Exploring Asia’s Dominance in the Shipping Industry

Discover Asia’s dominance in the global shipping industry, from top ports and shipbuilding to sustainability and trade routes.

Asia stands as the cornerstone of the global maritime industry, wielding unmatched influence in shipping, shipbuilding, port operations, and the supply of seafarers. The region’s strategic geographic positioning, cutting-edge infrastructure, technological advancements, and robust economic growth have cemented its leadership in maritime trade. This article delves into the multifaceted factors driving Asia’s dominance, the challenges it faces, and the opportunities shaping its future, while highlighting key players like China, Singapore, and the Philippines.

Strategic Geographic Advantage

Asia’s location along critical maritime trade routes, such as the Malacca Strait, South China Sea, and connections to the Suez Canal, makes it the epicenter of global trade. These routes facilitate the movement of goods between Asia, Europe, the Americas, and Africa, handling approximately 36% of global containerized trade. The Malacca Strait alone is a vital chokepoint, with over 80,000 vessels passing annually, carrying goods ranging from electronics to raw materials.

Major ports like Shanghai, Singapore, and Hong Kong serve as transshipment hubs, connecting over 600 ports worldwide. The Port of Shanghai, the world’s busiest container port, handles over 40 million TEUs (Twenty-foot Equivalent Units) annually, while Singapore’s port is renowned for its efficiency, linking global supply chains seamlessly. This geographic advantage, coupled with robust infrastructure, ensures Asia remains integral to global trade flows.

Advanced Port Infrastructure

Asian ports are global leaders in efficiency and capacity, driven by state-of-the-art facilities and continuous investment. Deep-water berths, automated cranes, and IoT-enabled logistics systems enable rapid vessel turnaround and high throughput. For instance, the Port of Singapore employs automated guided vehicles and digital twin technology to optimize operations, reducing waiting times and boosting productivity.

Investments in port expansion and modernization are widespread. China’s Belt and Road Initiative (BRI) has poured billions into developing ports like Gwadar in Pakistan and Hambantota in Sri Lanka, enhancing connectivity. Similarly, Singapore’s Tuas Port project aims to double its capacity by 2040, targeting 65 million TEUs annually. These developments ensure Asian ports remain competitive amid rising trade volumes.

Table 1: Top Asian Ports by Container Throughput (2023)

