Do I Need Boat Insurance? (Answers to the Top 9 Questions)

Learn if you need boat insurance with answers to the top 9 questions, covering requirements, coverage types, costs, and safety tips.

Boat ownership brings unparalleled joy, offering freedom on the water for recreation, fishing, or relaxation. However, with this freedom comes responsibility, including the decision of whether to insure your vessel. Boat insurance can protect your investment and mitigate risks, but is it necessary for every boater? This comprehensive guide answers the top nine questions about boat insurance, providing clarity on requirements, coverage options, costs, and safety practices to help you make an informed decision.

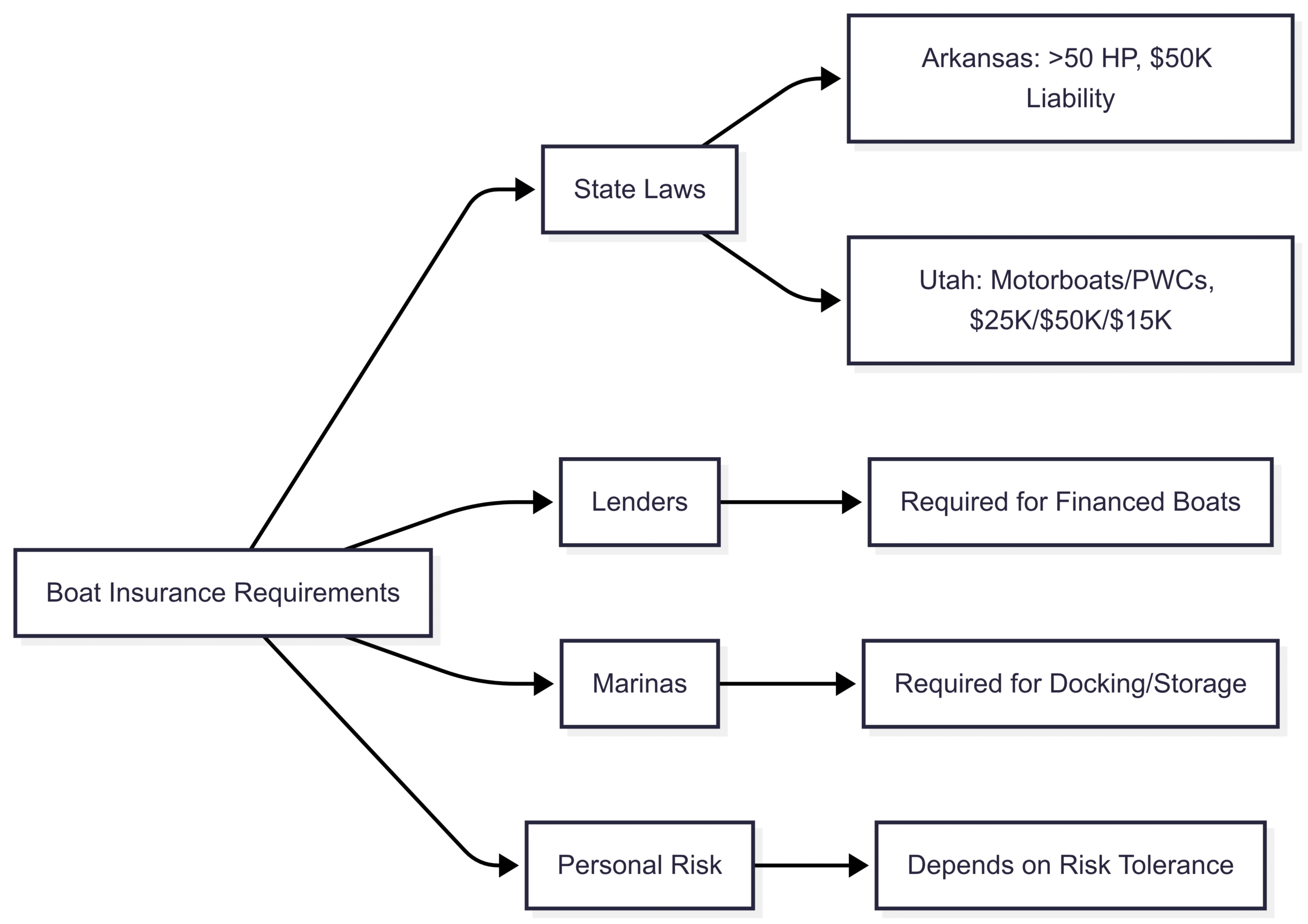

1. Is Boat Insurance Legally Required?

Boat insurance requirements vary by location, with only a few U.S. states mandating coverage. Currently, Arkansas and Utah are the only states with explicit boat insurance laws, though requirements can differ based on the type of watercraft and its usage.

