Explore the rise and fall of Glacier Bay Catamarans, a leading power catamaran manufacturer, and its impact on owners and the boating industry.

Glacier Bay Catamarans was once a titan in the power catamaran industry, renowned for its innovative designs and robust vessels that promised stability and comfort on the water. Founded in 1986 by Larry Graf in Monroe, Washington, the company carved a niche in the marine market with its high-quality displacement catamarans, appealing to anglers and cruisers alike. However, despite its strong reputation and loyal customer base, Glacier Bay faced insurmountable financial challenges, leading to its closure and eventual acquisition by competitor World Cat in 2009. This article delves into the company’s journey, the reasons behind its demise, the impact on owners, and the broader implications for the power catamaran market, offering insights into why Glacier Bay’s boats remain cherished despite the company’s collapse.

The Genesis of Glacier Bay Catamarans

Glacier Bay Catamarans emerged in the mid-1980s when multihull designs were still a novelty in the recreational boating world. Unlike traditional monohull boats, which dominated the U.S. market, Glacier Bay’s twin-hull catamarans offered superior stability, fuel efficiency, and a smoother ride in moderate seas. The company’s founder, Larry Graf, was a visionary in the marine industry, leveraging his expertise to create boats that combined durability with practical design. By the early 2000s, Glacier Bay had established itself as the leading U.S. manufacturer of power catamarans, with a lineup ranging from the compact 2240 Dual Console to the luxurious 3480 Hardtop.

The company’s boats were celebrated for their craftsmanship. Owners praised their ability to handle rough waters, with models like the 2680 Coastal Runner earning accolades for navigating 5-foot waves at 30 mph with minimal impact. The Glacier Bay brand became synonymous with quality, attracting a dedicated community of owners who valued the boats’ soft ride and stability. The company’s reputation for excellent customer service further solidified its standing, with dealers like Aman Marine stepping in to cover warranty repairs when issues arose.

Key Models and Specifications

Glacier Bay’s portfolio included a diverse range of models tailored for fishing, cruising, and family outings. Below is a table summarizing some of their flagship models, their specifications, and estimated pricing at the time of production.

| Model | Length | Beam | Hull Type | Engine Options | Fuel Capacity | Approx. Price (New) |

|---|---|---|---|---|---|---|

| 2240 Dual Console | 22 ft | 8.5 ft | Displacement Cat | Twin Outboards (115-150 hp) | 120 gal | $60,000 – $80,000 |

| 2680 Coastal Runner | 26 ft | 8.5 ft | Displacement Cat | Twin Outboards (150-225 hp) | 180 gal | $89,000 – $120,000 |

| 3065 Center Console | 30 ft | 10 ft | Displacement Cat | Twin Outboards (200-300 hp) | 240 gal | $120,000 – $160,000 |

| 3480 Hardtop | 34 ft | 13 ft | Displacement Cat | Twin Inboards/Outboards (250-350 hp) | 300 gal | $200,000 – $250,000 |

Note: Prices are approximate and based on historical data from dealer reports and forum discussions. Actual prices varied by region, options, and dealer discounts.

These models were designed with versatility in mind. The 2240 Dual Console was ideal for day trips and light fishing, while the 2680 Coastal Runner became a favorite for offshore anglers due to its robust build and spacious deck. Larger models like the 3065 and 3480 catered to cruisers seeking comfort and long-range capability. However, their premium pricing—often exceeding $100,000 for mid-range models—positioned Glacier Bay as a high-end brand, which later contributed to its financial struggles.

The Financial Storm: Why Glacier Bay Went Under

Despite its strong market presence, Glacier Bay faced significant financial challenges by the mid-2000s. The company’s high production costs, driven by premium materials and labor-intensive construction, strained its finances. In 2007, Glacier Bay received multiple loans totaling $5 million from Aequitas Capital Management to bolster inventory and equipment. While these funds provided temporary relief, they also highlighted the company’s cash flow issues.

