Florida’s extensive coastlines, vibrant waterways, and thriving boating culture make it a paradise for boat enthusiasts. With over 1.3 million registered boats, the Sunshine State leads the nation in recreational boating. However, navigating Florida’s waters requires more than just a love for the open sea—it demands a clear understanding of boating laws and the role of boat insurance in protecting your investment and ensuring safety. While Florida does not mandate boat insurance, the risks of boating accidents, severe weather, and financial liabilities make coverage a critical consideration for every boater. This guide explores Florida’s boating laws, the importance of boat insurance, coverage options, costs, and practical tips to ensure you’re well-prepared for safe and enjoyable boating.

Understanding Florida’s Boating Laws

Florida’s boating regulations are enforced by the Florida Fish and Wildlife Conservation Commission (FWC), which oversees vessel registration, operator requirements, and safety standards. Below is a detailed look at the key laws every boater should know:

Boating Education Requirements

- Mandatory Education: Boaters born on or after January 1, 1988, must complete a National Association of State Boating Law Administrators (NASBLA)-approved boating safety course or an equivalent exam to operate a vessel with 10 horsepower or more. These courses cover navigation rules, safety equipment, and emergency procedures.

- Online and In-Person Options: Courses are available online through providers like Boat-Ed or in-person at local training centers. A temporary certificate is issued upon completion, which is valid for operating a vessel.

- Exemptions: Boaters with a valid U.S. Coast Guard captain’s license or those operating under supervision may be exempt.

Age Restrictions

- Personal Watercraft (PWC): Operators under 14 years of age are prohibited from operating PWCs, even with adult supervision.

- General Operation: Operators under 16 must be supervised by an adult when operating vessels with 10 horsepower or more, unless they have completed the required boating safety course.

Vessel Registration

- Mandatory Registration: All motorized vessels used on Florida waters must be registered with the FWC, except for non-motorized boats under 16 feet or vessels used exclusively in private ponds.

- Documentation: Registration requires proof of ownership, a bill of sale, or a manufacturer’s statement of origin. Fees vary based on vessel length, ranging from $5.50 for boats under 12 feet to $36.25 for boats 40 feet or longer.

- Display: Registration numbers must be displayed on both sides of the vessel’s bow, and a validation decal must be affixed.

Safety Equipment

Florida law mandates specific safety equipment based on vessel size and type:

- Life Jackets: One U.S. Coast Guard-approved life jacket per person is required. Children under 6 must wear a life jacket at all times when the vessel is underway.

- Sound-Producing Devices: Vessels 16 feet or longer must carry a whistle or horn audible for at least half a mile.

- Fire Extinguishers: Required on vessels with inboard engines, closed compartments, or fuel tanks. The number and type depend on vessel size.

- Navigation Lights: Required for operation between sunset and sunrise.

- Visual Distress Signals: Required for vessels operating on coastal waters.

Boating Under the Influence (BUI)

- Legal Limit: Operating a vessel with a blood alcohol concentration (BAC) of 0.08% or higher is illegal.

- Penalties: Convictions can result in fines up to $500, jail time, and suspension of boating privileges. Repeat offenses carry harsher penalties.

Environmental Regulations

- Fuel Spills: Federal law prohibits discharging fuel or oil into navigable waters. Violators may face significant fines and cleanup costs.

- Manatee Zones: Boaters must adhere to speed limits in designated manatee protection zones to prevent collisions with these protected species.

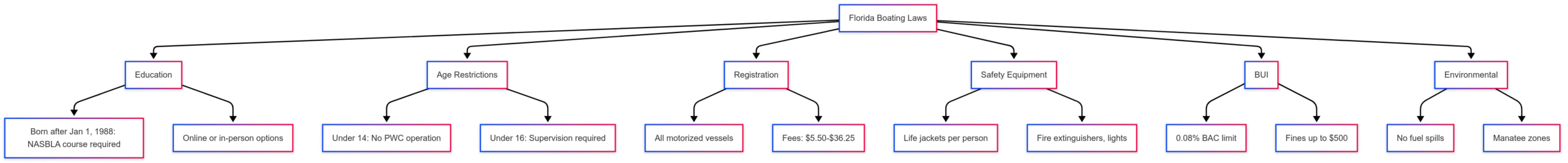

Below is a chart summarizing key Florida boating laws:

Why Boat Insurance Matters in Florida

While Florida law does not require boat insurance, the state’s high accident rates, severe weather, and financial risks make coverage essential. Here’s why:

High Boating Accident Rates

Florida leads the nation in boating accidents, with the FWC reporting 836 incidents in 2020, resulting in 79 fatalities and 534 injuries. Common causes include operator inattention, excessive speed, and collisions with other vessels or fixed objects. Without insurance, you could face:

- Out-of-Pocket Costs: Repairing or replacing a damaged boat can cost thousands of dollars.

- Liability Claims: If you’re at fault, you may be sued for medical expenses, lost wages, or property damage, potentially costing tens or hundreds of thousands.

Severe Weather Risks

Florida’s hurricane-prone climate poses a significant threat to boats. Over 41% of U.S. hurricanes make landfall in Florida, often causing widespread damage to docked or stored vessels. Comprehensive insurance can cover losses from storms, floods, or wind damage.