State-Specific Requirements

- Arkansas: All motorboats with engines exceeding 50 horsepower and personal watercraft (PWC) must carry liability insurance with a minimum of $50,000 in coverage. Operating without this insurance is illegal and can result in fines.

- Utah: All motorboats and PWCs, except those with engines under 50 horsepower and airboats, require owner’s or operator’s liability insurance. Minimum coverage includes:

- $25,000 for bodily injury per person

- $50,000 for total bodily injury per accident

- $15,000 for property damage

Other states may impose insurance requirements for boats used in state parks or docked at state-operated marinas. For example, some marinas mandate proof of insurance for docking privileges. Always verify requirements with your state’s marine board or governing agency, as regulations can change.

Non-Legal Requirements

Even if your state doesn’t mandate insurance, other entities may require it:

- Banks and Lenders: If you finance your boat, lenders typically require insurance to protect their collateral. Failure to provide proof of coverage may lead to “force-placed” insurance, which is often more expensive.

- Marinas: Many marinas require liability insurance to dock or store your boat, ensuring protection against potential damages to their facilities or other vessels.

Personal Risk Assessment

Beyond legal or contractual obligations, your risk tolerance plays a significant role. Boats represent a significant financial investment, and accidents—whether caused by you or another boater—can lead to costly repairs, medical bills, or legal fees. Consider the potential financial impact of operating without insurance, especially in high-traffic waters or with a high-value vessel.

Chart: Boat Insurance Requirements by Entity

2. Which States Mandate Boat Insurance?

As noted, only Arkansas and Utah currently require boat insurance, but the specifics differ:

- Arkansas: Focuses on high-powered boats (over 50 horsepower) and PWCs, requiring at least $50,000 in liability coverage to cover potential injuries or damages caused by the operator.

- Utah: Applies to all motorboats and PWCs, with exemptions for low-powered engines and airboats. The minimum coverage limits ensure protection for bodily injury and property damage.

Other states may have indirect requirements. For instance, some state parks or public marinas may mandate insurance for access. Always check with your local marine authority to confirm current regulations, as these can evolve based on legislative changes or safety concerns.

3. What Types of Boat Insurance Are Available?

Boat insurance policies are tailored to the vessel’s size, value, and usage, offering several coverage types to address different risks. The primary categories include liability, uninsured boater, and collision/comprehensive coverage, with additional options for specific needs.

Liability Insurance

Liability insurance is the cornerstone of most boat insurance policies and is often required by states, lenders, or marinas. It covers:

- Bodily Injury: Medical expenses for injuries to others caused by your boat.

- Property Damage: Costs to repair or replace another person’s property, such as another boat or a dock, damaged in an accident you caused.

Experts recommend at least $100,000 in liability coverage, though higher amounts may be prudent for high-performance boats that pose greater risks.

Uninsured Boater Coverage

This coverage protects you and your passengers if an uninsured or underinsured boater causes an accident. It covers medical expenses and damages, reducing out-of-pocket costs when the at-fault party lacks sufficient insurance.

Collision and Comprehensive Coverage

- Collision Coverage: Pays for repairs or replacement of your boat after an accident, minus your deductible. This is ideal for high-value boats or frequent use in busy waters.

- Comprehensive Coverage: Covers non-collision incidents, such as theft, vandalism, fire, or weather-related damage. This is crucial for protecting your investment against unpredictable events.

Additional Coverage Options

- Hull Coverage: Protects the boat’s physical components, including trailers, motors, and accessories, against damage from fire, windstorms, or other perils.

- Fuel Spill Liability: Covers fines or cleanup costs from fuel spills, which can be significant due to environmental regulations.

- Medical Payments: Covers medical expenses for you and your passengers, regardless of fault.

- Towing and Assistance: Covers costs for on-water towing or emergency services if your boat breaks down.

- Personal Property: Covers items like fishing gear or electronics, though some policies may require additional endorsements.

