Boat Insurance Quotes | Calculate Instantly

Instantly calculate boat insurance quotes. Learn key factors, coverage options, and costs to protect your vessel with the best policy.

Owning a boat brings unparalleled joy, whether you’re cruising coastal waters, fishing on inland lakes, or hosting friends on a pontoon. However, boats are significant investments, vulnerable to accidents, theft, storms, and liability risks. Boat insurance provides financial protection, ensuring peace of mind on the water. This comprehensive guide explores how to calculate boat insurance quotes instantly, the factors influencing costs, coverage options, and strategies to secure the best policy. Whether you own a yacht, sailboat, or personal watercraft, understanding boat insurance is crucial for safeguarding your investment.

Why Boat Insurance Matters

Boats face unique risks, from collisions and storms to theft and vandalism. Unlike small watercraft like kayaks or canoes, which may be partially covered by homeowners insurance, larger or motorized boats require dedicated policies. Homeowners policies often have limitations, such as:

- Size Restrictions: Coverage may exclude boats over a certain length.

- Horsepower Limits: Boats with engines exceeding 25 horsepower are typically not covered.

- Damage Caps: Homeowners policies may offer minimal coverage for boat damage or liability.

Without proper insurance, a boating accident could lead to significant out-of-pocket expenses. For example, boating accidents caused $55 million in property damage in 2019, with 2,559 injuries and 613 fatalities. Boat insurance mitigates these risks, covering repairs, medical bills, and legal costs, allowing you to focus on recovery rather than financial strain.

Legal and Practical Requirements

Only Utah and Arkansas mandate boat insurance for personal watercraft or powerboats with over 50 horsepower. However, other situations often necessitate coverage:

- Marina Requirements: Most marinas require liability insurance to protect their docks and other vessels.

- Financing Obligations: Lenders typically mandate comprehensive and collision coverage for financed boats.

- High-Value Boats: Yachts, speedboats, and other expensive vessels carry higher risks, making insurance essential.

Even if not required, insurance is a wise choice given the prevalence of human error in boating accidents, such as inattention, improper lookout, and inexperience.

Understanding Boat Insurance Costs

Boat insurance premiums vary widely, with average annual costs ranging from $300 to $800 for most boaters. However, costs can escalate to 1–5% of the boat’s value for larger or high-value vessels like yachts. For example:

| Boat Value | Estimated Annual Premium |

|---|---|

| $20,000 | $300 |

| $50,000 | $750 |

| $100,000 | $1,500 |

| $500,000 | $7,500 |

| $2,000,000 | $30,000 |

For smaller boats, costs may dip below $200, while superyachts can exceed 6–10% of the vessel’s value due to increased liability and risk.

Factors Influencing Costs

Several factors determine your boat insurance premium, allowing insurers to balance risk and pricing:

- Boat Value and Type

- More expensive boats like yachts or speedboats incur higher premiums due to higher repair costs.

- Boat Type: Pontoons and fishing boats are often cheaper to insure than jet skis or sailboats due to lower risk profiles.

- Boat Size and Length

- Boats over 100 feet cost ~66% more to insure; those under 20 feet may reduce premiums by ~20%.

- Age of the Boat

- Older boats may have lower premiums due to lower replacement costs, but maintenance issues can raise rates.

- Some insurers hesitate to cover boats over 30 years old.

- Usage and Navigation Area

- Recreational use in calm inland waters is less costly than coastal cruising or racing.

- High-risk areas (e.g., hurricane-prone regions, saltwater environments) increase premiums due to weather and corrosion risks.

- Boating Experience

- Completing a state-approved safety course can lower rates.

- Six or more accidents or violations in the past five 5 years can increase premiums by up to ~90%.

- Coverage and Deductibles

- Higher coverage levels (e.g., comprehensive, collision) raise premiums.

- Higher deductibles (e.g., $1,000–$5,000) reduce premiums but increase out-of-pocket claim costs.

- Boating and Driving History

- A clean records history can decrease premiums by up to ~40%.

- Poor records or claims history can inflate costs.

- Location

- Florida’s year-round boating and hurricane risk result in higher rates compared to the Great Lakes, where the season is shorter.

- Saltwater boating is pricier than freshwater due to corrosion.

- Other Factors

- Credit Score: A higher score may lower rates.

- Engine Type: Inboard motors are costlier to insure than outboard motors.

- Storage: Secure storage (e.g., private marinas) can reduce premiums by up to ~20%.

