EEXI and CII – ship carbon intensity and rating system

Explore EEXI and CII regulations reshaping maritime decarbonization. Learn their impact, compliance strategies, and innovations for vessel efficiency.

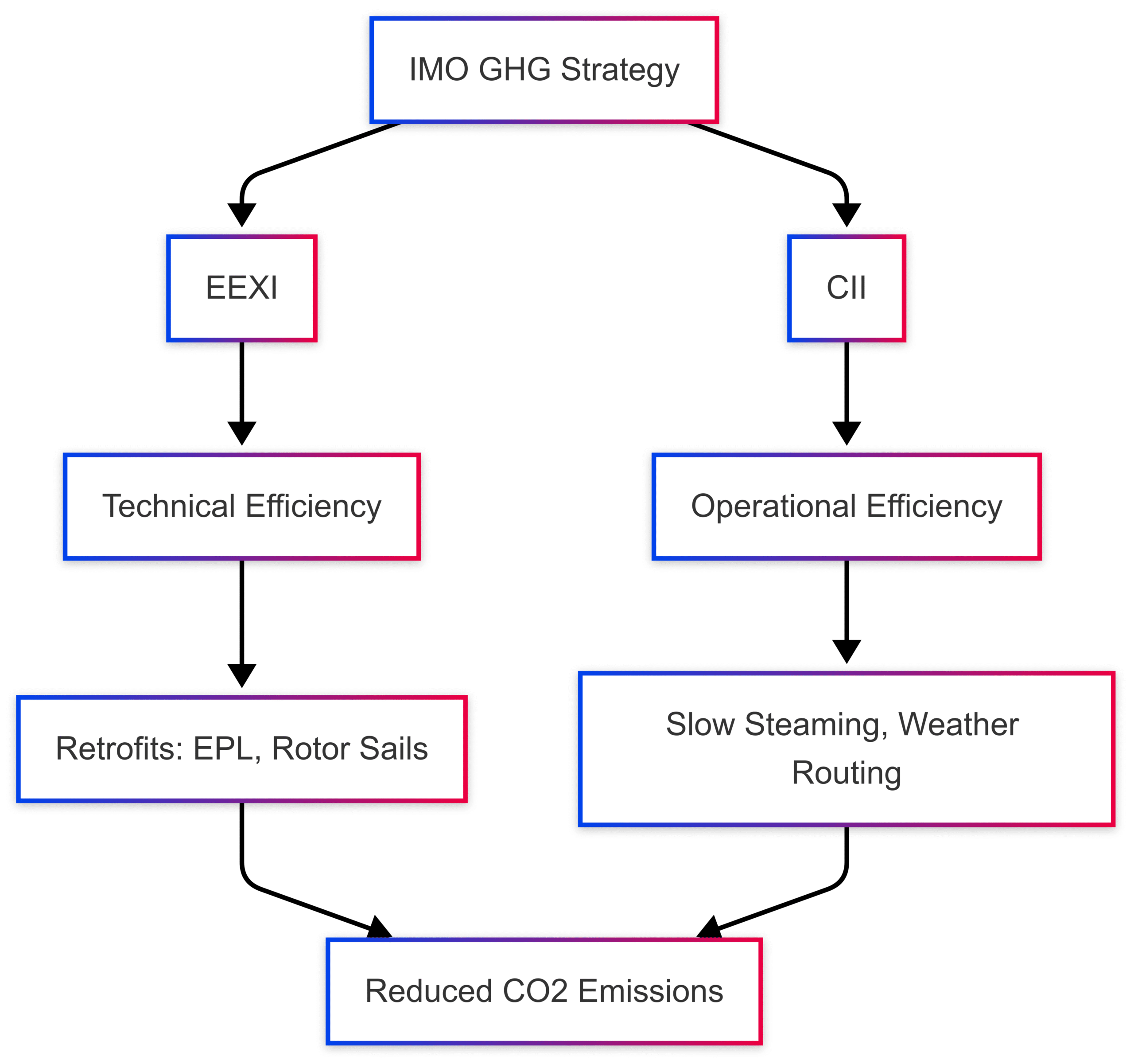

The global shipping industry, responsible for nearly 3% of global greenhouse gas (GHG) emissions, faces mounting pressure to align with international climate goals. The International Maritime Organization (IMO) has introduced two pivotal regulations under MARPOL Annex VI: the Energy Efficiency Existing Ship Index (EEXI) and the Carbon Intensity Indicator (CII). These measures, effective since January 2023, target the technical and operational efficiency of ships to reduce carbon emissions, driving a seismic shift in how the maritime sector operates.