| Port | Country | TEUs Handled (Millions) | Key Features |

|---|---|---|---|

| Shanghai | China | 40.2 | World’s busiest, automated terminals |

| Singapore | Singapore | 37.3 | Transshipment hub, smart port technology |

| Ningbo-Zhoushan | China | 31.8 | Deep-water berths, BRI integration |

| Shenzhen | China | 28.5 | High automation, export hub |

| Hong Kong | Hong Kong | 17.8 | Strategic location, efficient logistics |

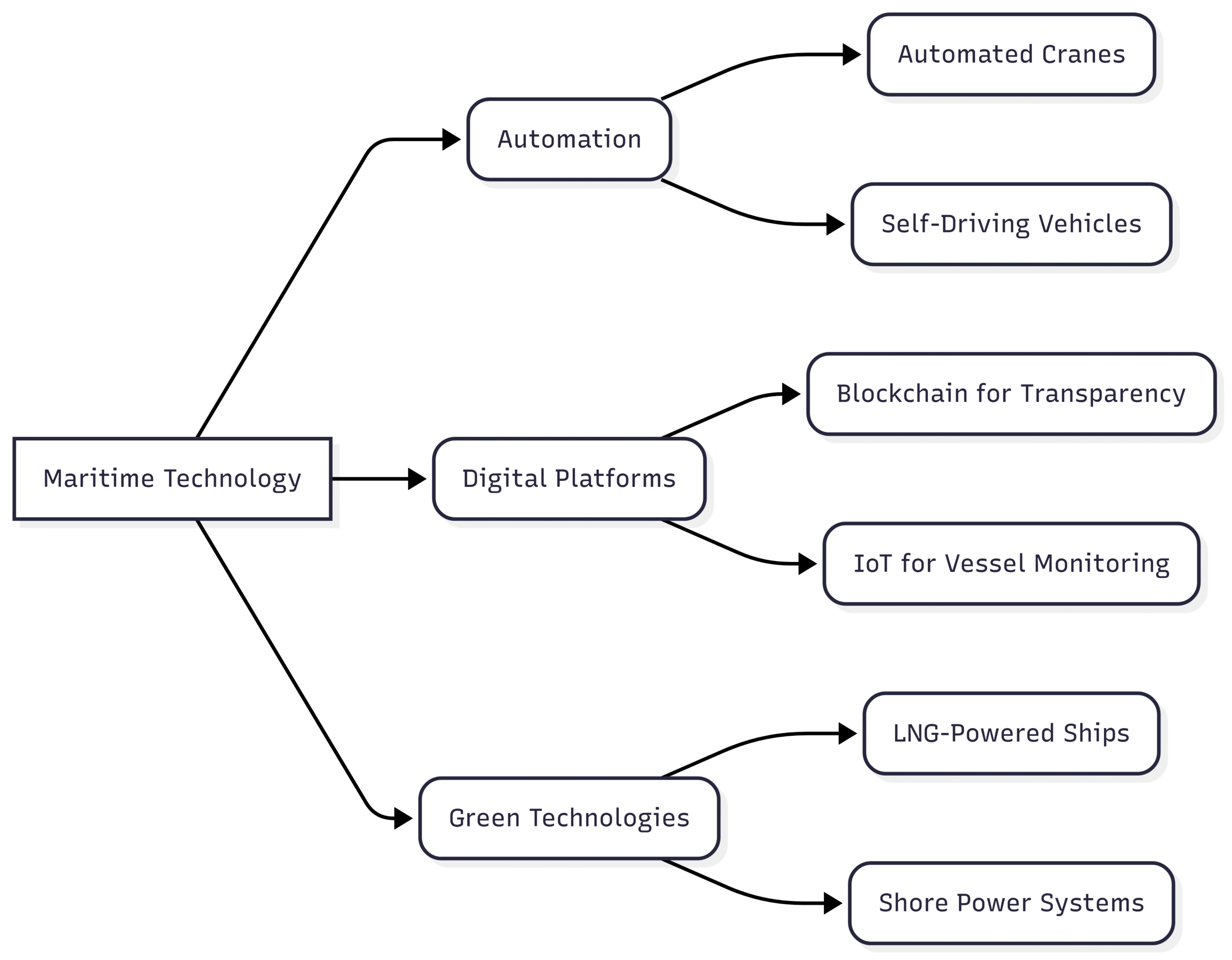

Technological Leadership in Maritime Operations

Asia leads in adopting smart port technologies and automation. Automated terminals in Shanghai and Singapore use AI-driven systems for cargo handling and predictive maintenance, reducing operational costs by up to 20%. Blockchain technology enhances supply chain transparency, while IoT devices provide real-time vessel tracking, improving security and efficiency.

Digital platforms are transforming port management. For example, Singapore’s PortNet system integrates stakeholders for seamless cargo tracking and documentation. China’s ports leverage 5G networks for real-time data analysis, optimizing traffic flow and reducing congestion. These advancements position Asian ports as global benchmarks for efficiency.

Chart: Maritime Technology Integration

Shipbuilding and Ship Recycling Dominance

Asia accounts for 95% of global shipbuilding output, with China, South Korea, and Japan leading the charge. In 2023, China delivered over 50% of the world’s new ships, including container vessels, bulk carriers, and tankers. South Korea excels in high-value vessels like LNG carriers, while Japan focuses on specialized ships. These countries benefit from advanced manufacturing, economies of scale, and government support.

Ship recycling is another critical area, with India, Bangladesh, Go here for the continuation of the content:

and Pakistan handling a significant share of global shipbreaking. The upcoming Hong Kong International Convention for Safe and Environmentally Sound Recycling of Ships, effective June 2025, will enforce stricter environmental and safety standards, impacting Asian recycling hubs. Investments in eco-friendly recycling facilities are rising to meet these regulations.