Cost by Boat Type

| Boat Type | Average Annual Cost | Key Considerations |

|---|---|---|

| Pontoon | $250–$500 | Low risk, spacious, inland use |

| Personal Watercraft | $300–$600 | High risk due to speed |

| Fishing Boat | $300–$700 | Equipment coverage often needed |

| Speedboat | $500–$1,500 | High risk due to speed and power |

| Sailboat | $400–$1,200 | Varies by size and racing activities |

| Yacht | $1,500–$30,000+ | High value, long-range navigation |

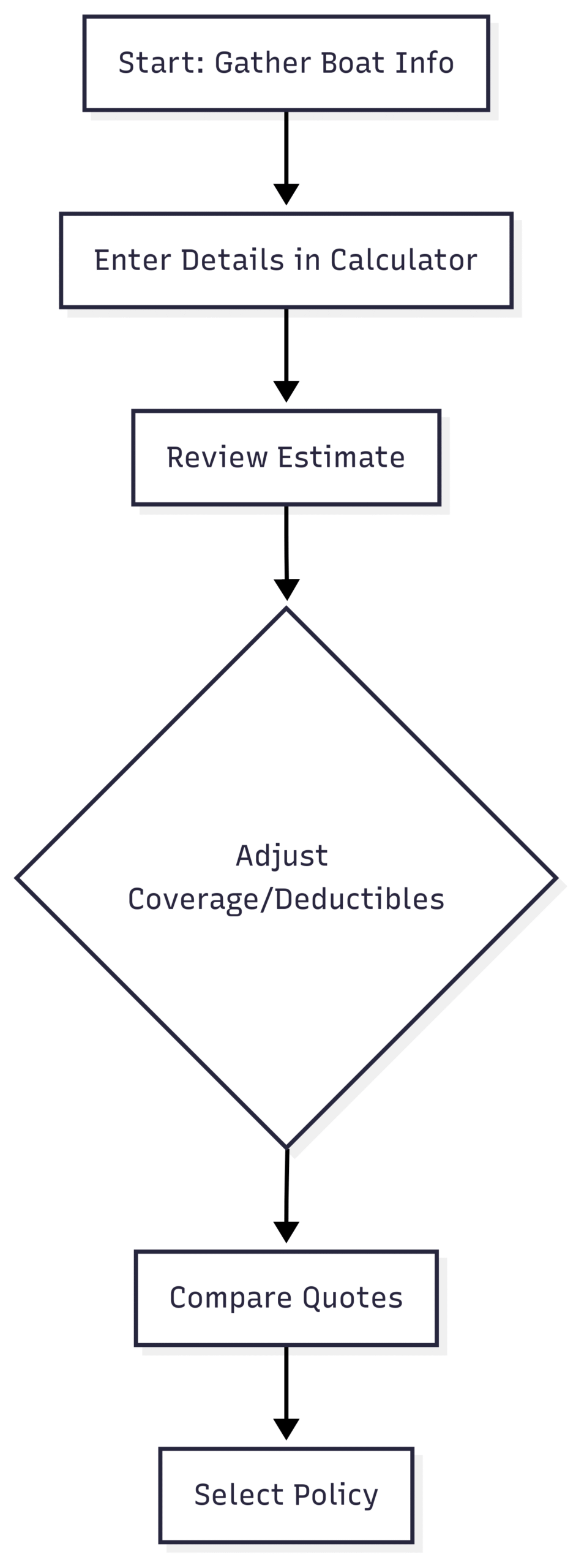

How to Calculate Boat Insurance Quotes Instantly

A boat insurance calculator simplifies the process of estimating premiums. Follow these steps to get an accurate quote:

- Gather Information

- Collect details about your boat: make, model, year, value, length, engine type, and horsepower.

- Note usage patterns (e.g., recreational, racing), navigation areas, and storage location.

- Have your boating history, safety course certifications, and driving record ready.

- Enter Details

- Input the information into an online boat insurance calculator, available on insurer websites like Progressive, GEICO, or the National Boat Owners Association (NBOA).

- Review and Adjust

- Analyze the estimate, tweaking coverage options (e.g., liability-only vs. comprehensive) or deductibles to balance cost and protection.

- Compare Quotes

- Request quotes from multiple insurers to compare pricing and coverage. Independent agents can shop across carriers like Progressive, State Farm, or GEICO Marine.

Sample Quote Calculation

Consider a 2020 pontoon boat valued at $30,000, used recreationally on an inland lake, with a clean boating record and a $500 deductible:

- Base Premium: ~1.5% of $30,000 = $450

- Adjustments:

- Inland use: -10% ($45)

- Safety course: -5% ($22.50)

- Clean record: -10% ($45)

- Final Estimate: ~$337.50 annually

For a $200,000 yacht in coastal waters, the premium could rise to ~$3,000–$4,000 due to higher value and risk.

Key Coverage Options

Boat insurance policies offer a range of coverages to suit different needs. Standard and optional coverages include:

Standard Coverages

- Liability

- Covers damages or injuries to others if you’re at fault, including legal fees.

- Example: Repairs to another boat or dock, or medical bills for injured parties.

- Physical Damage (Hull and Equipment)

- Covers damage to your boat from collisions, fire, theft, vandalism, or storms.