Table: Common Boat Insurance Coverage Types

| Coverage Type | Description | Typical Deductible |

|---|---|---|

| Liability | Covers bodily injury and property damage to others | None |

| Uninsured Boater | Protects against uninsured/underinsured boaters | None |

| Collision | Covers repairs/replacement after an accident | $500–$1,000 |

| Comprehensive | Covers non-collision damages (theft, vandalism, weather) | $500–$1,000 |

| Hull Coverage | Protects boat, trailer, motors, and accessories | $500–$1,000 |

| Fuel Spill Liability | Covers fines/cleanup for fuel spills | Varies |

| Medical Payments | Covers medical expenses for you and passengers | None |

| Towing and Assistance | Covers on-water towing and emergency services | Varies |

4. How Much Boat Insurance Do I Need?

The amount of coverage depends on legal requirements, contractual obligations, and personal factors like your boat’s value and your risk tolerance. Here’s how to determine your needs:

- State Minimums: If you’re in Arkansas or Utah, meet the mandated liability limits. Other states may have specific requirements for certain waterways or marinas.

- Boat Value: High-value or high-performance boats require more coverage due to higher repair costs or potential damage they can cause.

- Usage and Location: Boats used in busy waters or high-risk areas (e.g., coastal regions prone to storms) may need comprehensive coverage.

- Risk Tolerance: If you’re comfortable covering minor repairs out of pocket, you might opt for higher deductibles to lower premiums. However, liability coverage is non-negotiable to protect against lawsuits.

Consult with insurance providers like Progressive or GEICO to assess your boat’s specifics, such as engine size, age, and intended use, to tailor coverage.

5. What Does Boat Insurance Typically Cover?

Boat insurance policies are customizable, but most include a combination of the following:

- Property Damage Liability: Covers damage to another boat, dock, or structure caused by your vessel.

- Bodily Injury Liability: Pays for medical expenses, lost wages, or legal fees if you’re responsible for injuring someone.

- Collision Damage: Covers repairs or replacement of your boat after a collision, subject to a deductible.

- Comprehensive Damage: Protects against non-collision incidents like theft, vandalism, or storm damage.

- Fuel Spill Liability: Addresses environmental cleanup costs or fines from fuel spills.

- Medical Payments: Covers medical expenses for you and your passengers, regardless of fault.

- Towing and Assistance: Provides coverage for on-water towing or emergency services.

- Hull and Equipment: Covers the boat, motor, trailer, and accessories against physical damage.

Exclusions often include wear and tear, defective machinery, or damage from marine life (e.g., zebra mussels). Always review your policy’s fine print to understand coverage limits and exclusions.

6. What Is the Best Type of Boat Insurance?

The “best” boat insurance depends on your needs, budget, and boating habits. Consider:

- Legal and Contractual Needs: Ensure your policy meets state, lender, or marina requirements.

- Boat Type and Value: High-value or high-performance boats may need comprehensive and collision coverage, while smaller boats may suffice with liability-only policies.

- Risk Exposure: If you boat in low-traffic areas, liability coverage may be sufficient. In high-traffic or storm-prone areas, comprehensive coverage is advisable.

- Budget: Balance coverage with affordability, opting for higher deductibles or agreed value policies to manage costs.

Speak with multiple insurers to compare coverage options, discounts, and customer service. Companies like Progressive, GEICO, and Allstate often offer competitive rates and customizable policies.

7. Is Boat Insurance Expensive?

Boat insurance costs vary based on factors like boat type, location, usage, and your boating history. According to industry data, annual premiums typically range from $277 to $753, with an average of about 1.5% of the boat’s market value. For example:

- A $20,000 boat might cost $300–$450 annually.

- A $100,000 yacht could cost $1,500 or more.

Factors Influencing Costs

- Boat Type and Value: High-performance boats or yachts are costlier to insure due to higher repair costs and liability risks.

- Location: Boating in high-risk areas (e.g., hurricane-prone regions like Florida) increases premiums.

- Boating Experience: Experienced boaters with clean claims histories often receive lower rates.

- Coverage Type: Liability-only policies are cheaper than comprehensive plans.

Cost-Saving Tips

- Buy Only Necessary Coverage: Avoid over-insuring with unnecessary add-ons.

- Choose Agreed Value vs. Actual Cash Value: Agreed value policies are costlier but ensure full payout for total losses without depreciation. Switch to actual cash value for older boats to save on premiums.

- Take a Boater Safety Course: Many insurers offer discounts (5–15%) for completing approved courses from the U.S. Coast Guard, Boat-Ed, or similar organizations.

- Invest in Safety Gear: Fire extinguishers, ship-to-shore radios, and other safety equipment may qualify for discounts.

- Bundle Policies: Combining boat insurance with home, auto, or umbrella policies can reduce costs.

- Maintain a Claims-Free Record: Some insurers offer discounts for two or more years without claims.

