial professionals and consult with lenders who specialize in boat financing to explore the best options for your individual circumstances. By understanding the implications of financing options and the associated financial commitments, you can make informed decisions and enjoy your boat ownership experience without undue financial strain.

Recurring Expenses:

Owning a boat involves ongoing expenses that must be factored into your budget. Understanding these recurring costs will help you plan and manage your finances effectively. Here are some important recurring expenses to consider:

Insurance:

Boat insurance is crucial for protecting your investment and managing potential risks. Premium costs are influenced by factors such as the type of boat, its value, location, and usage. Different types of coverage, including liability, comprehensive, and additional endorsements, offer varying levels of protection. It’s important to shop around for insurance quotes, compare coverage options, and ensure you have adequate coverage tailored to your specific needs.

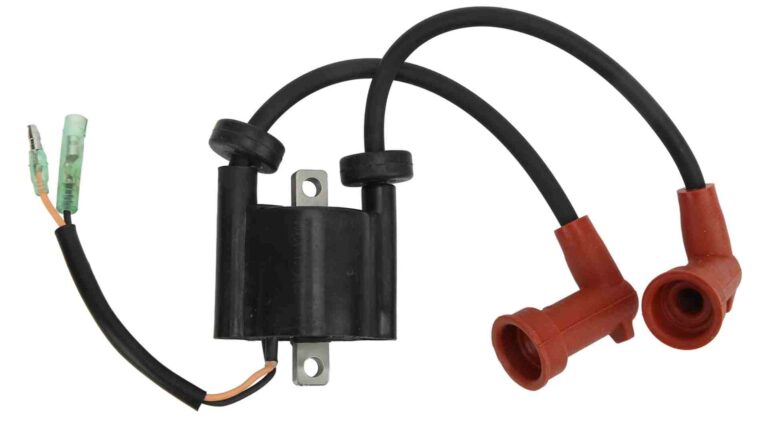

Maintenance and Repairs:

Maintaining and repairing a boat is an ongoing expense that requires budgeting. Regular servicing, winterization, engine maintenance, hull cleaning, and other upkeep expenses contribute to the overall cost. Proactive maintenance is key to preventing costly repairs in the long run. Following manufacturer guidelines, conducting regular inspections, and addressing any issues promptly can help minimize repair costs and prolong the life of your boat.

Docking and Storage Fees:

Docking and storing a boat incur expenses that vary depending on your choices. Marina fees, docking permits, or storage facility costs need to be considered. Different options, such as marina slips, dry storage, or trailer storage, come with different price points. Research and compare costs, availability, and convenience to choose the option that best suits your needs and budget.

Fuel and Operating Costs:

Fuel and operating costs are ongoing expenses associated with boating. Fuel consumption depends on factors such as boat type, engine size, usage patterns, and local fuel prices. It’s important to estimate fuel costs based on these factors and incorporate them into your budget. Additionally, routine maintenance supplies such as marine-grade oil, filters, and cleaning products should be considered as part of your operating costs.

Registration and Licensing Fees:

Boat registration, renewals, and licensing fees are recurring costs that vary by jurisdiction. These fees ensure compliance with local regulations and laws. Additionally, some regions may have additional fees specific to boating, such as invasive species permits or boater safety course requirements. Research the requirements and associated costs in your area to properly budget for these expenses.

By understanding and accounting for these recurring expenses, you can create a realistic budget and effectively manage the financial aspects of boat ownership. It’s important to allocate funds for insurance, maintenance and repairs, docking and storage fees, fuel and operating costs, as well as registration and licensing fees. Being prepared for these ongoing expenses will help ensure a smooth and enjoyable boating experience.

Additional Expenses:

Owning a boat often involves additional expenses beyond the basic purchase and recurring costs. These expenses can vary based on your boating activities and personal preferences. Here are two important additional expense categories to consider:

Accessories and Equipment:

Outfitting your boat with accessories and equipment enhances safety, navigation, and enjoyment. These can include safety gear, navigation equipment, fishing gear, water sports equipment, and entertainment systems. The cost of accessories and equipment can vary widely depending on the type and quality of the items. It’s essential to budget for these items and prioritize based on your boating activities and preferences. Make a list of the necessary items and gradually acquire them over time to manage the costs effectively.

Upgrades and Customizations:

Boat owners often consider upgrades or customizations to personalize their vessel or improve functionality. These can range from aesthetic modifications to performance enhancements. Upgrades might include adding new electronics, upgrading seating or upholstery, installing a sound system, or enhancing the boat’s efficiency. It’s crucial to carefully consider the potential costs, research the available options, and assess the value these upgrades will bring to your boating experience. Budgeting and planning for upgrades and customizations is essential to avoid overspending and ensure the modifications align with your long-term goals.

It’s important to strike a balance between essential accessories and equipment and discretionary upgrades. Prioritize safety and functionality first, ensuring you have the necessary gear and equipment for your specific boating activities. As you gain more experience and assess your needs, you can gradually invest in additional accessories and consider upgrades that enhance your boating experience. By planning, budgeting, and making informed decisions, you can manage these additional expenses effectively and enjoy a boat that is tailored to your preferences and needs.

Budgeting and Financial Planning:

Creating a comprehensive budget and financial plan is crucial for successful boat ownership. It helps you manage expenses, make informed decisions, and avoid financial strain. Here’s why it’s important and some tips to consider:

Importance of Budgeting and Financial Planning:

Boat ownership involves various costs, both upfront and recurring. Creating a budget allows you to estimate and track your expenses, ensuring that you can comfortably afford the overall cost of owning a boat.