Marina and Lender Requirements

- Marinas: Most marinas require proof of liability insurance to dock a vessel, with minimum coverage limits often starting at $100,000.

- Lenders: If you finance your boat, lenders typically mandate comprehensive and collision coverage to protect their investment.

Financial Protection

Boats are significant investments, with costs ranging from $10,000 for a small recreational boat to over $1 million for a yacht. Insurance safeguards your financial stake and protects against liabilities, such as:

- Injuries to passengers or other boaters.

- Damage to docks, other boats, or structures.

- Environmental cleanup costs from fuel spills.

Table: Risks of Boating Without Insurance

| Risk | Potential Cost | Insurance Coverage |

|---|---|---|

| Collision with another boat | $5,000–$50,000+ | Liability, Collision |

| Hurricane damage | $10,000–$100,000+ | Comprehensive |

| Injury lawsuit | $50,000–$500,000+ | Bodily Injury Liability |

| Fuel spill cleanup | $10,000–$100,000+ | Fuel Spill Liability |

| Theft of equipment | $1,000–$10,000 | Personal Effects Coverage |

Types of Boat Insurance Coverage

Boat insurance policies are customizable, allowing you to tailor coverage to your needs. Below are the primary types of coverage available in Florida:

Liability Coverage

- Purpose: Covers costs if you’re responsible for injury or property damage.

- Examples: Medical bills, legal fees, repairs to another boat or dock.

- Recommended Limits: At least $100,000 for standard boats; higher for high-performance vessels.

- Importance: Essential in Florida due to high accident rates.

Physical Damage Coverage

- Comprehensive: Covers non-collision incidents like theft, vandalism, fire, or storm damage.

- Collision: Covers damage from collisions with other boats, docks, or objects.

- Deductibles: Typically $500–$2,000 or 1–2% of the boat’s insured value. Named-storm deductibles may apply for hurricane damage.

Uninsured/Underinsured Boater Coverage

- Purpose: Protects you if an uninsured or underinsured boater causes an accident.

- Coverage: Medical expenses and boat repairs for you and your passengers.

- Relevance: Critical in Florida, where insurance is not mandatory.

Medical Payments Coverage

- Purpose: Covers medical expenses for injuries sustained by you, your passengers, or watersport participants (e.g., water-skiers), regardless of fault.

- Limits: Typically $5,000–$25,000 per policy.

Fuel Spill Liability

- Purpose: Covers cleanup costs and fines for fuel or oil spills, which are illegal under federal law.

- Cost: Cleanup can exceed $10,000, making this coverage vital.

Wreckage Removal

- Purpose: Pays for removing a sunken or severely damaged boat, often required for environmental compliance.

- Cost: Can range from $5,000 to $50,000+ depending on the situation.

Personal Effects Coverage

- Purpose: Covers loss or damage to personal items like fishing gear, electronics, or scuba equipment.

- Limits: Up to $10,000 total, with per-item limits (e.g., $1,000).

Towing and Assistance (Sign & Glide)

- Purpose: Covers on-water towing, fuel delivery, or jump-starts if your boat is disabled.

- Cost: Typically $50–$150 per incident without coverage.

Propulsion Plus

- Purpose: Covers repairs or replacement of outboard or inboard/outboard motor units due to mechanical breakdown.

- Exclusions: Does not apply to jet drives or inboard motors.

Agreed Value vs. Actual Cash Value

- Agreed Value: Pays the pre-determined value of the boat in case of a total loss, ideal for newer boats.

- Actual Cash Value: Pays the depreciated value, which may lower premiums for older boats.

How Much Does Boat Insurance Cost in Florida?

Boat insurance costs in Florida vary based on several factors, including the boat’s value, type, usage, and the operator’s profile. According to industry data from providers like Progressive, annual premiums typically range from $277 to $753, with an average of about 1.5% of the boat’s market value.

Factors Affecting Premiums

- Boat Type and Value:

- Small recreational boats (e.g., 17-foot Sea Ray): $100–$300/year for liability-only.

- High-performance boats or yachts: $1,000–$5,000+/year.

- Horsepower: Boats with engines over 50 horsepower cost more to insure due to higher risk.

- Boating Experience: Experienced operators with clean records pay less.

- Claims History: Past claims can increase premiums.

- Location: Coastal areas like Miami or Fort Lauderdale may have higher premiums due to hurricane risks.

- Navigation Area: Policies covering ocean waters (up to 75 miles offshore) may cost more.

- Deductibles: Higher deductibles (e.g., $2,000) lower premiums but increase out-of-pocket costs.

Sample Insurance Quotes

| Boat Type | Value | Coverage | Annual Premium |

|---|---|---|---|

| 17’ Sea Ray (Recreational) | $15,000 | Liability Only | $100–$200 |

| 25’ Center Console | $50,000 | Comprehensive + Collision | $500–$800 |

| 40’ Yacht | $250,000 | Full Coverage + High Liability | $2,500–$4,000 |

Ways to Lower Costs

- Bundle Policies: Combine boat insurance with auto, home, or RV insurance for multi-policy discounts (up to 20% with Progressive).