The global economic downturn that began in 2008 exacerbated Glacier Bay’s troubles. The recreational boating industry, heavily reliant on discretionary spending, was hit hard as consumers tightened their budgets. Forum posts from the time reflect the industry’s struggles, with users noting that dealers were offering steep discounts—such as a 2680 model for $89,000—to clear inventory. The company’s expansion into larger, more expensive models like the 3480 Hardtop may have overextended its resources, as demand for these high-cost boats lagged in a shrinking market.

By early 2009, Glacier Bay’s financial situation became untenable. The company was foreclosed upon, and its Monroe, Washington, facility was shuttered. Owners received letters informing them of the closure, and the company’s website announced a liquidation sale to offload remaining inventory with bank assistance. The lack of communication with customers and dealers further fueled frustration, with owners like “poipu” expressing dismay over the sudden collapse and loss of warranty support.

Economic Context and Industry Impact

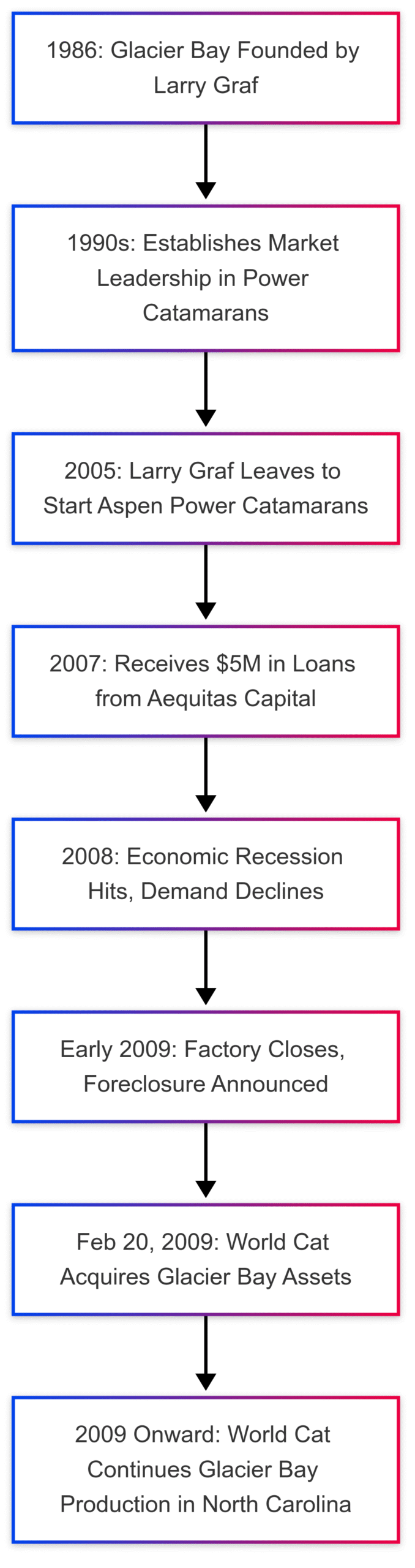

The closure of Glacier Bay was not an isolated incident. The 2008 recession decimated the boating industry, with other manufacturers like ProKat and Twin Vee also facing bankruptcy or eviction. The following Mermaid chart illustrates the timeline of Glacier Bay’s financial struggles and eventual acquisition.

The recession’s impact was particularly severe for manufacturers of premium boats like Glacier Bay, as buyers gravitated toward more affordable options or delayed purchases altogether. The company’s reliance on high-end pricing and a niche market segment left it vulnerable when economic conditions deteriorated.

Owner Reactions: Frustration and Resilience

The closure of Glacier Bay sparked a range of reactions among owners, as evidenced by forum discussions on platforms like TheHullTruth.com and YachtForums.com. Many expressed disappointment over the loss of warranty support and customer service, which had been a cornerstone of the brand’s appeal. For instance, “poipu” lamented paying $130,000 for a 2008 model, only to face a warranty issue (a bulkhead punching through the hull cap) and later discover the company’s collapse. Others, like “obxfish,” urged owners to focus on the boats’ quality, noting that their 1999 Canyonrunner had never required warranty repairs.