It helps you prioritize spending, allocate funds to different categories, and plan for unexpected costs. A well-planned budget provides a clear financial roadmap, enabling you to enjoy your boating experience while maintaining financial stability.

Estimating and Tracking Expenses:

Begin by estimating your boat ownership expenses, including the initial purchase cost, recurring expenses (insurance, maintenance, docking fees, fuel, etc.), and additional costs (accessories, upgrades).

Research and gather information to get accurate estimates for each category. As you start owning a boat, track your actual expenses to compare them against your estimates and make adjustments if necessary. This helps you identify any areas where you may need to cut back or reallocate funds.

Allocating Funds for Different Categories:

Allocate funds to different categories based on your priorities and the estimated costs. Give special consideration to recurring expenses that require regular payments, such as insurance premiums, maintenance, and docking fees.

Set aside funds for these recurring costs to ensure you can meet your financial obligations. Allocate additional funds for discretionary expenses like accessories and upgrades based on your preferences and financial capacity.

Planning for Unexpected Costs:

Boat ownership inevitably comes with unexpected costs. It’s important to plan for these surprises by setting aside an emergency fund within your budget.

This fund acts as a safety net to cover unexpected repairs, unforeseen maintenance issues, or other emergencies that may arise. Aim to save a percentage of your overall boat ownership costs to build a reserve fund for these unforeseen expenses.

Consider Your Overall Financial Situation:

When determining the affordability of boat ownership, consider your overall financial situation. Evaluate your income, savings, and other financial commitments to ensure you can comfortably manage the expenses of boat ownership without jeopardizing your financial stability. Assess how boat ownership fits into your long-term financial goals and obligations, such as retirement planning or other financial priorities.

Remember, a realistic and well-structured budget allows you to enjoy the benefits of boat ownership while maintaining financial peace of mind. Regularly review and adjust your budget as needed, and seek the advice of financial professionals if necessary. By taking a thoughtful and proactive approach to budgeting and financial planning, you can make informed decisions and fully enjoy the boating lifestyle without unnecessary financial stress.

Watch 280k Sunseeker Portofino 47 – How much does it cost to own (and run) a boat like this? Video

How much does a boat cost to own?

The cost of owning a boat varies greatly depending on several factors, including the type of boat, size, age, location, and intended usage. On average, boat ownership costs can range from 10% to 15% of the boat’s purchase price per year. It’s important to consider expenses such as insurance, maintenance, fuel, docking or storage fees, registration, and upgrades when estimating the overall cost.

What are the ongoing expenses of boat ownership?

The ongoing expenses of boat ownership typically include insurance premiums, regular maintenance and repairs, fuel and operating costs, docking or storage fees, and registration fees. These expenses can vary depending on factors such as boat size, usage, and location. It’s important to budget for these recurring expenses to effectively manage the cost of boat ownership.

How much does boat insurance cost?

The cost of boat insurance depends on several factors, including the boat’s type, value, location, usage, and the coverage options chosen. On average, boat insurance premiums can range from 1% to 2% of the boat’s value per year. Factors such as the boater’s experience, claims history, and desired coverage limits can also influence the cost. It’s advisable to obtain multiple insurance quotes and compare coverage options to find the best policy for your needs.

What is the average cost of boat maintenance?

The average cost of boat maintenance can vary significantly depending on the boat’s size, age, complexity, and usage. As a general guideline, it’s recommended to budget around 10% of the boat’s value per year for maintenance and repairs. However, this estimate can fluctuate based on the boat’s condition, specific maintenance needs, and any unexpected repairs that may arise. Regular maintenance and proactive care can help minimize long-term costs.

Are there additional costs besides the purchase price and maintenance?

Yes, besides the purchase price and maintenance, there are additional costs to consider. These can include fuel and operating costs, docking or storage fees, registration fees, insurance, and expenses for accessories or upgrades. It’s important to factor in these additional costs when estimating the overall cost of boat ownership to ensure a comprehensive and realistic budget.

Conclusion:

In conclusion, boat ownership comes with a range of costs and financial considerations that must be carefully evaluated. Key factors to consider include the initial purchase cost, financing options, recurring expenses, additional expenses, and the importance of budgeting and financial planning.

Thorough financial planning and budgeting are essential to ensure that boat ownership aligns with your financial means. It’s crucial to conduct proper research, consult with experts, and make informed decisions throughout the process. By estimating and tracking expenses, allocating funds for different categories, and planning for unexpected costs, you can navigate the financial aspects of boat ownership more effectively.

Long-term financial commitment is another important consideration. Boat ownership involves ongoing expenses such as insurance, maintenance, docking fees, fuel, and registration fees. It’s crucial to evaluate your overall financial situation, including income, savings, and other financial commitments, to determine the affordability of boat ownership and maintain financial stability.

To ensure a realistic and enjoyable boating experience within your financial means, take the time to thoroughly research the costs, consult with professionals, and create a comprehensive budget. By making informed decisions and considering the long-term financial commitment, you can enjoy the freedom and joy of boat ownership while maintaining financial peace of mind.

Remember, every boat owner’s situation is unique, and it’s important to tailor your financial plan to your specific circumstances. By taking these steps and staying financially prepared, you can embark on a rewarding and enjoyable boating experience.

Share How Much Does a Boat Cost to Own: 5 Key Factors to Consider with your friends and Leave a comment below with your thoughts.

Read How to Attach a Tow Rope to a Boat: A Step-by-Step Guide until we meet in the next article.