- Includes hull, sails, engines, and equipment.

- Medical Payments

- Reimburses medical expenses for injuries to you or passengers, regardless of fault.

Optional Coverages

- Uninsured/Underinsured Boater

- Covers damages or injuries if an uninsured boater is at fault.

- Example: Repairs if an uninsured speedboat damages your vessel.

- Towing and Assistance

- Covers towing costs if your boat breaks down or runs aground.

- GEICO’s TowBoatUS offers 24/7 emergency services.

- Personal Effects

- Reimburses personal items (e.g., fishing gear, electronics) damaged or stolen on the boat.

- Fishing Equipment

- Covers rods, reels, and tackle, often up to $1,000.

- Water Sports Liability

- Protects against injuries or damages from activities like wakeboarding or tubing.

- Hurricane Hauling

- Covers costs to move your boat during a hurricane warning.

- Wreckage and Fuel Removal

- Reimburses costs to recover or destroy wreckage and clean up fuel spills.

- Pet Coverage

- Covers veterinary fees (up to $1,000) for pets injured on the boat.

- Replacement Cost or Agreed Value

- Agreed value pays the boat’s full insured amount without depreciation; actual cash value accounts for depreciation.

What’s Not Covered

Boat insurance typically excludes:

- Wear and Tear: Normal aging or maintenance costs.

- Faulty Machinery: Manufacturer defects or neglected maintenance.

- Animal Damage: Damage from marine animals, insects, or infestations.

- Improper Storage: Damage due to careless storage or transport.

- Navigational Limit Violations: Accidents outside agreed areas.

- Layup Period Use: Use during off-season storage.

Top Boat Insurance Providers

Choosing a reputable insurer ensures reliable coverage and support. Top providers include:

| Company | Strengths | Notable Features |

|---|---|---|

| GEICO Marine/BoatUS | Affordable rates, towing services | 24/7 towing, multi-policy discounts |

| Progressive | Flexible policies, online quotes | Safety course discounts |

| State Farm | Strong financial stability | Bundling options |

| Allstate | Comprehensive coverage options | Fishing equipment coverage |

| Nationwide | Excellent customer service | Roadside assistance for trailers |

When selecting a provider, consider:

- Specialization: Providers like GEICO Marine focus on boating needs.

- Financial Stability: Check AM Best ratings for reliability.

- Customer Service: Ensure prompt claims processing and support.

Discounts to Lower Costs

Insurers offer discounts to reduce premiums, including:

- Safety Course Discount: Up to 5–10% off for completing approved courses.

- Bundling Discount: Savings for combining boat insurance with auto or home policies.

- Paid-in-Full Discount: Reduced rates for paying the annual premium upfront.

- Clean Record Discount: Lower rates for no accidents or claims.

- Diesel Engine Discount: Savings for diesel-powered boats.

- Homeowner Discount: Discounts for owning a home, even if not insured by the same carrier.

An independent agent can identify additional savings tailored to your profile.

Why Choose an Independent Insurance Agent?

Independent agents simplify the insurance process by:

- Shopping Multiple Carriers: Comparing quotes from providers like Progressive, GEICO, and Nationwide.

- Clarifying Terms: Explaining policy details and fine print.

- Finding Discounts: Identifying all eligible savings.

- Personalized Service: Tailoring coverage to your boat and usage.

Agents have access to a broad network, ensuring competitive pricing and comprehensive protection.

Emerging Trends in Boat Insurance

The marine insurance industry is evolving, influenced by:

- Technology: Real-time alerts and streamlined claims via apps.

- Climate Change: Higher premiums in storm-prone areas due to increased natural disasters.

- Geopolitical Factors: Global conflicts affecting shipping routes and insurance considerations.

Staying informed about these trends helps you choose a policy that adapts to future risks.

Boat Insurance FAQs

Is boat insurance required?

Does boat insurance cover theft?

Does boat insurance cover hurricanes?

Does boat insurance cover engine damage?

Do I need to insure my boat trailer?

Does boat insurance cover passengers?

Can I insure a boat for racing?

Final Thoughts

Boat insurance is essential for protecting your investment and ensuring worry-free adventures on the water. By using a boat insurance calculator, understanding cost factors, and comparing quotes, you can secure a policy that balances coverage and affordability. Whether you own a pontoon, yacht, or jet ski, partnering with an independent agent and reputable providers like GEICO Marine or Progressive ensures tailored protection. Take action today—get a free quote and navigate with confidence, knowing your boat and finances are safeguarded.

For personalized advice, consult a licensed insurance professional or contact GEICO Marine at (855) 395-1412.

Happy Boating!

Share Boat Insurance Quotes | Calculate Instantly with your friends and leave a comment below with your thoughts.

Read The Guide to Boat Ice Coolers: Keeping Your Catch Cool until we meet in the next article.