Table: Estimated Boat Insurance Costs by Boat Type

| Boat Type | Estimated Annual Premium | Notes |

|---|---|---|

| Small Powerboat | $150–$300 | <25 HP, liability-only |

| PWC (Jet Ski) | $200–$500 | Higher risk due to speed |

| Mid-Size Powerboat | $300–$750 | 25–100 HP, includes comprehensive |

| Yacht | $1,000–$3,000+ | High value, coastal use |

8. How Much Does Boat Insurance Cost?

As mentioned, boat insurance typically costs between $277 and $753 annually, though costs can vary widely. For smaller boats, like a 17-foot Sea Ray on a calm lake, premiums can be as low as $100–$200 per year for liability-only coverage. Larger or high-performance boats in busy or high-risk areas may cost thousands annually.

Real-World Examples

- 17’ Sea Ray (New Hampshire): $186/year with GEICO, including towing coverage.

- 28’ Boat ($18,000 value): $500/year, including $1 million in contamination cleanup coverage.

- $50,000 Boat (Cape Cod): $2,500/year with Progressive, reflecting high regional costs.

Cost Breakdown

- Liability-Only Policies: $100–$300/year for small boats, covering bodily injury and property damage.

- Comprehensive Policies: $500–$1,500/year, including collision, theft, and weather damage.

- Deductibles: Typically $500–$1,000 for collision/comprehensive claims, though higher deductibles can lower premiums.

Compare quotes from multiple insurers to find the best value. Online tools from Progressive, GEICO, or State Farm can provide quick estimates based on your boat’s details.

9. Who Offers the Best Boat Insurance Rates?

Several insurance companies offer competitive boat insurance rates, including:

- Progressive: Known for affordable premiums and customizable policies, often ranking high in customer satisfaction.

- GEICO: Offers low-cost liability policies, with premiums as low as $186/year for small boats.

- Allstate: Provides flexible coverage options, though availability may vary by state.

- State Farm: Offers comprehensive policies but may not cover boats on the water under homeowners policies.

- Specialty Insurers: Companies like Markel or BoatUS focus on marine insurance, offering tailored coverage for unique needs.