Table 2: Leading Asian Shipbuilding Nations (2023)

| Country | Share of Global Output (%) | Key Ship Types | Notable Shipyards |

|---|---|---|---|

| China | 50.2 | Container ships, bulk carriers | COSCO, Dalian Shipbuilding |

| South Korea | 30.5 | LNG carriers, tankers | Hyundai Heavy Industries, Samsung |

| Japan | 14.8 | Specialized vessels, bulk carriers | Mitsubishi Heavy Industries, Imabari |

Economic Growth and Trade Dynamics

Asia’s role as the world’s manufacturing hub drives its shipping dominance. China, South Korea, and Japan produce vast quantities of electronics, automobiles, and industrial goods, necessitating robust shipping networks. In 2023, Asia handled 80% of global maritime merchandise trade, with intra-Asian trade growing by 9.3% due to agreements like the Regional Comprehensive Economic Partnership (RCEP).

The region’s economic growth fuels demand for raw materials like iron ore and energy resources like LNG. China and India, as top crude oil importers, rely heavily on maritime transport. The iron ore trade is projected to grow due to Asia’s steel production, while LNG infrastructure expansion supports rising gas trade.

Strategic Maritime Policies

Asian governments bolster the maritime sector through supportive policies. China’s BRI enhances global trade routes, while Singapore’s Maritime and Port Authority (MPA) promotes innovation through grants and R&D initiatives. Regulatory frameworks align with international standards, such as those set by the International Maritime Organization (IMO), ensuring safety and sustainability.

The Liner Shipping Connectivity Index, computed by UN Trade and Development (UNCTAD), ranks China, South Korea, and Singapore as the most connected maritime economies. Vietnam’s 199% connectivity increase since 2006 highlights the region’s growing integration into global networks.