- Take a Safety Course: Completing a NASBLA-approved course can reduce premiums by 5–15%.

- Pay in Full: Paying the annual premium upfront often earns a discount.

- Install Safety Gear: Features like GPS trackers or automatic fire extinguishers may qualify for discounts.

- Choose Actual Cash Value: For older boats, this can lower premiums compared to agreed value policies.

- Membership Discounts: Affiliations with USAA, U.S. Coast Guard Auxiliary, or United States Power Squadron may yield savings.

Choosing the Right Boat Insurance in Florida

Selecting the best boat insurance policy depends on your boat type, usage, and risk tolerance. Here’s how to make an informed decision:

Key Considerations

- Boat Type: Pontoons, PWCs, center consoles, or yachts have different coverage needs. For example, yachts may require specialized policies with higher liability limits.

- Usage: Recreational boaters may need less coverage than charter operators or commercial fishermen.

- Storage: Boats stored indoors or in dry racks face lower risks than those kept outdoors or in the water year-round.

- Navigation Limits: Ensure your policy covers your intended boating areas, such as coastal waters or inland lakes.

Top Providers in Florida

Several insurers offer competitive boat insurance in Florida, including:

- Progressive: Known for affordable rates (starting at $100/year for liability) and comprehensive options like Sign & Glide and Full Replacement Cost coverage.

- Wallace Welch & Willingham (W3): Specializes in marine insurance, offering tailored policies for boats, yachts, charters, and commercial vessels.

- Boater’s Choice: Provides premium coverage with high liability limits (up to $1,000,000) and broad navigation allowances.

- Florida Farm Bureau: Offers personalized coverage through local agents, ideal for small recreational boats.

Questions to Ask Your Insurer

- What is the named-storm deductible for hurricane damage?

- Are there exclusions for wear and tear, mold, or marine life damage?

- Does the policy cover unattached equipment like fishing gear or skis?

- What are the navigational limits, and do they align with my boating plans?

- Are there discounts for safety courses or bundling policies?

Boat Storage and Maintenance Tips

Proper storage and maintenance can reduce risks and potentially lower insurance premiums. Here’s how to protect your boat:

Storage Options

- Indoor Storage: Offers the best protection against theft, vandalism, and weather but is the most expensive ($100–$500/month).

- Dry Rack Storage: Cost-effective ($50–$200/month) but may limit access during off-season months.

- Outdoor Storage: Most affordable but requires shrink-wrapping and regular checks to prevent damage.

Pre-Storage Checklist

- Inspect Performance: Take the boat for a final ride to identify and fix mechanical issues.

- Clean Thoroughly: Remove dirt, sand, or debris to prevent paint damage or cracks.

- Wax the Hull: Protects against dirt accumulation during storage.

- Change Fluids: Replace oil and antifreeze to prevent corrosion.

- Remove Batteries: Store on a trickle charger to maintain charge.

- Add Fuel Stabilizer: Prevents fuel degradation in the tank.

- Check Tires: Inflate trailer tires to avoid flats.

Boating in Florida: Best Practices

To ensure safety and compliance, follow these best practices:

- Complete a Safety Course: Even if not required, education reduces accident risks and may lower premiums.

- Wear Life Jackets: Ensure all passengers, especially children, wear properly fitted life jackets.

- Monitor Weather: Check forecasts before heading out, especially during hurricane season (June–November).

- Know Your Limits: Avoid operating in unfamiliar waters or conditions beyond your skill level.

- Carry Insurance: Even for small recreational boats on calm lakes, basic liability coverage protects against unexpected incidents.

Case Study: Small Recreational Boats in Remote Areas

For boaters with small vessels (e.g., a 17-foot Sea Ray) on calm, low-traffic lakes, the need for insurance may seem less pressing. However, risks like theft, vandalism, or collisions with uninsured boaters still exist. For example:

- Scenario: A tree falls on your docked boat during a storm, causing $8,000 in damage.

- Without Insurance: You pay the full repair cost out of pocket.

- With Insurance: Comprehensive coverage covers the damage, minus a deductible (e.g., $500).

For low-value boats, a liability-only policy ($100–$200/year) or a basic comprehensive policy ($300–$500/year) can provide peace of mind without breaking the bank.

Conclusion

Florida’s vibrant boating culture offers endless opportunities for adventure, but it comes with risks that require careful preparation. While boat insurance is not legally required, the state’s high accident rates, severe weather, and marina/lender requirements make coverage a smart investment. By understanding Florida’s boating laws, exploring coverage options, and comparing providers, you can tailor a policy that protects your boat, finances, and peace of mind. Whether you’re cruising the Atlantic coast or enjoying a quiet lake, the right insurance ensures you can focus on the joy of boating.

For personalized advice, contact a marine insurance specialist or get a quote from providers like Progressive, W3, or Boater’s Choice. Stay safe, stay insured, and enjoy Florida’s waters with confidence.

Share Florida Boat Insurance & Boating Laws with your friends and Leave a comment below with your thoughts.

Read What Is Likelihood of Drowning for Paddlers in Small Boats? until we meet in the next article.