Despite the closure, many owners remained fiercely loyal to Glacier Bay’s boats. Users like “fishinayak” praised the 2680’s ability to handle rough seas, while “itwonder” described Glacier Bay as a “top quality product” worth owning despite the company’s demise. The community of owners formed a tight-knit network, sharing knowledge and support to maintain their boats without factory backing. This resilience underscores the enduring appeal of Glacier Bay’s designs, even in the face of corporate failure.

Warranty Concerns and Dealer Challenges

The loss of factory warranty support was a significant blow for owners and dealers. Boats still under warranty faced uncertainty, as dealers like Aman Marine had to cover repairs out of pocket. Forum users reported that some dealers offered extended warranties through third-party companies appointed by Glacier Bay, but details were scarce. Dealers, meanwhile, were left with unsold inventory and outstanding loans, forcing them to sell boats at a loss. As “kylesdad” noted, “The smart ones will sell them for a loss as soon as they can get rid of them,” highlighting the financial pressure on dealers.

The World Cat Acquisition: A New Chapter

In February 2009, World Cat, a North Carolina-based competitor backed by HC Composites and Hornet Capital, acquired Glacier Bay’s assets, including its molds and brand name. The acquisition was a strategic move to consolidate the power catamaran market, with World Cat planning to relocate Glacier Bay’s production to its Tarboro, North Carolina, facility. The deal promised to create 120 jobs with an average annual wage of $29,560 and was supported by a $130,000 grant from the One North Carolina Fund.

World Cat’s president, Andrew Brown, and Glacier Bay’s new president, Chris Brockway, emphasized the distinct identities of the two brands. Brockway likened Glacier Bay to Mercedes-Benz and World Cat to BMW, noting that Glacier Bay would continue focusing on displacement catamarans for cruising, while World Cat would prioritize semi-displacement hulls for fishing. The acquisition aimed to leverage the strengths of both brands to capture a larger share of the market, particularly against monohull competitors, which held about 90% of the U.S. fishing and cruising boat market.

Implications for Owners and the Market

For existing Glacier Bay owners, the acquisition offered hope that production would resume, potentially stabilizing the brand’s reputation and resale value. World Cat’s commitment to maintaining Glacier Bay’s legacy and supporting its customers was a positive signal, though some owners remained skeptical about the transition. The move to North Carolina also raised concerns about labor costs and production quality, as West Coast manufacturing hubs like Washington faced higher wages and business taxes.

The acquisition had broader implications for the power catamaran market. By consolidating two major players, World Cat strengthened its position against other manufacturers like Freeman Boatworks and Renaissance Prowlers. However, the niche nature of power catamarans—often perceived as expensive and less versatile than monohulls—continued to limit their market share. Brockway’s goal of “chipping away at the V-hull market” underscored the challenge of convincing traditional boaters to embrace multihull designs.

The Legacy of Glacier Bay’s Designs

Despite its closure, Glacier Bay’s boats remain highly regarded for their engineering and performance. The 2680 Coastal Runner, in particular, was lauded for its balance of size, stability, and offshore capability. Owners reported fuel efficiencies of 1-2 mpg at cruising speeds, a significant advantage over monohulls. However, some criticized the boats’ performance in extreme conditions, noting that large waves hitting the center tunnel could cause abrupt stops, as described by “Capt J” and “Manny.”

The company’s designs also faced scrutiny for their lack of innovation after the 260 base model. Forum user “Bullshipper” argued that Glacier Bay failed to produce compelling new designs, with larger models like the 3480 being labeled an “abomination.” Larry Graf’s departure in 2005 to start Aspen Power Catamarans further shifted focus away from Glacier Bay, as his new venture explored unconventional designs like the single-engine “power proa.” While innovative, these designs were criticized as impractical for real-world conditions, with users like “NYCAP123” questioning their viability.