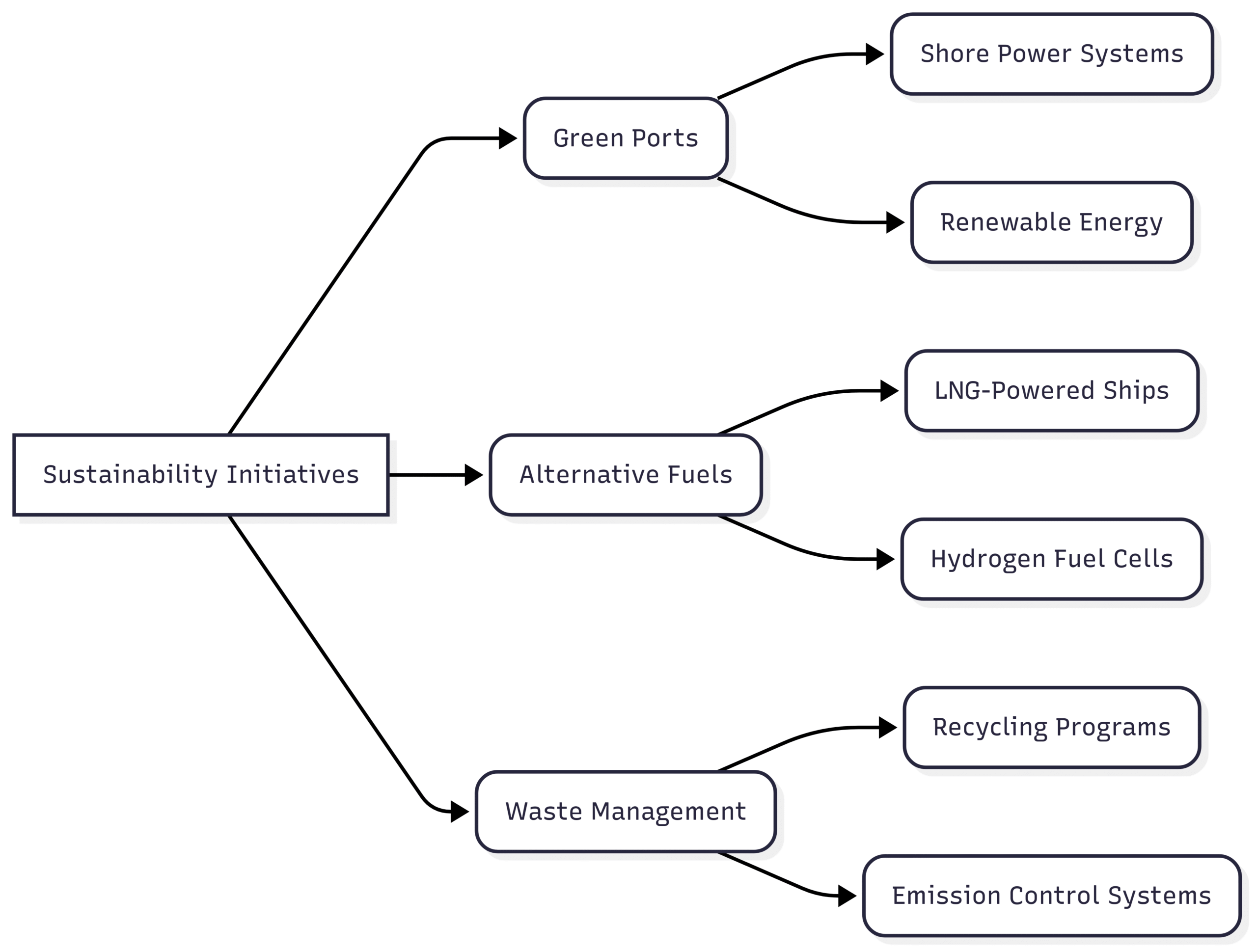

Sustainability and Green Initiatives

Sustainability is a priority for Asia’s maritime industry. Green port initiatives, such as shore power systems and renewable energy adoption, reduce emissions. For example, the Port of Shanghai uses solar panels and electric equipment to lower its carbon footprint. Singapore’s Green Port Programme targets a 50% emissions reduction by 2030.

Alternative fuels like LNG and hydrogen are gaining traction. South Korea’s Hyundai Heavy Industries is developing ammonia-powered ships, while Japan invests in hydrogen fuel cells. These innovations align with IMO’s 2050 net-zero emissions goal, positioning Asia as a leader in sustainable shipping.

Chart: Sustainability Initiatives

Seafarers: The Backbone of the Industry

Asia supplies 50-60% of the world’s seafarers, with the Philippines, China, India, and Indonesia as major contributors. The Philippines alone provides over 400,000 seafarers, whose remittances bolster the national economy. However, challenges like prolonged isolation, stringent environmental regulations, and a projected officer shortage by 2026 threaten the workforce.

Maritime education programs in the region, aligned with the Standards of Training, Certification and Watchkeeping for Seafarers (STCW), ensure a skilled workforce. The IMO and regional bodies like ESCAP promote training for green and digital technologies, addressing the industry’s evolving needs.

Gender Equality in the Maritime Workforce

Women represent only 1.2% of global seafarers, despite a 45.8% increase since 2015. Barriers include gender norms, limited access to training, and workplace safety concerns. Initiatives like the IMO’s Women’s International Shipping and Trade Association (WISTA) and ESCAP’s Women’s Maritime Associations (WIMA) aim to boost female participation through mentorship and policy advocacy. Governments and shipping companies must invest in career development and gender-responsive policies to achieve equality.

Challenges Facing Asia’s Maritime Industry

Geopolitical Tensions

Geopolitical conflicts, such as the Red Sea crisis, disrupt Asia’s trade routes. Houthi attacks since November 2023 have reduced Suez Canal transits, increasing shipping costs and delays. Singapore’s port waiting times nearly doubled to 40 hours in mid-2024, while Port Klang saw a 30% increase. These disruptions raise insurance premiums and strain supply chains.