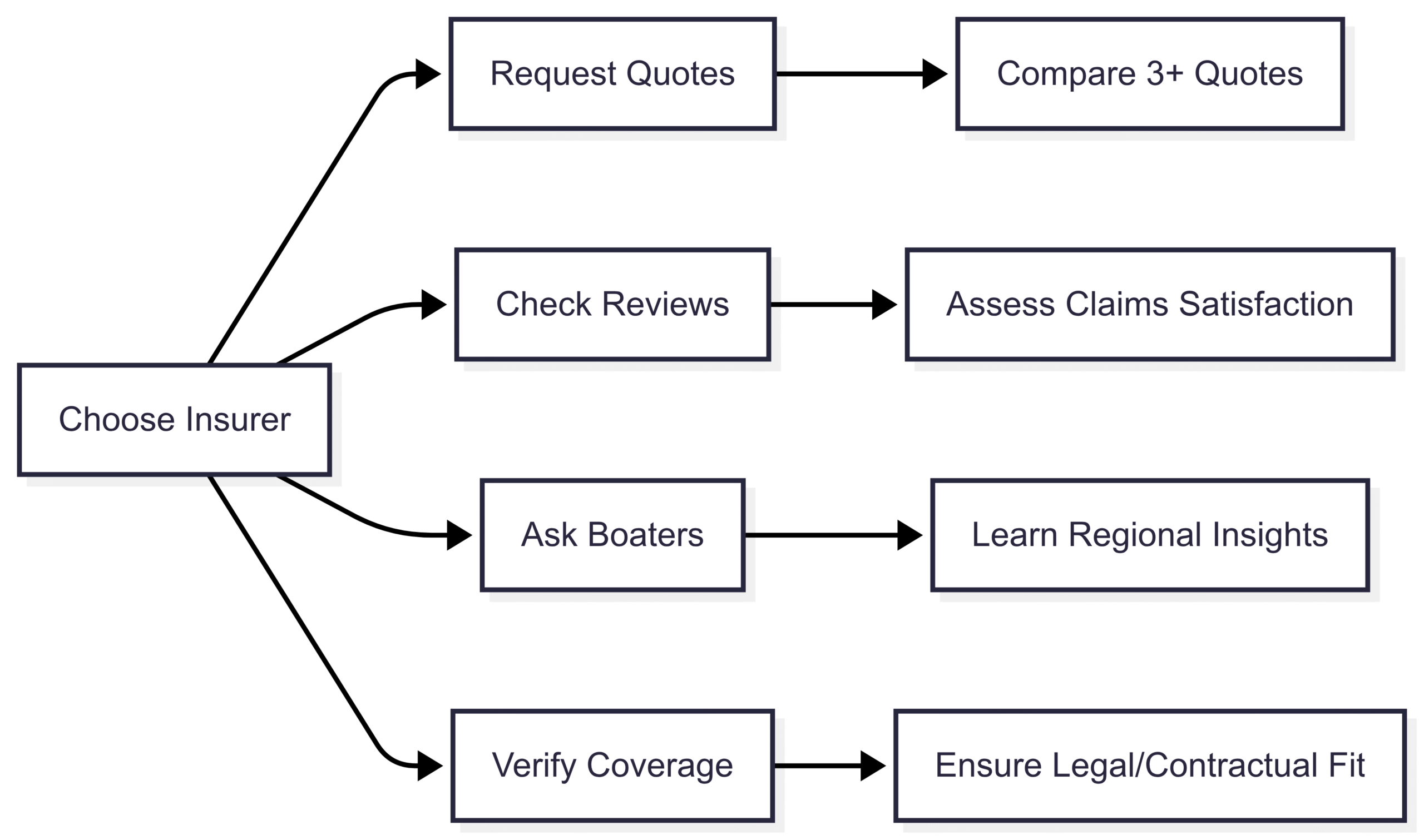

Choosing the Right Insurer

- Compare Quotes: Request quotes from at least three insurers to compare coverage and costs.

- Check Reviews: Look for customer feedback on claims processing and service quality.

- Ask Fellow Boaters: Local boating communities can provide insights into reliable insurers and regional considerations.

- Verify Coverage: Ensure the policy meets your state’s requirements and covers your specific boating activities.

Chart: Boat Insurance Provider Comparison Process

Additional Considerations for Small-Scale Boating

For boaters like the original poster, operating a 17-foot Sea Ray on a quiet New Hampshire lake, the decision to insure may hinge on specific risks:

- Low Traffic: Remote lakes reduce the likelihood of collisions, but accidents like hitting submerged logs or environmental spills remain concerns.

- Salvage Costs: If your boat sinks, salvage operations can cost thousands, and environmental cleanup fees for fuel spills can reach $25,000 or more.

- Liability Risks: Even on a calm lake, injuring another person or damaging their property could lead to significant legal and medical costs.

Comments from boating communities highlight the value of liability coverage:

- A personal injury attorney emphasized the danger of boating accidents, noting that even small mistakes can lead to serious injuries.

- A maritime attorney underscored the inherent risks of boating, citing hard surfaces, lack of seatbelts, and propeller dangers.

- Boaters reported affordable premiums ($100–$500/year) for small boats, making insurance a cost-effective safeguard.

Boat Safety Best Practices

Insurance is only one part of safe boating. To minimize risks and maintain a claims-free record, follow these best practices:

- Equip Your Boat: Carry required navigation lights, life jackets, fire extinguishers, a first-aid kit, flares, and a radio.

- Check Weather: Review forecasts before heading out to avoid hazardous conditions.

- Maintain Your Vessel: Inspect engine, fuel, electrical, and steering systems regularly.

- Distribute Weight: Load passengers and gear evenly to prevent capsizing.

- Follow Regulations: Obey marine traffic laws and distress signals.

- Avoid Impairment: Never operate a boat under the influence of alcohol or drugs.

- Take a Safety Course: Complete a state-approved boater safety course to enhance skills and qualify for insurance discounts.

Conclusion: Protect Your Boat and Peace of Mind

Boat insurance is not just about protecting your vessel—it’s about safeguarding your financial security and ensuring the safety of others on the water. While only a few states mandate insurance, lenders, marinas, and personal risk factors often make it a necessity. By understanding coverage options, comparing quotes, and adopting safe boating practices, you can enjoy your time on the water with confidence.

For small-scale boaters, liability coverage is often sufficient and affordable, costing as little as $100–$300 annually. For high-value or high-risk boats, comprehensive policies provide broader protection. Whatever your situation, research your options, consult with insurers, and prioritize safety to make the most of your boating experience.

Happy Boating!

Share Do I Need Boat Insurance? (Answers to the Top 9 Questions) with your friends and leave a comment below with your thoughts.

Read What Does Boat Insurance Cover: Boat Insurance Coverage until we meet in the next article.