Comparison with Competitors

To contextualize Glacier Bay’s place in the market, the following table compares its key models with those of World Cat and Freeman Boatworks, two prominent competitors.

| Manufacturer | Model | Length | Beam | Hull Material | Engine Options | Approx. Price (New) |

|---|---|---|---|---|---|---|

| Glacier Bay | 2680 Coastal Runner | 26 ft | 8.5 ft | Fiberglass | Twin Outboards (150-225 hp) | $89,000 – $120,000 |

| World Cat | 250DC Dual Console | 25 ft | 8.5 ft | Fiberglass | Twin Outboards (150-200 hp) | $80,000 – $110,000 |

| Freeman Boatworks | 33 Center Console | 33 ft | 10 ft | Wood/Fiberglass | Twin Outboards (300-350 hp) | $200,000 – $250,000 |

Note: Prices are approximate and based on historical data. Freeman Boatworks’ higher price reflects custom construction and premium materials.

Glacier Bay’s boats were competitively priced but faced challenges due to their premium positioning. Freeman Boatworks, known for its wooden hulls, appealed to a niche audience willing to pay for custom craftsmanship, while World Cat offered more affordable options with a focus on performance.

The Debate Over Hull Materials: Fiberglass vs. Wood

The closure of Glacier Bay sparked discussions about hull materials, with some users advocating for wooden boats from manufacturers like Freeman Boatworks. Owners like “captwells” praised Freeman’s wooden cats for their strength-to-weight ratio, citing a 33-foot model that cruised at 40 mph while burning 25-26 gallons per hour. However, others, like “CopyKat,” expressed concerns about wood’s susceptibility to rot, arguing that fiberglass offered greater durability in marine environments.

The debate highlighted a divide in the boating community. While wooden boats were celebrated for their craftsmanship and aesthetic appeal, fiberglass remained the industry standard for its low maintenance and longevity. Glacier Bay’s fiberglass hulls, often incorporating wood in stringers and transoms, struck a balance but were not immune to issues, as seen in “poipu’s” warranty claim for a hull cap failure.

The Future of Power Catamarans

The acquisition of Glacier Bay by World Cat marked a turning point for the power catamaran industry. By preserving Glacier Bay’s brand and designs, World Cat ensured that its legacy would continue, albeit under new management. The move to North Carolina promised cost efficiencies, but it also raised questions about whether the brand could maintain its reputation for quality in a new production environment.

For prospective buyers, the closure of Glacier Bay and other manufacturers like ProKat and Twin Vee underscored the risks of investing in niche brands during economic downturns. However, it also presented opportunities to purchase high-quality boats at discounted prices, as dealers sought to clear inventory. Forum users like “wmalloy382” advised buyers to get surveys and capitalize on potential savings of $20,000 or more.

The power catamaran market remains a small but growing segment, with manufacturers like World Cat and Freeman Boatworks continuing to innovate. The challenge lies in overcoming the dominance of monohulls, which offer simpler designs and broader appeal. As Brockway noted, educating consumers about the benefits of catamarans—stability, fuel efficiency, and space—will be critical to expanding their market share.

Conclusion

Glacier Bay Catamarans’ rise and fall is a cautionary tale of ambition, quality, and economic vulnerability. The company’s boats were celebrated for their performance and craftsmanship, earning a loyal following among owners who valued their stability and comfort. However, high production costs, an ill-timed expansion, and the 2008 recession led to its demise. The acquisition by World Cat offered a lifeline, preserving Glacier Bay’s legacy while highlighting the challenges of sustaining a niche brand in a competitive market.

For owners, the closure was a bitter pill, but the enduring quality of Glacier Bay’s boats and the support of their community provided solace. For the industry, the story of Glacier Bay underscores the importance of financial resilience and adaptability. As power catamarans continue to carve out their place in the boating world, Glacier Bay’s legacy serves as both an inspiration and a reminder of the fragility of even the most respected brands.

Share Dissapointed Glacier Bay is out of business with your friends and leave a comment below with your thoughts.

Read Carolina Skiff vs. Boston Whaler: Detailed Comparison until we meet in the next article.