Climate Change Impacts

Climate-induced challenges, like Panama Canal draft restrictions in 2023, led to a 31% increase in sailing distances and a 25% decrease in cargo volume for Asia-bound routes. Droughts and rising sea levels threaten port operations, necessitating resilient infrastructure.

Piracy and Security

Southeast Asia, particularly the Malacca Strait, accounts for a significant share of global piracy incidents (120 reported in 2023). Economic instability fuels opportunistic attacks on smaller vessels. The Regional Cooperation Agreement on Combating Piracy and Armed Robbery against Ships in Asia (ReCAAP) enhances security through information sharing and joint patrols.

Financial Volatility

Post-pandemic freight rate surges in 2021 boosted profits, but rates stabilized by 2024, squeezing margins amid rising fuel costs. Companies investing in green technologies face high upfront costs, balancing long-term sustainability with short-term financial stability.

Opportunities for Growth and Innovation

Digital Transformation

Investments in digital technologies like AI, blockchain, and IoT are transforming Asia’s maritime sector. Predictive maintenance reduces downtime, while digital twins optimize port operations. China’s 5G-enabled ports and Singapore’s smart logistics systems set global standards.

Green Technology Adoption

The shift to alternative fuels and eco-friendly designs presents opportunities for innovation. Asian shipbuilders are developing zero-emission vessels, aligning with global decarbonization goals. Green port initiatives attract environmentally conscious investors and clients.

Inland Connectivity

Dry ports and inland terminals, part of the Asian Highway and Trans-Asian Railway Networks, enhance regional connectivity. China’s dry port network and India’s inland container depots decentralize operations, reducing port congestion and improving trade flows.

Table 3: Key Opportunities in Asia’s Maritime Industry

| Opportunity | Description | Key Players |

|---|---|---|

| Digital Transformation | AI, IoT, and blockchain for efficiency | China, Singapore |

| Green Technology | LNG, hydrogen, and ammonia-powered ships | South Korea, Japan |

| Inland Connectivity | Dry ports and rail networks for trade efficiency | China, India |

| Workforce Development | Training for green and digital technologies | Philippines, Indonesia |

Case Studies

Port of Shanghai

The Port of Shanghai’s Yangshan Deep-Water Port uses automated terminals and 5G connectivity to handle over 40 million TEUs annually. Its integration with the BRI enhances China’s trade dominance, connecting Asia to Europe and Africa.

Port of Singapore

Singapore’s port, a global transshipment leader, leverages smart technologies like PortNet and automated cranes. Its Green Port Programme targets sustainability, reducing emissions through shore power and renewable energy.

China’s Belt and Road Initiative

The BRI strengthens Asia’s maritime connectivity through investments in ports, railways, and logistics hubs. Projects like the China-Pakistan Economic Corridor boost trade efficiency, reinforcing Asia’s global influence.

The Philippines’ Seafarer Workforce

The Philippines supplies over 25% of global seafarers, with training programs meeting STCW standards. Remittances from seafarers contribute billions to the economy, but challenges like isolation and gender inequality require targeted policies.

Future Outlook

Asia’s maritime industry is poised for continued growth, driven by its strategic location, advanced infrastructure, and innovation. However, addressing geopolitical risks, climate impacts, and workforce challenges is critical. Investments in green technologies and digitalization will ensure long-term competitiveness, while policies promoting gender equality and seafarer welfare will sustain the workforce.

The region’s dominance is reflected in its top-ranking ports, shipbuilding prowess, and connectivity, as evidenced by UNCTAD’s Liner Shipping Connectivity Index. As global trade evolves, Asia’s maritime sector will remain a driving force, shaping economic growth and connectivity worldwide.

For expert consultations on navigating Asia’s maritime landscape, contact QBE Asia’s Marine and Loss Prevention teams at [email protected] or visit qbe.com.

Happy Boating!

Share Exploring Asia’s Dominance in the Shipping Industry with your friends and leave a comment below with your thoughts.

Read What Garbage Can Be Burned in a Ship’s Incinerator? until we meet in the next article.