This comprehensive guide explores the mechanics of EEXI and CII, their impacts on vessel operations, compliance challenges, and the innovations propelling the industry toward a net-zero future by 2050. With a focus on practical strategies, real-world applications, and data-driven insights, we unpack how these regulations are reshaping maritime decarbonization.

Understanding EEXI and CII: A Dual Framework for Efficiency

What is EEXI?

The Energy Efficiency Existing Ship Index (EEXI) is a technical measure assessing the energy efficiency of existing ships based on design parameters like engine power, fuel consumption, and hull characteristics. Applicable to ships of 400 gross tonnage (GT) and above, EEXI compares a ship’s attained efficiency to a required baseline derived from the Energy Efficiency Design Index (EEDI) for newbuilds.

To comply, ships must achieve an attained EEXI value below the required EEXI, which varies by ship type (e.g., bulk carriers, tankers, containerships) and size. Non-compliant vessels often require retrofits, such as Engine Power Limitation (EPL) or energy-saving technologies like air lubrication systems.

What is CII?

The Carbon Intensity Indicator (CII) is an operational measure evaluating a ship’s carbon emissions per unit of transport work, expressed as grams of CO2 per deadweight tonnage-nautical mile (gCO2/dwt-nm). Applicable to ships of 5,000 GT and above, CII assigns an annual rating from A (best) to E (worst), with C as the acceptable baseline.

CII ratings are calculated based on verified fuel consumption and voyage data, with stricter reduction factors applied annually to align with the IMO’s goal of reducing carbon intensity by 40% by 2030 compared to 2008. Ships rated D for three consecutive years or E for one year must submit a corrective action plan within their Ship Energy Efficiency Management Plan (SEEMP).

Key Differences

| Aspect | EEXI | CII |

|---|---|---|

| Focus | Technical design efficiency | Operational carbon intensity |

| Applicability | Ships ≥ 400 GT | Ships ≥ 5,000 GT |

| Measurement | CO2 emissions based on design parameters | gCO2 per dwt-nm based on operations |

| Compliance | One-time certification | Annual rating and reporting |

| Outcome | Pass/fail based on required EEXI | A-E rating with corrective actions for D/E |

The IMO’s Decarbonization Vision

EEXI and CII are cornerstones of the Initial IMO Strategy on Reduction of GHG Emissions from Ships (2018), which aims to:

- Reduce carbon intensity by 40% by 2030 (vs. 2008).

- Cut total GHG emissions by 50% by 2050 (vs. 2008).

- Achieve net-zero emissions by or around 2050.

The 2023 IMO GHG Strategy reinforces these targets, emphasizing enhanced energy efficiency for new ships and operational improvements for existing fleets. A review of EEXI and CII effectiveness is scheduled by January 2026, potentially leading to tighter standards or new enforcement mechanisms.

Six Transformative Impacts of EEXI and CII

1. Surge in Energy-Efficient Technologies

EEXI compliance often necessitates retrofitting, with over 30% of vessels requiring modifications, per DNV. Common technologies include:

- Shaft Power Limitation (ShaPoLi): Caps engine output to reduce fuel use.

- Engine Power Limitation (EPL): Adjusts engine settings for efficiency.

- Air Lubrication Systems: Reduce hull friction by injecting air beneath the vessel.

- Rotor Sails: Harness wind power for propulsion.

- Propeller Upgrades: Optimize hydrodynamic performance.

Case Study: Maersk implemented EPL and ShaPoLi on its container fleet, achieving EEXI compliance without extensive retrofits, saving millions in capital expenditure.

| Technology | Estimated CO2 Reduction | Approx. Cost (USD) |

|---|---|---|

| EPL/ShaPoLi | 5-10% | $50,000-$200,000 |

| Air Lubrication | 5-15% | $1M-$3M |

| Rotor Sails | 5-20% | $2M-$5M |

| Propeller Upgrades | 2-5% | $100,000-$500,000 |

2. Slow Steaming as Standard Practice

CII incentivizes slow steaming, where ships reduce speed to lower fuel consumption. A 10% speed reduction can cut fuel use by up to 27% (Lloyd’s Register). However, this introduces challenges:

- Extended Voyage Times: Disrupts schedules.

- Port Congestion: Requires better coordination.

- Charterer Pressure: High freight rates favor faster voyages.

Solution: Companies like NYK Line use AI-driven weather routing and voyage optimization software, reducing carbon intensity by 13% across their dry bulk fleet.

3. Marketability Linked to CII Ratings

CII ratings are reshaping market dynamics. Charterers like Shell and Trafigura prioritize vessels with A or B ratings, while D or E rated ships face reduced charter rates or contract rejections. Ports like Singapore offer lower dues for high-rated vessels, creating a market tiering effect.

Data Insight: Bulk carriers achieving A/B ratings increased from 2019 to 2023, correlating with CII enforcement (VesselsValue).

4. Heightened Compliance and Data Demands

Compliance requires robust data collection for fuel consumption, voyage details, and emissions. Ships must update their SEEMP Part III with:

- CII targets.

- Implementation plans.

- Self-evaluation methods.

Digital tools like Wärtsilä’s performance dashboards and Inmarsat’s Fleet Data streamline reporting. However, inconsistent data quality remains a challenge, necessitating investment in crew training and automated systems.

5. Fleet Renewal and Scrapping

Older vessels with poor EEXI scores face a trilemma:

- Retrofit: Costly upgrades to meet standards.

- Devaluation: Accept lower market value.

- Scrapping: Exit the market.

Clarksons Research reported a 15% increase in scrapping rates in 2023, particularly for older bulk carriers and tankers. Newbuilds now prioritize dual-fuel engines (e.g., LNG, methanol) and efficient hull designs.

6. Cultural Shift in Operations

EEXI and CII demand a data-driven mindset. Crews play a pivotal role in:

- Optimizing fuel use.

- Monitoring CII dynamics.

- Using digital reporting tools.

Training programs, like IMO Model Course 4.05, now include CII principles, fostering a sustainability-focused workforce. Case Study: Hafnia Tankers improved its fleet-wide CII rating to B through crew training on dynamic modeling.

Challenges and Solutions

Challenges

- Data Inconsistencies: Ship-to-shore data varies in quality.

- Retrofitting Costs: High capital expenditure for upgrades.

- Split Incentives: Charterers may prioritize speed over efficiency.

- Operational Complexity: Slow steaming disrupts schedules.

Solutions

- Cloud-Based Monitoring: Platforms like Inmarsat’s Fleet Data ensure accurate reporting.

- Financial Incentives: Green financing and carbon credits offset costs.

- Port Collaboration: Align arrival windows with slow steaming.

- Contractual Reforms: Address split incentives in chartering agreements.

Real-World Applications

- NYK Line (Japan): Integrated voyage planning with weather routing, cutting carbon intensity by 13% in 12 months.

- MSC Mediterranean Shipping Company: Deployed rotor sails and ShaPoLi, improving energy efficiency by 20% on select routes.

- Hafnia Tankers: Achieved a fleet-wide B rating through crew training on CII modeling.

Future Outlook: Beyond Compliance

The IMO’s 2026 review may tighten CII thresholds or introduce life-cycle emissions assessments. Forward-thinking shipowners are investing in:

- Dual-Fuel Engines: Methanol and ammonia-ready vessels.

- Alternative Propulsion: Wind and solar-assisted systems.

- AI Optimization: Predictive analytics for voyage planning.

Hydrogen-powered ships show promise but remain in early development, with scalability challenges. The industry’s ability to balance innovation with compliance will determine its competitive landscape.

FAQ

How do EEXI and CII differ?

EEXI evaluates technical design efficiency, while CII measures operational carbon intensity annually.

Which ships are affected?

EEXI applies to ships ≥ 400 GT; CII applies to ships ≥ 5,000 GT, including bulk carriers, tankers, and containerships.

Can CII ratings improve without retrofits?

Yes, through slow steaming, weather routing, and optimized cargo loading.

What happens with a poor CII rating?

Ships rated D for three years or E for one must submit a corrective plan, risking market penalties.

Do ports enforce EEXI/CII?

Not directly, but some offer incentives like reduced dues for high-rated ships.

Is financial support available?

Green financing from banks and classification societies supports compliant upgrades.

How do crews impact CII?

Crews manage fuel settings, voyage speeds, and reporting, directly affecting ratings.

Conclusion

EEXI and CII are more than regulatory checkboxes—they are catalysts for a greener, data-driven shipping industry. By targeting both technical and operational efficiency, these measures align maritime operations with global climate goals. While challenges like retrofitting costs and split incentives persist, innovations in technology, data analytics, and crew training offer pathways to compliance and competitive advantage. As the IMO’s 2030 and 2050 targets loom, embracing EEXI and CII is not just a necessity but a strategic opportunity to lead in a carbon-conscious world.

Happy Boating!

Share EEXI and CII – ship carbon intensity and rating system with your friends and leave a comment below with your thoughts.

Read SOLAS Requirement on steering gear system until we meet in the next article.